Region:Global

Author(s):Geetanshi

Product Code:KRAA1261

Pages:80

Published On:August 2025

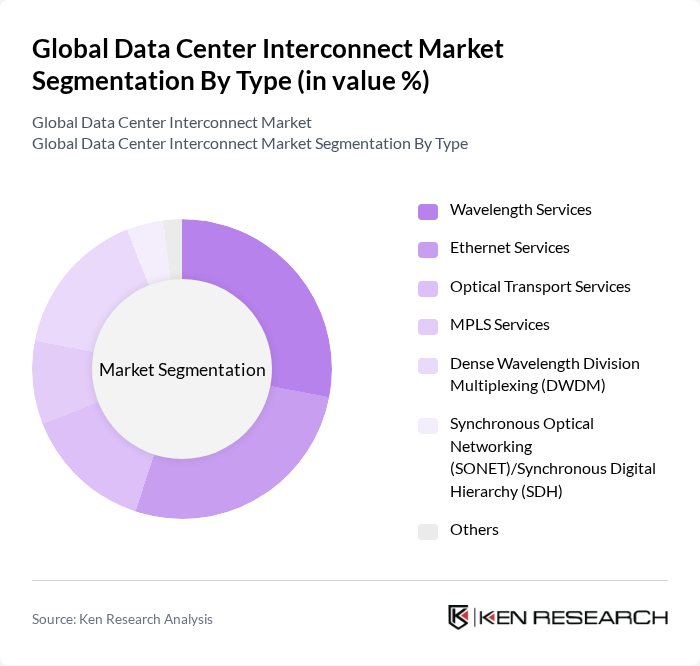

By Type:The market is segmented into various types, including Wavelength Services, Ethernet Services, Optical Transport Services, MPLS Services, Dense Wavelength Division Multiplexing (DWDM), Synchronous Optical Networking (SONET)/Synchronous Digital Hierarchy (SDH), and Others. Among these, Dense Wavelength Division Multiplexing (DWDM) and Ethernet Services are particularly prominent due to their ability to provide ultra-high bandwidth, long-distance data transmission, and flexibility for enterprises and cloud service providers. The increasing demand for bandwidth-intensive applications, the rise of hyperscale data centers, and the need for reliable data transfer solutions are driving the growth of these segments .

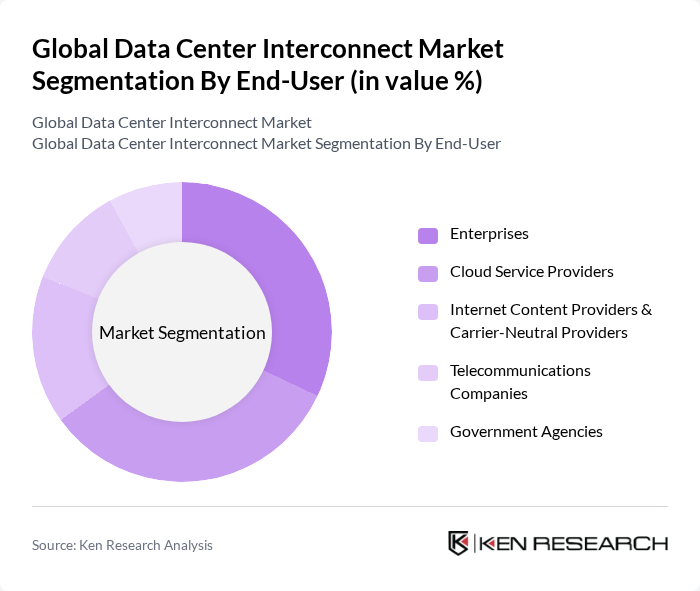

By End-User:The end-user segmentation includes Enterprises, Cloud Service Providers, Internet Content Providers & Carrier-Neutral Providers, Telecommunications Companies, and Government Agencies. Cloud Service Providers and Enterprises are leading this segment due to the rapid adoption of cloud solutions, the need for seamless interconnectivity between data centers, and the increasing importance of business continuity and disaster recovery. Internet Content Providers and Carrier-Neutral Providers are also significant due to the surge in digital content consumption and the need for scalable, low-latency connectivity .

The Global Data Center Interconnect Market is characterized by a dynamic mix of regional and international players. Leading participants such as Equinix, Inc., Lumen Technologies, Inc. (formerly CenturyLink, Inc.), AT&T Inc., NTT Communications Corporation, Verizon Communications Inc., Ciena Corporation, Cisco Systems, Inc., Juniper Networks, Inc., Orange S.A., Zayo Group Holdings, Inc., Tata Communications Limited, Digital Realty Trust, Inc., Interxion (a Digital Realty company), Huawei Technologies Co., Ltd., Nokia Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the data center interconnect market in None is poised for transformative growth, driven by technological advancements and evolving consumer demands. As organizations increasingly adopt hybrid cloud models, the need for seamless interconnectivity will intensify. Additionally, the rise of edge computing will necessitate localized data processing solutions, further enhancing the relevance of interconnect technologies. With a focus on sustainability, companies will also seek energy-efficient interconnect solutions, aligning with global environmental goals and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Wavelength Services Ethernet Services Optical Transport Services MPLS Services Dense Wavelength Division Multiplexing (DWDM) Synchronous Optical Networking (SONET)/Synchronous Digital Hierarchy (SDH) Others |

| By End-User | Enterprises Cloud Service Providers Internet Content Providers & Carrier-Neutral Providers Telecommunications Companies Government Agencies |

| By Application | Data Backup and Recovery Disaster Recovery Data Migration Business Continuity Shared Data and Resources/Server High-Availability Clusters (Geoclustering) Real-Time Disaster Recovery and Business Continuity |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Indirect Sales Online Sales |

| By Deployment Mode | On-Premises Cloud Hybrid |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Service Providers | 100 | Network Engineers, Data Center Managers |

| Telecommunications Companies | 80 | Infrastructure Directors, Operations Managers |

| Colocation Facilities | 60 | Facility Managers, Sales Directors |

| Enterprise IT Departments | 90 | IT Managers, Chief Information Officers |

| Data Center Technology Vendors | 50 | Product Managers, Technical Sales Representatives |

The Global Data Center Interconnect Market is valued at approximately USD 10.1 billion, driven by the increasing demand for high-speed data transfer, cloud computing, and disaster recovery solutions, among other factors.