Region:Global

Author(s):Dev

Product Code:KRAC0460

Pages:82

Published On:August 2025

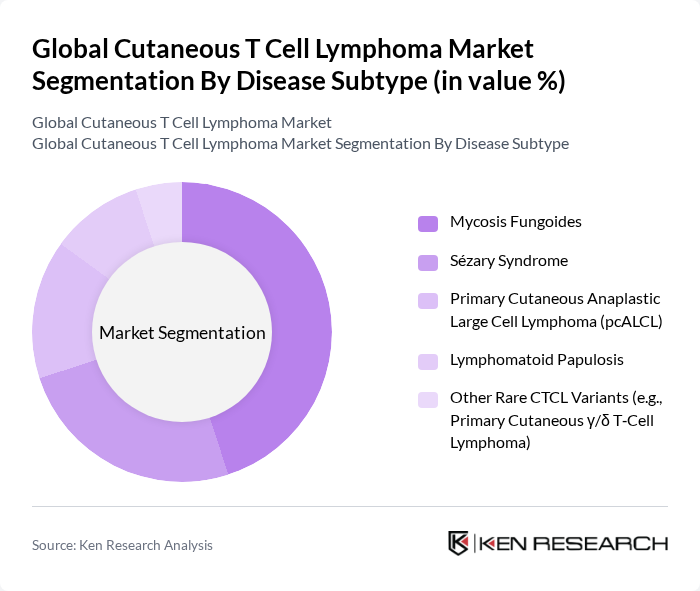

By Disease Subtype:The disease subtype segmentation includes Mycosis Fungoides, Sézary Syndrome, Primary Cutaneous Anaplastic Large Cell Lymphoma (pcALCL), Lymphomatoid Papulosis, and Other Rare CTCL Variants (e.g., Primary Cutaneous ?/? T?Cell Lymphoma). Among these, Mycosis Fungoides is the most prevalent subtype, accounting for the majority of CTCL cases in epidemiologic literature, with estimates commonly indicating it represents the largest share of CTCL burden; Sézary syndrome remains rarer but clinically significant.

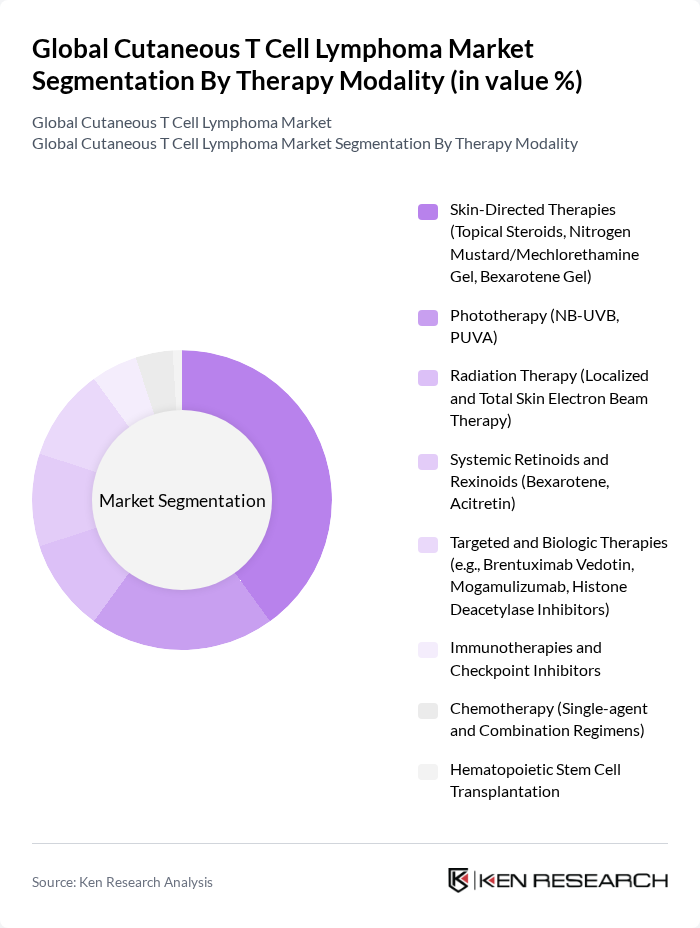

By Therapy Modality:The therapy modality segmentation encompasses Skin-Directed Therapies, Phototherapy, Radiation Therapy, Systemic Retinoids and Rexinoids, Targeted and Biologic Therapies, Immunotherapies and Checkpoint Inhibitors, Chemotherapy, and Hematopoietic Stem Cell Transplantation. Skin?Directed Therapies are widely used in early?stage disease, with topical mechlorethamine gel (Valchlor/Ledaga), topical corticosteroids, and bexarotene gel as foundational options; phototherapy (NB?UVB, PUVA) and localized radiation/total skin electron beam therapy are standard modalities across guidelines and practice patterns. The growing availability and clinical use of targeted and biologic therapies (e.g., brentuximab vedotin, mogamulizumab, HDAC inhibitors) supports broader systemic treatment in advanced or refractory cases.

The Global Cutaneous T Cell Lymphoma Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kyowa Kirin Co., Ltd. (Poteligeo, mogamulizumab), Seagen Inc. (Adcetris, brentuximab vedotin), Helsinn Group (Valchlor/ Ledaga, mechlorethamine gel), Soligenix, Inc. (HyBryte, synthetic hypericin photodynamic therapy), Innate Pharma S.A. (Lacutamab, IPH4102), Merck & Co., Inc. (Keytruda, pembrolizumab – off?label/clinical use in CTCL), Bristol Myers Squibb (nivolumab and immuno?oncology portfolio in CTCL trials), Incyte Corporation (ruxolitinib/itacitinib research in T?cell malignancies), Yakult Honsha Co., Ltd. (Poteligeo commercialization partner in Japan), Regeneron Pharmaceuticals, Inc. (cemiplimab/REGN pipeline in CTCL studies), Eisai Co., Ltd. (oncology alliances relevant to CTCL markets), Takeda Pharmaceutical Company Limited (historic ADC partnerships; oncology footprint), Recordati S.p.A. (Ledaga EU commercialization), Helsinn–Recordati Alliance (CTCL topical chemotherapy commercialization in EU), Ono Pharmaceutical Co., Ltd. (ONO?4685 and immuno?oncology in T?cell malignancies) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CTCL market appears promising, driven by ongoing advancements in personalized medicine and the integration of technology in treatment protocols. The shift towards individualized therapies is expected to enhance treatment efficacy, while telemedicine is likely to improve patient access to specialists. Furthermore, the incorporation of artificial intelligence in diagnostics will streamline the identification of CTCL, leading to earlier interventions. These trends indicate a robust growth trajectory for the market, fostering innovation and improved patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Disease Subtype | Mycosis Fungoides Sézary Syndrome Primary Cutaneous Anaplastic Large Cell Lymphoma (pcALCL) Lymphomatoid Papulosis Other Rare CTCL Variants (e.g., Primary Cutaneous ?/? T?Cell Lymphoma) |

| By Therapy Modality | Skin?Directed Therapies (Topical Steroids, Nitrogen Mustard/Mechlorethamine Gel, Bexarotene Gel) Phototherapy (NB?UVB, PUVA) Radiation Therapy (Localized and Total Skin Electron Beam Therapy) Systemic Retinoids and Rexinoids (Bexarotene, Acitretin) Targeted and Biologic Therapies (e.g., Brentuximab Vedotin, Mogamulizumab, Histone Deacetylase Inhibitors) Immunotherapies and Checkpoint Inhibitors Chemotherapy (Single?agent and Combination Regimens) Hematopoietic Stem Cell Transplantation |

| By Distribution Channel | Hospital Pharmacies Specialty Pharmacies Retail Pharmacies Online Pharmacies |

| By End?User | Hospitals and Cancer Centers Specialty Dermatology/Oncology Clinics Homecare and Outpatient Settings Academic and Research Institutions |

| By Region | North America Europe Asia?Pacific Latin America Middle East & Africa |

| By Patient Demographics | Age Group (Adults, Elderly) Gender Comorbidity Profile |

| By Clinical Stage (TNMB Staging) | Early?Stage (IA–IIA) Advanced?Stage (IIB–IV) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncologists Specializing in CTCL | 100 | Hematologists, Medical Oncologists |

| Healthcare Providers in Dermatology | 80 | Dermatologists, Nurse Practitioners |

| Pharmaceutical Sales Representatives | 40 | Sales Managers, Product Specialists |

| Patient Advocacy Group Leaders | 50 | Advocacy Coordinators, Patient Support Managers |

| Health Economists and Policy Makers | 40 | Health Policy Analysts, Economic Researchers |

The Global Cutaneous T Cell Lymphoma Market is valued at approximately USD 1.9 billion, with estimates suggesting the treatment market could reach near the two-billion range, driven by increasing prevalence and advancements in therapies.