Region:Global

Author(s):Shubham

Product Code:KRAC0588

Pages:93

Published On:August 2025

By Type:

The Data Cleansing Tools segment is currently dominating the market due to the increasing volume of data generated by organizations and the necessity to maintain data accuracy and integrity. Broader market analyses highlight growing adoption of AI/ML-assisted cleansing and anomaly detection, as well as cloud-based delivery of data quality functions, which further strengthen cleansing uptake in highly regulated industries such as finance and healthcare .

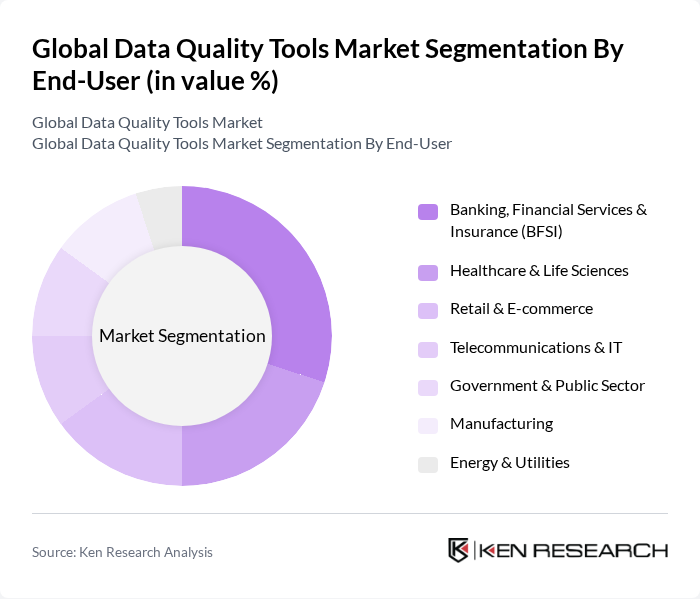

By End-User:

The Banking, Financial Services & Insurance (BFSI) sector is the leading end-user of data quality tools, driven by stringent regulatory requirements (e.g., KYC/AML, reporting standards) and the centrality of accurate data to risk, fraud, and customer analytics. Independent market coverage consistently cites BFSI and healthcare as top adopters due to compliance intensity and the need for trusted data in mission-critical workflows .

The Global Data Quality Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Informatica, Talend, SAS Institute, IBM, SAP, Oracle, Microsoft, Ataccama, Trifacta (Alteryx Designer Cloud), Data Ladder, Experian, TIBCO Software (now part of Cloud Software Group), DQ Global, Precisely, OpenRefine, Melissa (Melissa Data), Dun & Bradstreet, OpenText (including former Micro Focus/Trifacta connectors), Collibra, Alation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the data quality tools market is poised for significant transformation, driven by technological advancements and evolving business needs. Organizations are increasingly adopting automated solutions to enhance efficiency and reduce human error in data management. Furthermore, the integration of artificial intelligence and machine learning into data quality tools is expected to revolutionize data processing capabilities, enabling real-time insights and improved decision-making. As businesses prioritize data-driven strategies, the demand for innovative data quality solutions will continue to rise.

| Segment | Sub-Segments |

|---|---|

| By Type | Data Profiling Tools Data Cleansing Tools Data Matching & Deduplication Tools Data Monitoring & Observability Tools Data Enrichment & Standardization Tools Master Data Management (MDM)-Integrated DQ Tools Data Quality as a Service (DQaaS) |

| By End-User | Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Retail & E-commerce Telecommunications & IT Government & Public Sector Manufacturing Energy & Utilities |

| By Deployment Model | On-Premises Cloud (SaaS) Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Data Domain | Customer/Party Data Product/Inventory Data Financial/Transactional Data Supplier/Vendor & Third-Party Data Compliance & Reference Data |

| By Functionality | Data Profiling & Assessment Data Cleansing, Matching & Improvement Data Quality Monitoring & Remediation Data Lineage, Rules, and Policy Management |

| By Pricing Model | Subscription (Per User/Per Core/Consumption) Perpetual License + Maintenance Usage-Based/Pay-As-You-Go Open-Source (Support & Enterprise Editions) |

| By Organization Size | Large Enterprises Small & Medium-Sized Enterprises (SMEs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Data Quality | 120 | Data Analysts, Compliance Officers |

| Healthcare Data Management | 95 | IT Managers, Data Governance Leads |

| Retail Customer Data Quality | 100 | Marketing Managers, CRM Specialists |

| Manufacturing Data Integrity | 80 | Operations Managers, Quality Assurance Leads |

| Telecommunications Data Quality Tools | 85 | Network Analysts, Data Scientists |

The Global Data Quality Tools Market is valued at approximately USD 2.3 billion, reflecting a consistent trend in recent assessments that indicate rising adoption across various sectors, including analytics, governance, and compliance.