Region:Global

Author(s):Rebecca

Product Code:KRAD0303

Pages:92

Published On:August 2025

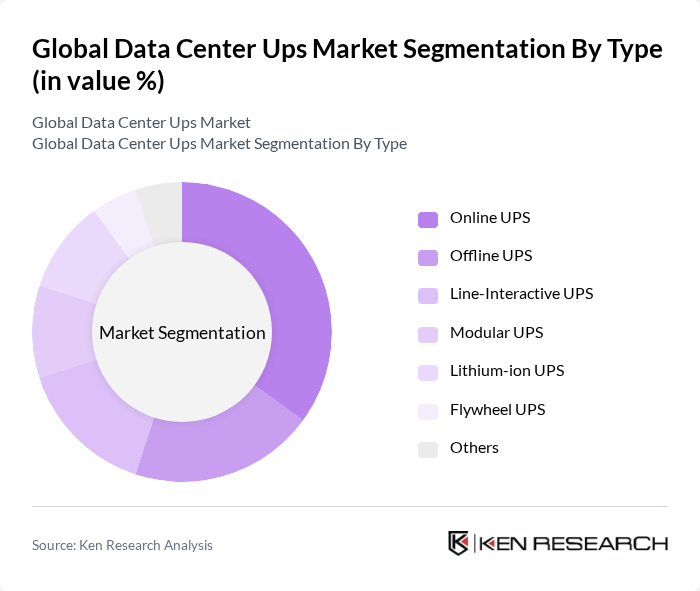

By Type:The market is segmented into various types of UPS systems, including Online UPS, Offline UPS, Line-Interactive UPS, Modular UPS, Lithium-ion UPS, Flywheel UPS, and Others. Each type serves different needs based on power requirements, efficiency, and application scenarios. Online UPS systems are preferred for mission-critical applications due to their continuous power conditioning, while modular and lithium-ion UPS are gaining traction for their scalability, energy efficiency, and reduced maintenance requirements. Flywheel UPS solutions are increasingly adopted for high-density data centers seeking rapid response and lower environmental impact .

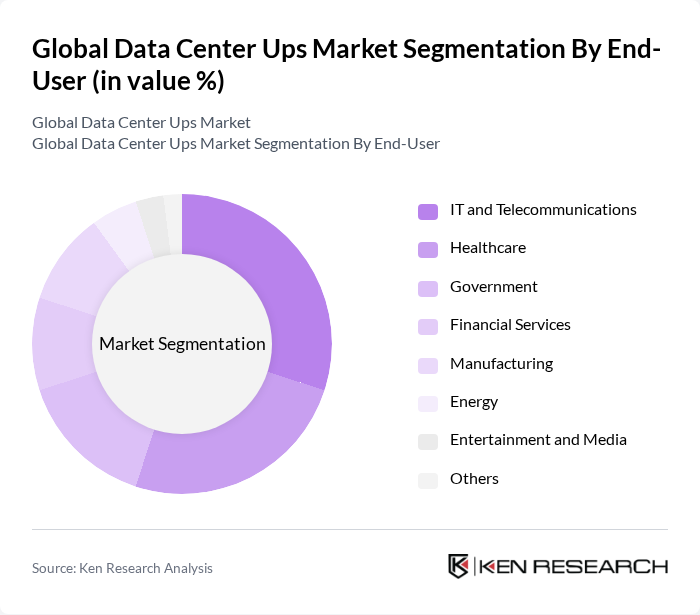

By End-User:The end-user segmentation includes IT and Telecommunications, Healthcare, Government, Financial Services, Manufacturing, Energy, Entertainment and Media, and Others. Each sector has unique power requirements and reliability needs, influencing the type of UPS systems adopted. IT and Telecommunications lead demand due to the proliferation of cloud computing and data traffic, while Healthcare and Financial Services require high-availability solutions for regulatory compliance and operational continuity. Manufacturing and Energy sectors are increasingly investing in UPS for automation and process reliability .

The Global Data Center UPS Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric, Eaton Corporation, Vertiv Co., ABB Ltd., Siemens AG, Emerson Electric Co., Tripp Lite, CyberPower Systems, APC by Schneider Electric, Riello UPS, Toshiba International Corporation, Mitsubishi Electric Corporation, Delta Electronics, Inc., Legrand SA, Piller Power Systems, Huawei Technologies Co., Ltd., Socomec Group, Kehua Data Co., Ltd., AEG Power Solutions, Fuji Electric Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the data center UPS market appears promising, driven by technological advancements and increasing energy efficiency demands. As organizations prioritize sustainability, the adoption of renewable energy sources and energy-efficient UPS systems will become more prevalent. Additionally, the rise of edge computing will create new opportunities for UPS solutions tailored to decentralized data processing, further enhancing market dynamics. The focus on modular and hybrid systems will also shape the landscape, promoting flexibility and scalability in power management.

| Segment | Sub-Segments |

|---|---|

| By Type | Online UPS Offline UPS Line-Interactive UPS Modular UPS Lithium-ion UPS Flywheel UPS Others |

| By End-User | IT and Telecommunications Healthcare Government Financial Services Manufacturing Energy Entertainment and Media Others |

| By Application | Hyperscale Data Centers Colocation Data Centers Edge Data Centers Enterprise Data Centers Industrial Applications Commercial Buildings Critical Infrastructure Others |

| By Distribution Channel | Direct Sales Indirect Sales Distributors Online Sales Retail Sales Others |

| By Component | UPS Systems Batteries Power Distribution Units Monitoring & Management Software Switchgear Others |

| By Capacity | Below 50 kVA –200 kVA –500 kVA Above 500 kVA Others |

| By Data Center Tier | Tier I & II Tier III Tier IV Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hyperscale Data Centers | 100 | Data Center Managers, Infrastructure Architects |

| Colocation Services | 80 | Sales Directors, Operations Managers |

| Enterprise Data Center Operations | 60 | IT Managers, Facility Engineers |

| Energy Efficiency Initiatives | 50 | Sustainability Officers, Energy Managers |

| Cloud Service Providers | 70 | Product Managers, Cloud Architects |

The Global Data Center UPS market is valued at approximately USD 8.9 billion, driven by the increasing demand for uninterrupted power supply in data centers, particularly due to the growth of cloud computing and digital transformation initiatives.