Region:Global

Author(s):Shubham

Product Code:KRAB0703

Pages:82

Published On:August 2025

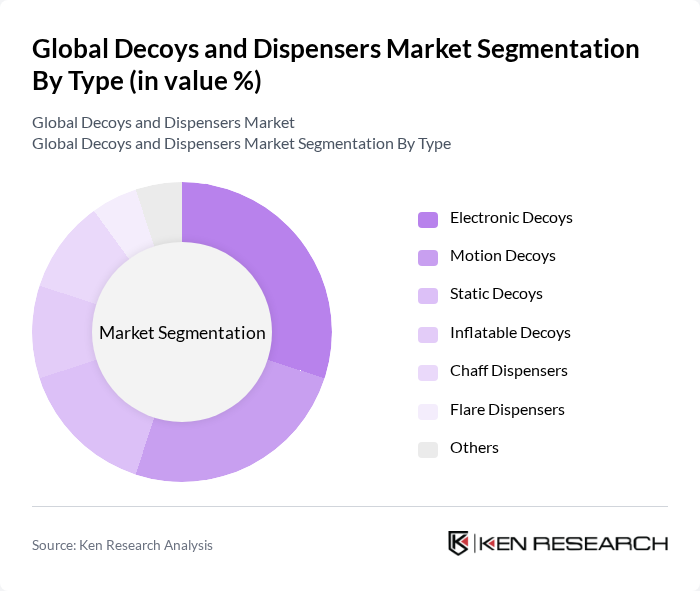

By Type:The market is segmented into Electronic Decoys, Motion Decoys, Static Decoys, Inflatable Decoys, Chaff Dispensers, Flare Dispensers, and Others. Electronic Decoys are gaining significant traction due to their advanced electronic countermeasure capabilities, particularly in military and aerospace applications. Motion Decoys remain popular in hunting and wildlife research, providing realistic movement to attract or divert targets. Chaff and Flare Dispensers are essential in military aircraft and naval defense for protection against radar-guided and infrared-guided threats .

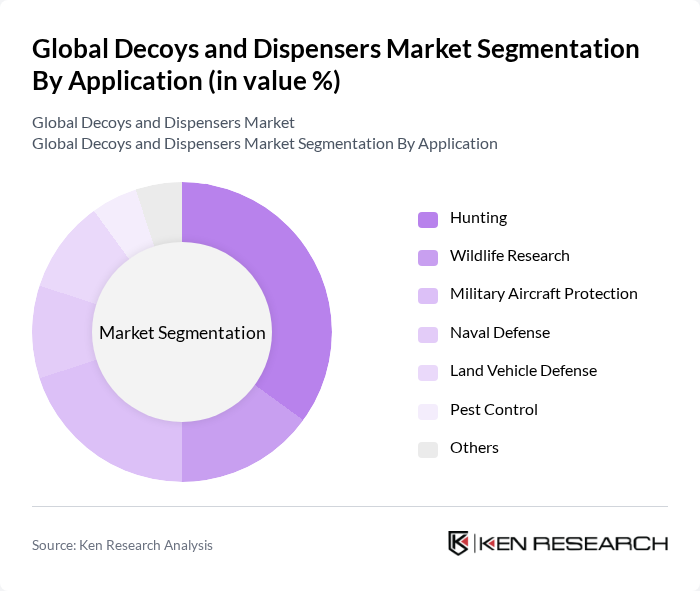

By Application:The applications of decoys and dispensers include Hunting, Wildlife Research, Military Aircraft Protection, Naval Defense, Land Vehicle Defense, Pest Control, and Others. The Hunting segment is significant, supported by increased participation in outdoor sports and the demand for technologically advanced hunting tools. Military applications, especially in aircraft and naval defense, are critical as armed forces prioritize survivability and countermeasure effectiveness in modern warfare environments .

The Global Decoys and Dispensers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Elbit Systems Ltd., Chemring Group PLC, Rheinmetall AG, Armtec Defense Technologies, BAE Systems plc, LACROIX, Leonardo S.p.A., Saab AB, Raytheon Technologies Corporation, Owen International Pty Ltd, Ordtech, Terma A/S, Bharat Dynamics Limited, Thales Group, Cobham Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the decoys and dispensers market appears promising, driven by technological innovations and a growing emphasis on sustainable practices. As consumers increasingly prioritize eco-friendly products, manufacturers are likely to invest in developing biodegradable materials and smart technologies. Additionally, the expansion into emerging markets, particularly in Asia and Africa, presents significant growth potential, as these regions experience rising interest in wildlife management and outdoor activities.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Decoys Motion Decoys Static Decoys Inflatable Decoys Chaff Dispensers Flare Dispensers Others |

| By Application | Hunting Wildlife Research Military Aircraft Protection Naval Defense Land Vehicle Defense Pest Control Others |

| By Material | Plastic Fabric Metal Foam Pyrotechnic Compounds Others |

| By Distribution Channel | Online Retail Specialty Stores Supermarkets Direct Sales Defense Contracts Others |

| By End-User | Individual Hunters Government Agencies Research Institutions Military (Air Force, Navy, Army) Defense Contractors Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Region | North America United States Canada Europe United Kingdom France Germany Russia Rest of Europe Asia-Pacific China India Japan South Korea Rest of Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Decoys | 100 | Store Managers, Product Buyers |

| Consumer Preferences for Dispensers | 80 | Hunting Enthusiasts, Outdoor Gear Reviewers |

| Market Trends in Electronic Decoys | 70 | Product Developers, Technology Specialists |

| Wildlife Management Practices | 50 | Wildlife Biologists, Conservation Officers |

| Impact of Regulations on Decoy Usage | 90 | Policy Makers, Environmental Consultants |

The Global Decoys and Dispensers Market is valued at approximately USD 2.1 billion, driven by increased defense budgets, geopolitical tensions, and advancements in electronic warfare technologies, alongside growing applications in hunting and wildlife research.