Region:Global

Author(s):Dev

Product Code:KRAB0619

Pages:80

Published On:August 2025

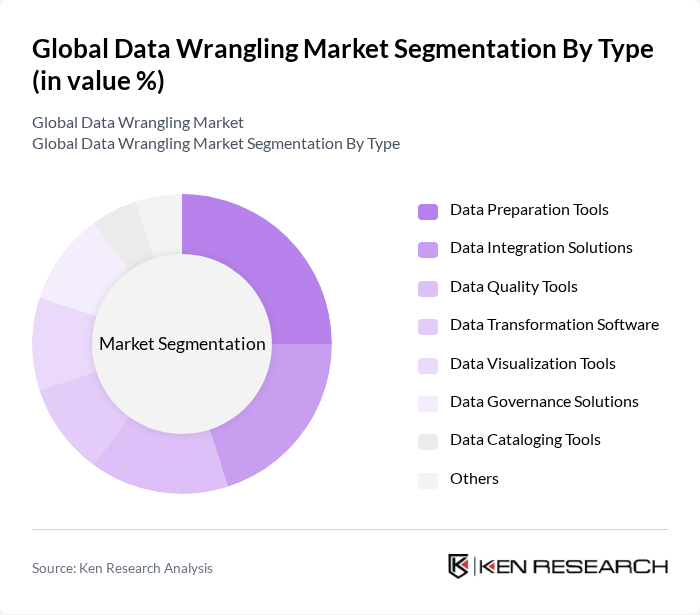

By Type:The market is segmented by type into Data Preparation Tools, Data Integration Solutions, Data Quality Tools, Data Transformation Software, Data Visualization Tools, Data Governance Solutions, Data Cataloging Tools, and Others. Data Preparation Tools automate cleansing, structuring, and transforming raw data for analytics, while Data Integration Solutions ensure seamless merging of data from multiple sources and formats. Data Quality Tools emphasize validation, deduplication, and error correction to maintain high data integrity. Data Transformation Software supports format conversion and normalization for downstream applications. Data Visualization Tools enable the presentation of wrangled data in interactive dashboards and graphical formats for decision-making. Data Governance Solutions focus on managing policies, access controls, and compliance across data assets. Data Cataloging Tools help organize and index data assets for easier discoverability and metadata management. The Others category comprises specialized tools that cater to niche requirements within the data wrangling process

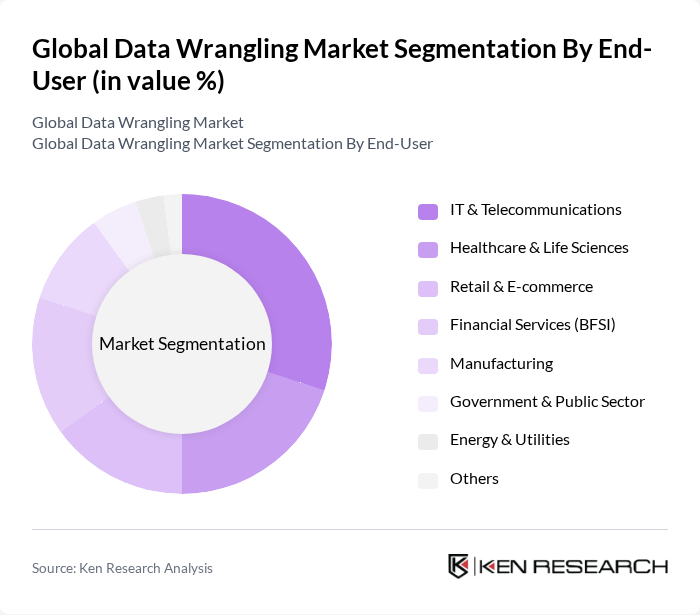

By End-User:End-user segmentation highlights the wide applicability of data wrangling across multiple industries. In IT and Telecommunications, it is used for network optimization, customer analytics, and service delivery. Healthcare and Life Sciences rely on data wrangling for patient data integration, clinical research, and regulatory reporting. Retail and E-commerce benefit from improved personalization, inventory management, and sales analytics. In the Financial Services (BFSI) sector, it enhances risk modeling, fraud detection, and regulatory compliance. Manufacturing applies it to supply chain optimization, production analytics, and predictive maintenance. Government and Public Sector entities use data wrangling to support policy analysis, citizen services, and data transparency. Energy and Utilities employ it for grid optimization, consumption analytics, and asset management. The Others category includes specialized applications in industries such as education and transportation.

The Global Data Wrangling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alteryx, Inc., Talend S.A., Informatica LLC, Trifacta, Inc., IBM Corporation, Microsoft Corporation, SAS Institute Inc., TIBCO Software Inc., Domo, Inc., QlikTech International AB, SAP SE, Oracle Corporation, Micro Focus International plc, DataRobot, Inc., Sisense Inc., Databricks, Inc., AWS (Amazon Web Services, Inc.), Google LLC (Google Cloud), ServiceNow, Inc., data.world, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

**Sources:**

The future of the data wrangling market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly prioritize data-driven strategies, the demand for efficient data wrangling solutions will continue to grow. The integration of AI and machine learning into data wrangling processes is expected to enhance automation and improve data quality. Additionally, the shift towards cloud-based solutions will facilitate easier access to data, enabling organizations to leverage real-time insights for strategic decision-making and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Data Preparation Tools Data Integration Solutions Data Quality Tools Data Transformation Software Data Visualization Tools Data Governance Solutions Data Cataloging Tools Others |

| By End-User | IT & Telecommunications Healthcare & Life Sciences Retail & E-commerce Financial Services (BFSI) Manufacturing Government & Public Sector Energy & Utilities Others |

| By Application | Business Intelligence & Analytics Customer Analytics Risk & Compliance Management Fraud Detection & Prevention Operational Analytics Marketing & Sales Analytics Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Organization Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Data Management | 100 | Data Analysts, IT Managers |

| Financial Services Data Wrangling | 80 | Risk Managers, Compliance Officers |

| Retail Analytics and Data Processing | 70 | Marketing Analysts, Operations Managers |

| Telecommunications Data Integration | 60 | Network Engineers, Data Architects |

| Manufacturing Data Optimization | 90 | Supply Chain Analysts, Production Managers |

The Global Data Wrangling Market is valued at approximately USD 3.6 billion, reflecting a significant growth trend driven by the increasing need for organizations to manage and analyze large volumes of data effectively.