Region:Global

Author(s):Dev

Product Code:KRAD0343

Pages:83

Published On:August 2025

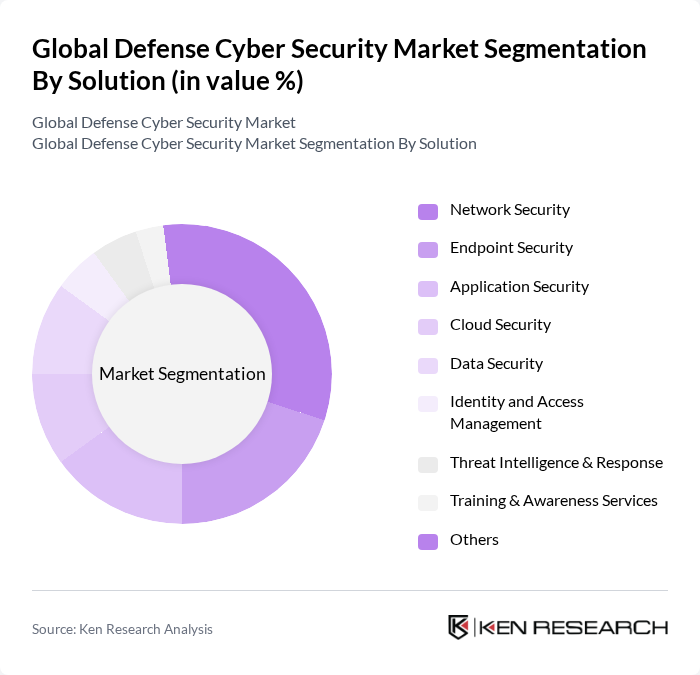

By Solution:The solutions segment includes a comprehensive range of cybersecurity offerings designed to protect defense systems from evolving cyber threats. Key subsegments are Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, Threat Intelligence & Response, Training & Awareness Services, and Others. Among these, Network Security remains the leading subsegment, driven by the critical need for secure, resilient communication networks in defense operations and the increasing adoption of advanced encryption and threat detection technologies .

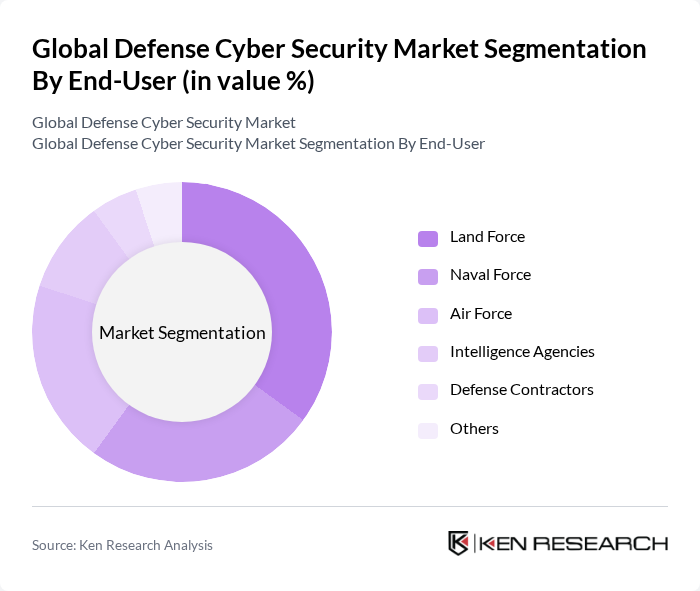

By End-User:The end-user segment comprises various branches of the military and defense organizations that deploy cybersecurity solutions. Key subsegments include Land Force, Naval Force, Air Force, Intelligence Agencies, Defense Contractors, and Others. Land Force is currently the dominant subsegment, reflecting the growing reliance on digital command, control, and communication systems for ground operations, and the need to secure mission-critical networks against increasingly sophisticated cyber threats .

The Global Defense Cyber Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Northrop Grumman Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, BAE Systems plc, Thales Group, General Dynamics Corporation, Cisco Systems, Inc., IBM Corporation, Palo Alto Networks, Inc., Leidos Holdings Inc., Booz Allen Hamilton Holding Corporation, L3Harris Technologies, Inc., CACI International Inc., QinetiQ Group plc, Airbus Defence and Space, SAIC Inc., Check Point Software Technologies Ltd., McAfee Corp., CrowdStrike Holdings, Inc., Fortinet, Inc., Palantir Technologies Inc., Splunk Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the defense cyber security market is poised for significant transformation, driven by technological advancements and increasing regulatory pressures. As organizations prioritize cyber resilience, investments in artificial intelligence and machine learning for threat detection are expected to rise. Additionally, the emphasis on zero trust security models will reshape security frameworks, ensuring that every access request is verified. These trends indicate a proactive approach to cyber defense, aligning with the growing recognition of cyber threats as a critical national security issue.

| Segment | Sub-Segments |

|---|---|

| By Solution | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Threat Intelligence & Response Training & Awareness Services Others |

| By End-User | Land Force Naval Force Air Force Intelligence Agencies Defense Contractors Others |

| By Component | Solutions Services |

| By Security Type | Network Security Endpoint Security Application Security Cloud Security Other Security Types |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Cybersecurity Operations | 100 | Cybersecurity Officers, Defense Analysts |

| Defense Contractor Cyber Solutions | 80 | IT Security Managers, Project Leads |

| Government Cybersecurity Policy | 60 | Policy Makers, Defense Strategists |

| Cybersecurity Training Programs | 50 | Training Coordinators, Military Educators |

| Emerging Cyber Threats Analysis | 70 | Threat Intelligence Analysts, Cybersecurity Researchers |

The Global Defense Cyber Security Market is valued at approximately USD 37 billion, reflecting a significant increase driven by the rising frequency and sophistication of cyber threats targeting national defense infrastructure and the need for secure military communication systems.