Region:Global

Author(s):Shubham

Product Code:KRAA2259

Pages:92

Published On:August 2025

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, Threat Intelligence & Incident Response, Security Operations Center (SOC) Solutions, and Others. Among these, Network Security is currently the leading sub-segment due to the increasing need for protecting network infrastructures from sophisticated cyber threats, including ransomware and state-sponsored attacks. The rise in remote work, cloud adoption, and the proliferation of IoT devices has further amplified the demand for robust network security solutions .

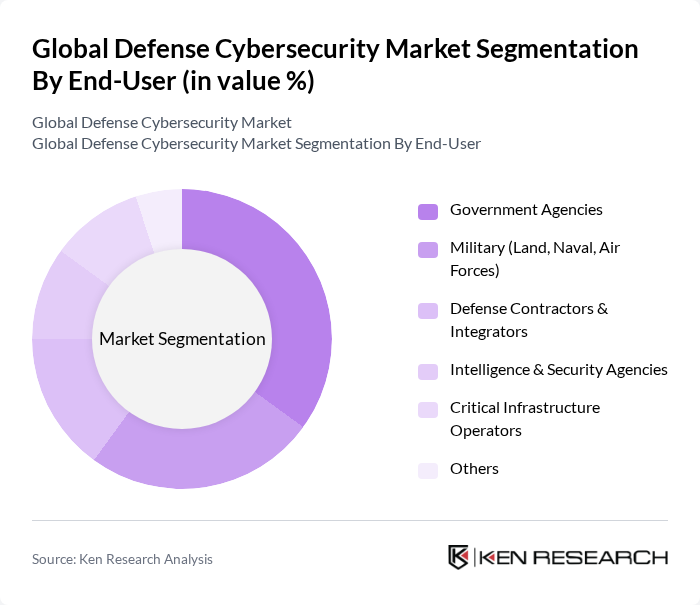

By End-User:The end-user segmentation includes Government Agencies, Military (Land, Naval, Air Forces), Defense Contractors & Integrators, Intelligence & Security Agencies, Critical Infrastructure Operators, and Others. The Government Agencies segment is the most significant contributor to the market, driven by the increasing need for national security and the protection of sensitive data. The military sector is also witnessing substantial investments in cybersecurity to safeguard defense operations and critical systems, with a focus on protecting command, control, communications, and surveillance networks .

The Global Defense Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raytheon Technologies Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems plc, Thales Group, General Dynamics Corporation, Cisco Systems, Inc., IBM Corporation, Palo Alto Networks, Inc., Trellix (formerly FireEye and McAfee Enterprise), Check Point Software Technologies Ltd., Leidos Holdings Inc., CACI International Inc., L3Harris Technologies, Inc., Palantir Technologies Inc., Airbus Defence and Space, Booz Allen Hamilton Holding Corp., QinetiQ Group plc, SAIC Inc., CrowdStrike Holdings, Inc., Fortinet, Inc., Splunk Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the defense cybersecurity market is poised for significant transformation, driven by technological advancements and evolving threat landscapes. As organizations increasingly adopt zero trust security models, the focus will shift towards proactive threat detection and response strategies. Additionally, the integration of artificial intelligence and machine learning will enhance cybersecurity capabilities, enabling defense agencies to better anticipate and mitigate cyber threats. Collaborative efforts among nations will further strengthen global cybersecurity resilience, fostering a more secure digital environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Threat Intelligence & Incident Response Security Operations Center (SOC) Solutions Others |

| By End-User | Government Agencies Military (Land, Naval, Air Forces) Defense Contractors & Integrators Intelligence & Security Agencies Critical Infrastructure Operators Others |

| By Component | Solutions (Software Platforms & Tools) Services (Consulting, Integration, Managed Security) Hardware (Security Appliances, Network Devices) |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Chile, Colombia, Rest of Latin America) Middle East & Africa (UAE, Saudi Arabia, Israel, South Africa, Rest of MEA) |

| By Compliance Standards | ISO/IEC 27001 NIST SP 800-53 PCI DSS HIPAA Defense-Specific Standards (e.g., CMMC, ITAR) |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships International Defense Alliances Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Cybersecurity Operations | 100 | Cybersecurity Officers, IT Managers |

| Defense Contractor Cyber Solutions | 70 | Business Development Managers, Technical Leads |

| Government Cybersecurity Policy Makers | 50 | Policy Analysts, Defense Strategists |

| Cybersecurity Training Programs for Defense | 40 | Training Coordinators, Program Directors |

| Cyber Threat Intelligence Sharing Initiatives | 60 | Threat Analysts, Intelligence Officers |

The Global Defense Cybersecurity Market is valued at approximately USD 37 billion, reflecting a significant increase driven by the rising frequency and sophistication of cyber threats targeting national defense infrastructure and military networks.