Region:Global

Author(s):Geetanshi

Product Code:KRAB0117

Pages:80

Published On:August 2025

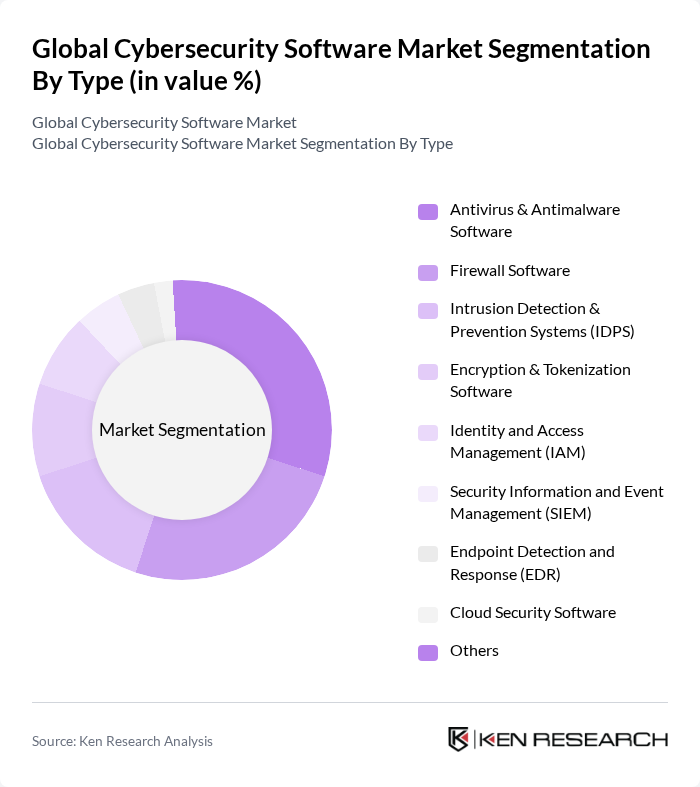

By Type:The cybersecurity software market is segmented into various types, including Antivirus & Antimalware Software, Firewall Software, Intrusion Detection & Prevention Systems (IDPS), Encryption & Tokenization Software, Identity and Access Management (IAM), Security Information and Event Management (SIEM), Endpoint Detection and Response (EDR), Cloud Security Software, and Others. Among these, Antivirus & Antimalware Software and Firewall Software remain the most prominent due to their foundational role in protecting endpoints and networks from malicious threats. However, there is a notable rise in demand for cloud security software and EDR solutions, driven by increased cloud adoption and the need for advanced endpoint protection in hybrid work environments .

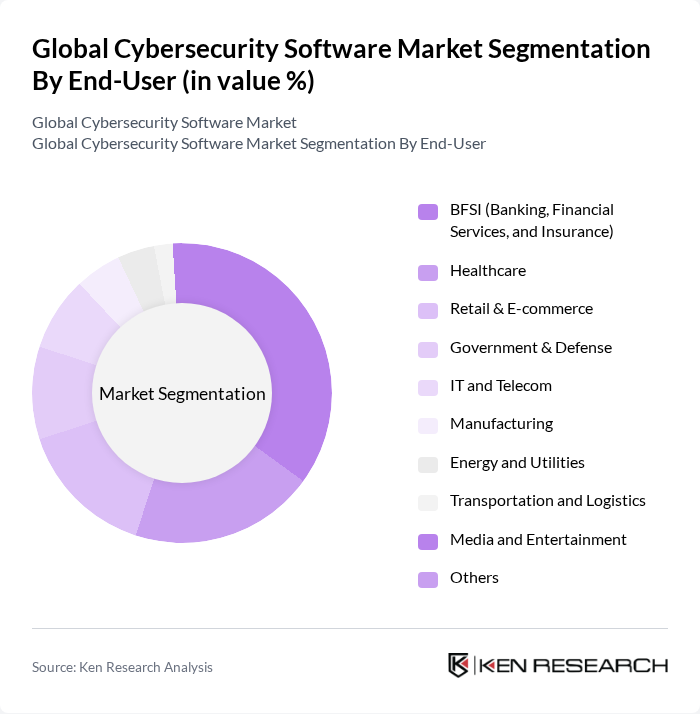

By End-User:The market is also segmented by end-user industries, including BFSI (Banking, Financial Services, and Insurance), Healthcare, Retail & E-commerce, Government & Defense, IT and Telecom, Manufacturing, Energy and Utilities, Transportation and Logistics, Media and Entertainment, and Others. The BFSI sector leads the market due to its critical need for data protection, compliance with stringent regulations, and the increasing adoption of digital finance and payments. Healthcare and retail sectors are also experiencing rapid growth in cybersecurity spending, driven by the proliferation of sensitive data and the rise in targeted attacks .

The Global Cybersecurity Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Palo Alto Networks, Fortinet, Check Point Software Technologies, Cisco Systems, McAfee Corp., Symantec (Broadcom Inc.), Trend Micro, IBM Security, Trellix, CrowdStrike, Sophos, Zscaler, RSA Security, CyberArk Software, Proofpoint, SentinelOne, Okta, Rapid7, Darktrace, Qualys contribute to innovation, geographic expansion, and service delivery in this space.

As the cybersecurity landscape evolves, organizations in None will increasingly adopt advanced technologies such as artificial intelligence and machine learning to enhance threat detection and response capabilities. The shift towards managed security services will also gain momentum, allowing businesses to leverage external expertise. Furthermore, the integration of zero trust security models will redefine access controls, ensuring that only authorized users can access sensitive data, thereby strengthening overall security posture in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Antivirus & Antimalware Software Firewall Software Intrusion Detection & Prevention Systems (IDPS) Encryption & Tokenization Software Identity and Access Management (IAM) Security Information and Event Management (SIEM) Endpoint Detection and Response (EDR) Cloud Security Software Others |

| By End-User | BFSI (Banking, Financial Services, and Insurance) Healthcare Retail & E-commerce Government & Defense IT and Telecom Manufacturing Energy and Utilities Transportation and Logistics Media and Entertainment Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Industry Vertical | Energy and Utilities Transportation and Logistics Education Media and Entertainment Others |

| By Service Type | Consulting Services Managed Security Services Training and Awareness Services |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cybersecurity Solutions | 100 | Chief Information Security Officers, IT Security Managers |

| Small Business Cybersecurity Tools | 60 | Small Business Owners, IT Consultants |

| Cloud Security Software | 50 | Cloud Architects, DevOps Engineers |

| Endpoint Protection Solutions | 40 | Network Administrators, IT Support Specialists |

| Compliance and Risk Management Software | 50 | Compliance Officers, Risk Management Analysts |

The Global Cybersecurity Software Market is valued at approximately USD 141 billion, reflecting significant growth driven by increasing cyber threats, digital transformation, and heightened data privacy awareness among organizations.