Region:Global

Author(s):Shubham

Product Code:KRAC0662

Pages:98

Published On:August 2025

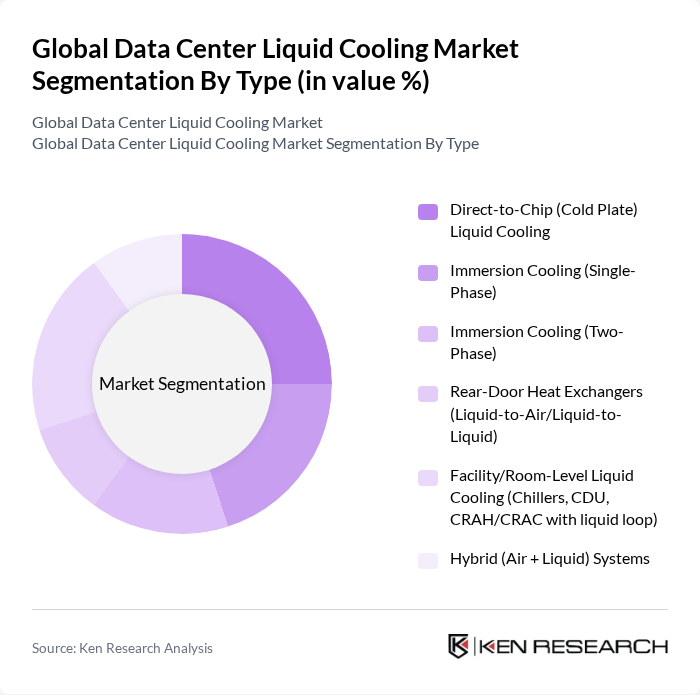

By Type:The market is segmented into various types of liquid cooling systems, each catering to different cooling needs and operational efficiencies.

The Direct-to-Chip (Cold Plate) Liquid Cooling segment is currently leading the market due to its efficiency in cooling high-performance processors and its ability to handle high thermal loads. This technology is particularly favored in hyperscale data centers where space and energy efficiency are critical. The growing trend of AI and machine learning applications, which require substantial computational power, has further propelled the demand for this cooling method. As data centers continue to evolve, the need for effective cooling solutions that can support increased rack densities will likely keep this segment at the forefront .

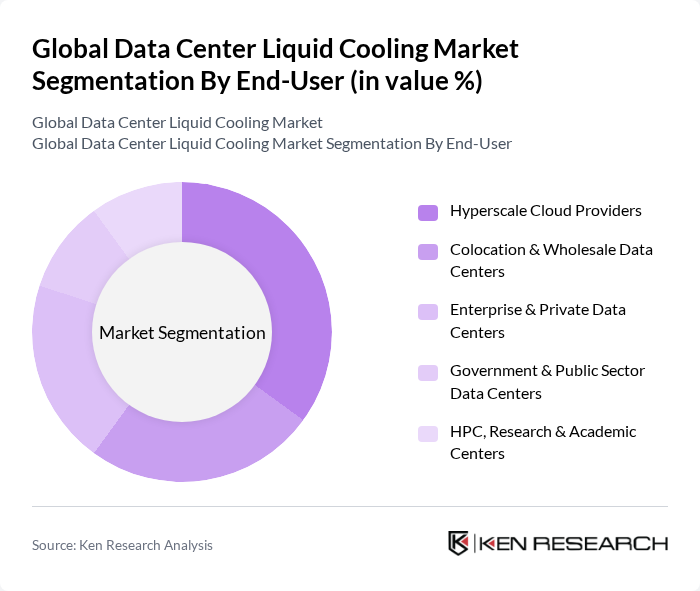

By End-User:The market is segmented based on the end-users of liquid cooling systems, which include various types of data centers.

The Hyperscale Cloud Providers segment dominates the market due to their extensive infrastructure and the need for efficient cooling solutions to manage large-scale operations. These providers are increasingly adopting liquid cooling technologies to enhance energy efficiency and reduce operational costs. The rapid growth of cloud services and the demand for high-performance computing capabilities are driving this trend, as these providers seek to optimize their data center operations while maintaining sustainability goals .

The Global Data Center Liquid Cooling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vertiv Holdings Co., Schneider Electric SE, Asetek A/S, CoolIT Systems Inc., Rittal GmbH & Co. KG, Delta Electronics, Inc., Fujitsu Limited, IBM Corporation, Green Revolution Cooling, Inc. (GRC), LiquidCool Solutions, Inc., STULZ GmbH, Airedale by Modine, Submer Technologies, S.L., Asperitas BV, Iceotope Technologies Limited, ThermoAiR Nortek Data Center Cooling (formerly Nortek Air Solutions), 3M Company, Lenovo Group Limited (ThinkSystem liquid cooling), Hewlett Packard Enterprise (HPE) – Cray liquid cooling, Dell Technologies (PowerEdge liquid cooling partners) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the data center liquid cooling market appears promising, driven by technological advancements and increasing environmental regulations. As data centers evolve, the integration of artificial intelligence and IoT for cooling management is expected to enhance operational efficiency. Additionally, the shift towards modular data centers will likely facilitate the adoption of liquid cooling solutions, enabling operators to optimize energy use and reduce their carbon footprint significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct-to-Chip (Cold Plate) Liquid Cooling Immersion Cooling (Single-Phase) Immersion Cooling (Two-Phase) Rear-Door Heat Exchangers (Liquid-to-Air/Liquid-to-Liquid) Facility/Room-Level Liquid Cooling (Chillers, CDU, CRAH/CRAC with liquid loop) Hybrid (Air + Liquid) Systems |

| By End-User | Hyperscale Cloud Providers Colocation & Wholesale Data Centers Enterprise & Private Data Centers Government & Public Sector Data Centers HPC, Research & Academic Centers |

| By Application | AI/ML Training & Inference Clusters High-Performance Computing (HPC) & Supercomputing Cloud & Virtualized Workloads Edge/Micro Data Centers Blockchain/Crypto Mining |

| By Component | Coolant Distribution Units (CDU) Cold Plates & Manifolds Immersion Tanks/Enclosures Pumps & Controls Heat Exchangers & Rear-Door Coolers Coolants (Water-Glycol, Dielectric Fluids) Sensors, Software & Monitoring |

| By Distribution Channel | Direct Sales (OEMs and System Integrators) Value-Added Resellers (VARs) & Distributors Strategic Alliances with Server OEMs (e.g., Lenovo, HPE, Dell) Online & Marketplace Procurement |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level (retrofit/single-rack solutions) Mid-Range (row- and room-level deployments) Premium/High-Density (AI/HPC-scale deployments) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Centers | 120 | Data Center Managers, IT Directors |

| Colocation Facilities | 80 | Facility Managers, Operations Directors |

| Cloud Service Providers | 90 | Cloud Architects, Infrastructure Engineers |

| Telecommunications Data Centers | 70 | Network Operations Managers, Technical Leads |

| Research Institutions | 60 | Research Facility Managers, IT Support Staff |

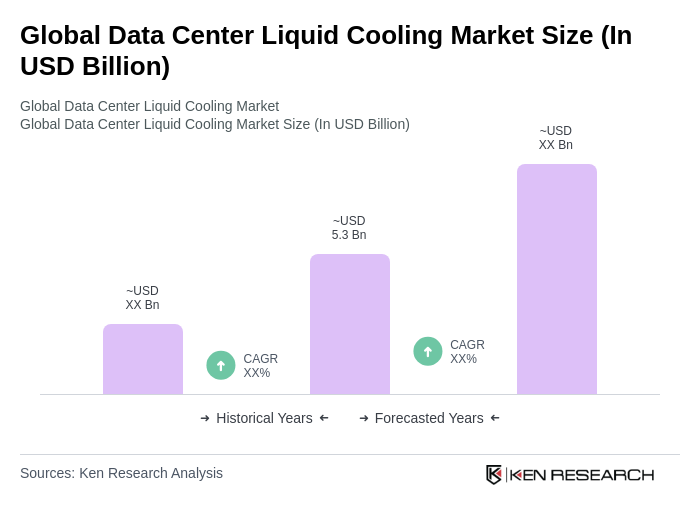

The Global Data Center Liquid Cooling Market is valued at approximately USD 5.3 billion, with estimates suggesting it falls within the USD 56 billion range. This growth is primarily driven by increasing power densities from AI and high-performance computing workloads.