Region:Global

Author(s):Dev

Product Code:KRAA1654

Pages:83

Published On:August 2025

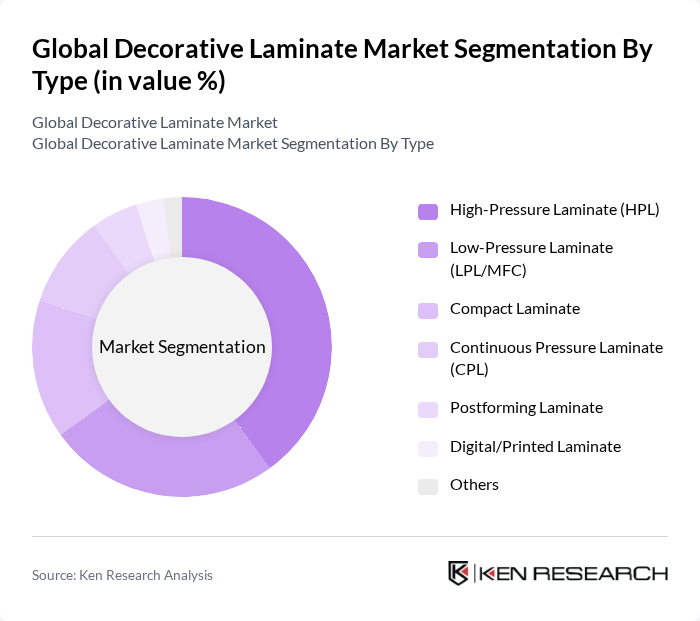

By Type:The decorative laminate market can be segmented into various types, including High-Pressure Laminate (HPL), Low-Pressure Laminate (LPL/MFC), Compact Laminate, Continuous Pressure Laminate (CPL), Postforming Laminate, Digital/Printed Laminate, and Others. Each type serves different applications and consumer preferences, influencing market dynamics. LPL/MFC is widely used in furniture and paneling for cost-effectiveness and ease of processing, while HPL and compact laminates address higher performance needs in commercial and high-traffic settings; Asia Pacific demand skews toward furniture and cabinets where low-pressure laminates are prevalent .

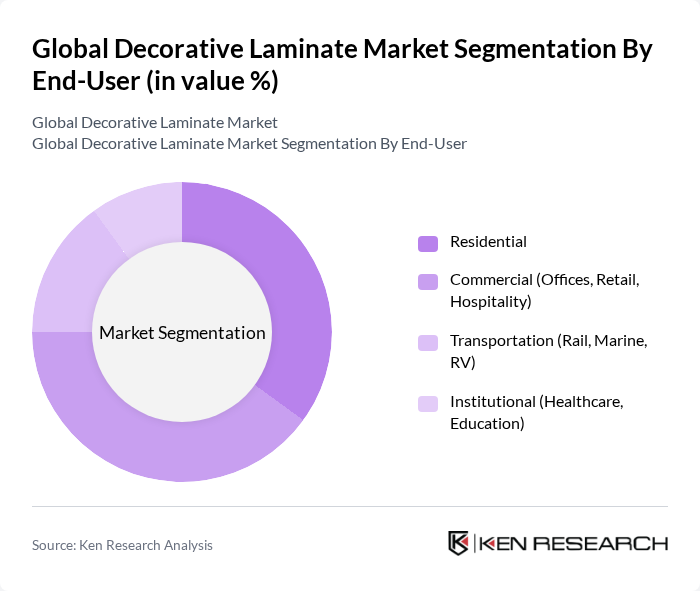

By End-User:The end-user segmentation includes Residential, Commercial (Offices, Retail, Hospitality), Transportation (Rail, Marine, RV), and Institutional (Healthcare, Education). Each segment has unique requirements and preferences, driving the demand for specific types of decorative laminates. Furniture and cabinets represent a major use-case across residential and commercial interiors due to durability, design variety, and low maintenance, while transportation and institutional specifications emphasize fire, impact, and chemical resistance .

The Global Decorative Laminate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wilsonart LLC, Formica Corporation, Laminex (The Laminex Group, Australia), Abet Laminati S.p.A., Panolam Industries International, Inc., Arpa Industriale S.p.A., Pionite (Panolam brand), Duropal (Pfleiderer Group), EGGER Group, Kronospan, Sonae Arauco, FunderMax GmbH, Greenlam Industries Limited, Merino Industries Limited, Trespa International B.V., AICA Kogyo Co., Ltd. (AICA Laminates), Stylam Industries Limited, Century Plyboards (India) Ltd. – CenturyLaminates, OMNOVA Solutions (SURTECO Group), Airolam Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the decorative laminate market appears promising, driven by ongoing trends in sustainability and customization. As consumers increasingly demand eco-friendly products, manufacturers are likely to invest in sustainable practices and materials. Additionally, the rise of e-commerce is expected to facilitate greater access to a variety of laminate designs, enhancing consumer choice. Innovations in smart technology integration will also play a crucial role in shaping product offerings, catering to the evolving preferences of modern consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Pressure Laminate (HPL) Low-Pressure Laminate (LPL/MFC) Compact Laminate Continuous Pressure Laminate (CPL) Postforming Laminate Digital/Printed Laminate Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Transportation (Rail, Marine, RV) Institutional (Healthcare, Education) |

| By Application | Furniture and Cabinets Interior Wall Panels & Partitions Flooring Countertops & Worktops |

| By Distribution Channel | Direct Sales (Project/Contract Sales) Distributors/Dealers Home Improvement & Specialty Stores Online Retail |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sustainability Certification | FSC Certified GREENGUARD/UL GREENGUARD Gold ISO 9001/14001 Certified PEFC/E1/E0/Carb2/TSCA Title VI |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Decorative Laminate Market | 150 | Homeowners, Interior Designers |

| Commercial Decorative Laminate Applications | 100 | Facility Managers, Architects |

| Industrial Decorative Laminate Usage | 80 | Procurement Managers, Operations Directors |

| Retail Sector Decorative Laminate Trends | 70 | Store Managers, Visual Merchandisers |

| Trends in Sustainable Decorative Laminates | 90 | Sustainability Officers, Product Development Managers |

The Global Decorative Laminate Market is valued at approximately USD 47.5 billion, reflecting sustained demand across various applications such as furniture, cabinetry, wall panels, and flooring, driven by aesthetics, durability, and cost-effectiveness.