Region:Global

Author(s):Rebecca

Product Code:KRAD0214

Pages:84

Published On:August 2025

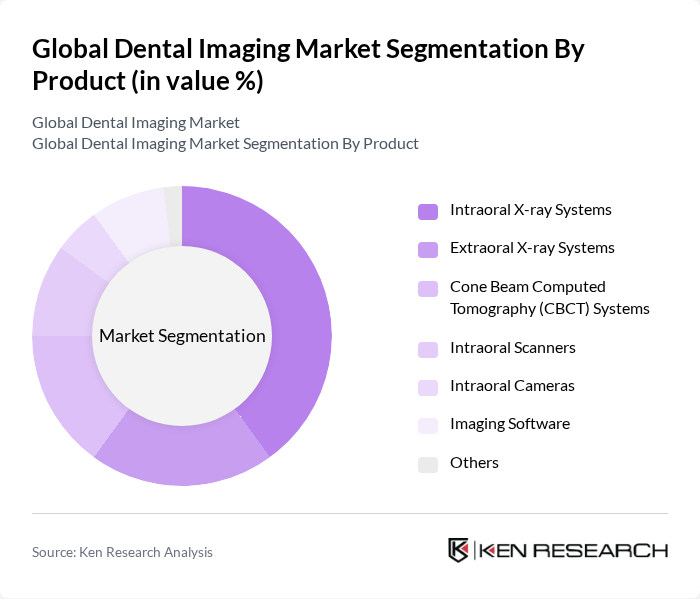

By Product:The product segmentation of the market includes a range of dental imaging systems and software. The dominant sub-segment is Intraoral X-ray Systems, widely used in dental clinics for their diagnostic efficiency and effectiveness. Other notable sub-segments include Cone Beam Computed Tomography (CBCT) Systems, which provide advanced 3D imaging for complex dental procedures, and Imaging Software, which is increasingly integrated with digital workflows to enhance image analysis and treatment planning .

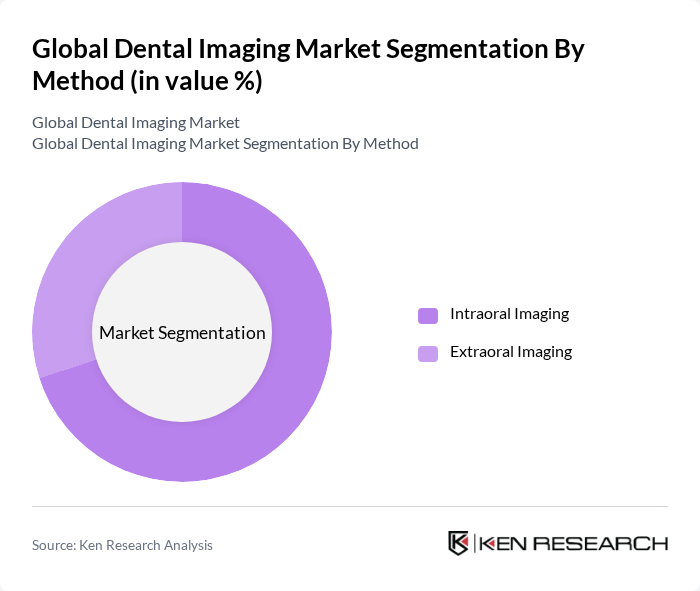

By Method:The market is segmented by imaging methods, primarily focusing on Intraoral Imaging and Extraoral Imaging. Intraoral Imaging is the leading method due to its widespread use in routine dental examinations and its ability to provide detailed images of teeth and surrounding structures. Extraoral Imaging is increasingly adopted for orthodontic assessments, implant planning, and complex surgical cases, reflecting its growing importance in comprehensive dental care .

The Global Dental Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carestream Dental LLC, Dentsply Sirona Inc., Planmeca Oy, Vatech Co., Ltd., Envista Holdings Corporation, 3Shape A/S, Midmark Corporation, Fujifilm Holdings Corporation, Konica Minolta, Inc., Acteon Group, Dental Wings Inc., XDR Radiology, Owandy Radiology, PreXion, Inc., FONA Dental s.r.o. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental imaging market appears promising, driven by technological advancements and increasing awareness of oral health. The integration of artificial intelligence in imaging solutions is expected to enhance diagnostic capabilities, improving patient outcomes. Additionally, the expansion of dental tourism, particularly in regions with lower treatment costs, is likely to boost demand for advanced imaging technologies. As practices adopt digital solutions, the market is poised for significant growth, fostering innovation and improved patient care.

| Segment | Sub-Segments |

|---|---|

| By Product | Intraoral X-ray Systems Extraoral X-ray Systems Cone Beam Computed Tomography (CBCT) Systems Intraoral Scanners Intraoral Cameras Imaging Software Others |

| By Method | Intraoral Imaging Extraoral Imaging |

| By Application | Implantology Endodontics Oral & Maxillofacial Surgery Orthodontics Periodontics Diagnostic Imaging Treatment Planning Patient Education Others |

| By End-User | Dental Clinics Hospitals Dental Support Organizations (DSO) Dental Academic Institutes Dental Laboratories Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Digital Radiography Analog Radiography Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics Imaging Usage | 120 | Dentists, Clinic Owners |

| Radiology Centers Equipment Adoption | 90 | Radiologists, Imaging Technicians |

| Dental Equipment Suppliers Feedback | 60 | Sales Managers, Product Development Heads |

| Market Trends in Dental Imaging | 50 | Industry Analysts, Market Researchers |

| Patient Experience with Imaging | 70 | Patients, Dental Hygienists |

The Global Dental Imaging Market is valued at approximately USD 3.1 billion, driven by innovations in imaging technology, rising demand for dental procedures, and increased awareness of oral health, alongside a higher prevalence of dental diseases.