Region:Global

Author(s):Dev

Product Code:KRAA1682

Pages:92

Published On:August 2025

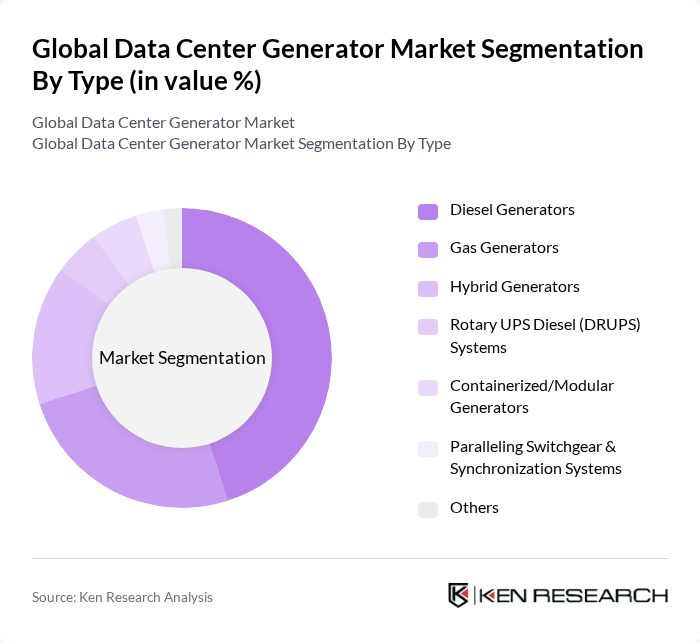

By Type:The market is segmented into various types of generators, including Diesel Generators, Gas Generators, Hybrid Generators, Rotary UPS Diesel (DRUPS) Systems, Containerized/Modular Generators, Paralleling Switchgear & Synchronization Systems, and Others. Diesel Generators are currently the most widely used due to their reliability and efficiency in providing backup power. However, there is a growing trend towards Gas and Hybrid Generators as companies seek to reduce emissions and operational costs; data center operators are also evaluating HVO-ready diesel and DRUPS solutions to align with sustainability goals while maintaining uptime requirements.

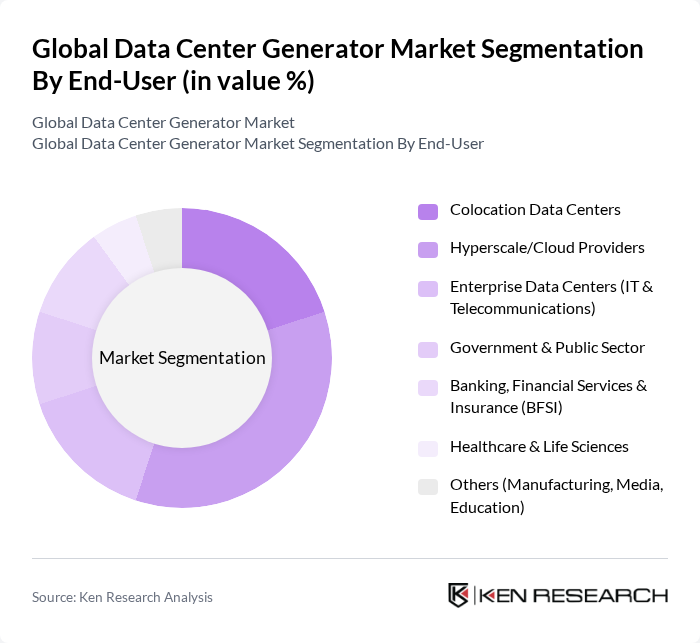

By End-User:The end-user segmentation includes Colocation Data Centers, Hyperscale/Cloud Providers, Enterprise Data Centers (IT & Telecommunications), Government & Public Sector, Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, and Others. The Hyperscale/Cloud Providers segment is leading due to the rapid expansion of cloud services and the need for scalable power solutions to support large data operations; global counts of data centers are led by the U.S., with strong deployments across Germany and China, underscoring hyperscale growth and backup power investments.

The Global Data Center Generator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Cummins Inc., Generac Power Systems, Inc., Kohler Energy (Kohler Co.), MTU Onsite Energy (Rolls-Royce Power Systems), Rolls-Royce Power Systems AG, Atlas Copco AB, Mitsubishi Heavy Industries, Ltd., Wärtsilä Corporation, HIPOWER Systems (Himoinsa USA), Perkins Engines Company Limited, HIMOINSA S.L. (a Yanmar Company), FG Wilson (Engineering) Ltd., Yanmar Holdings Co., Ltd., HITEC Power Protection B.V., Briggs & Stratton (Vanguard Commercial Power), Doosan Portable Power, DEUTZ AG, Clarke Energy (A Kohler Company), Aggreko plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the data center generator market is poised for significant transformation, driven by technological advancements and evolving energy demands. As data centers increasingly adopt modular generator systems, operational flexibility and efficiency will improve. Additionally, the integration of IoT technologies for real-time monitoring will enhance performance and maintenance. These trends, coupled with a growing emphasis on sustainability, will shape the market landscape, fostering innovation and investment in cleaner, more efficient power solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Diesel Generators Gas Generators Hybrid Generators Rotary UPS Diesel (DRUPS) Systems Containerized/Modular Generators Paralleling Switchgear & Synchronization Systems Others |

| By End-User | Colocation Data Centers Hyperscale/Cloud Providers Enterprise Data Centers (IT & Telecommunications) Government & Public Sector Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Others (Manufacturing, Media, Education) |

| By Application | Emergency/Backup Power (Standby) Prime/Continuous Power Peak Shaving & Demand Response Black Start/Commissioning Others |

| By Fuel Type | Diesel Natural Gas HVO/Renewable Diesel Propane/LPG Biogas/Hydrogen-Ready Others |

| By Power Rating | Up to 500 kW kW–1 MW MW–2 MW Above 2 MW |

| By Distribution Channel | Direct (OEM to Data Center Operators) Value-Added Resellers/Systems Integrators Distributors EPC/Contractors Online & Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Central & Eastern Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hyperscale Data Centers | 120 | Data Center Managers, Operations Directors |

| Colocation Facilities | 90 | Facility Managers, Energy Procurement Officers |

| Edge Computing Sites | 60 | Network Engineers, IT Infrastructure Managers |

| Renewable Energy Integration | 70 | Sustainability Officers, Energy Analysts |

| Generator Maintenance Services | 80 | Maintenance Supervisors, Technical Service Managers |

The Global Data Center Generator Market is valued at approximately USD 8.6 billion, reflecting a significant demand for reliable backup power solutions driven by the increasing need for uninterrupted power supply in data centers.