Region:Global

Author(s):Geetanshi

Product Code:KRAA2094

Pages:93

Published On:August 2025

By Type:The segmentation by type includes various categories such as Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, Intrusion Detection & Prevention Systems (IDPS), and Others. Each of these subsegments plays a crucial role in safeguarding vehicles from cyber threats. Network Security and Application Security are particularly critical due to the increasing connectivity of vehicle systems and the need to protect in-vehicle and external communications .

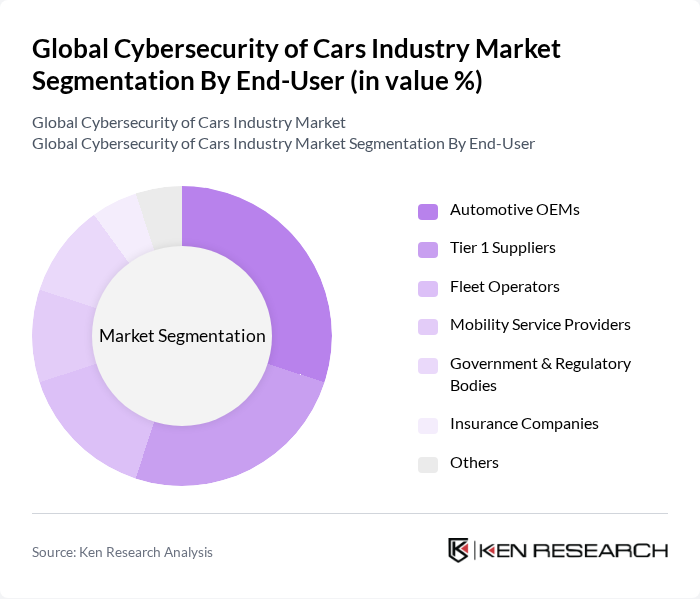

By End-User:The end-user segmentation includes Automotive OEMs, Tier 1 Suppliers, Fleet Operators, Mobility Service Providers, Government & Regulatory Bodies, Insurance Companies, and Others. Each of these segments has unique cybersecurity needs based on their operational requirements and regulatory obligations. Automotive OEMs and Tier 1 Suppliers are the primary adopters, focusing on compliance, product safety, and brand reputation, while fleet operators and mobility service providers prioritize secure data management and operational continuity .

The Global Cybersecurity of Cars Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Argus Cyber Security Ltd., Arilou Technologies, GuardKnox Cyber Technologies Ltd., Vector Informatik GmbH, NXP Semiconductors N.V., HARMAN International, Denso Corporation, Honeywell International, Inc., Continental AG, Aptiv PLC, Infineon Technologies AG, BlackBerry Limited, Cisco Systems, Inc., Trend Micro Incorporated, Kaspersky Lab contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity of cars industry is poised for significant transformation, driven by technological advancements and increasing regulatory pressures. As connected and autonomous vehicles proliferate, the demand for innovative cybersecurity solutions will intensify. In future, it is anticipated thatof vehicles will be connected, necessitating robust security frameworks. Additionally, the integration of artificial intelligence in cybersecurity measures will enhance threat detection capabilities, ensuring a proactive approach to safeguarding vehicle systems against evolving cyber threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Intrusion Detection & Prevention Systems (IDPS) Others |

| By End-User | Automotive OEMs Tier 1 Suppliers Fleet Operators Mobility Service Providers Government & Regulatory Bodies Insurance Companies Others |

| By Component | Hardware Software Services Others |

| By Application | Vehicle-to-Everything (V2X) Communication In-Vehicle Security Telematics Security Remote Vehicle Management Over-the-Air (OTA) Updates Security Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Online Distribution Offline Distribution Hybrid Distribution Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Chief Information Security Officers, IT Managers |

| Cybersecurity Solution Providers | 60 | Product Managers, Sales Directors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Automotive Suppliers | 70 | Supply Chain Managers, Quality Assurance Leads |

| Industry Analysts | 50 | Market Researchers, Technology Analysts |

The Global Cybersecurity of Cars Industry Market is valued at approximately USD 6 billion, driven by the increasing integration of advanced technologies in vehicles and the rising need for robust cybersecurity measures to combat growing cyber threats.