Region:Global

Author(s):Geetanshi

Product Code:KRAD7187

Pages:86

Published On:December 2025

By Product Type:The product type segmentation includes various categories such as Manikin-based Dental Simulators (Phantom Heads), Virtual Reality (VR) Dental Simulators, Haptic-enabled Dental Simulators, Hybrid Simulators (Mechanical + Digital), and Others (Accessories, Add-on Modules). Manikin-based simulators (phantom heads and typodont systems) currently account for a substantial share, as they remain the foundational tools for preclinical skills training in most dental schools worldwide. Virtual Reality (VR) and haptic-enabled dental simulators are gaining significant traction due to their immersive learning experience, real-time performance analytics, remote training capability, and ability to replicate complex clinical scenarios, making them increasingly preferred for advanced skills training and objective assessment. The demand for these digital and hybrid simulators is driven by advancements in graphics, haptics, and AI-based evaluation, as well as the increasing focus on interactive and competency-based learning methodologies in dental education.

By Component:The component segmentation consists of Hardware and Software. The hardware segment is currently leading the market due to the essential role of physical simulators, including manikin units, phantom heads, haptic devices, and VR headsets, in delivering realistic hands-on training experiences. Hardware investments are significant for dental schools, simulation centers, and hospitals aiming to expand their preclinical and continuing education capacities. At the same time, software solutions are gaining importance for enhancing the functionality of simulators through procedure libraries, assessment analytics, cloud-based curriculum management, and integration with digital dentistry workflows, which is driving faster growth of the software component from a smaller base.

The Global Dental Simulator Market is characterized by a dynamic mix of regional and international players. Leading participants such as KaVo Dental (KaVo Dental GmbH), Nissin Dental Products Inc., Dentsply Sirona Inc., DentSim (Image Navigation Ltd.), Moog Simodont Dental Trainer (Moog Inc.), Forsslund Systems AB, HRV Simulation (HRV AB), 3D Systems Corporation, VRMagic / VRmagic Holding AG, Planmeca Oy, Navadha Enterprises, Kilgore International Inc., CFG Dental (Columbia Dentoform), Nissin Dental Products of America Inc., Universal Simulation UK contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental simulator market appears promising, driven by technological advancements and increasing demand for effective training solutions. As institutions recognize the importance of simulation in enhancing educational outcomes, investments in these technologies are expected to rise. Furthermore, the integration of AI and machine learning into simulators will likely create more personalized learning experiences, catering to diverse student needs. This evolution will position dental simulators as essential tools in modern dental education, fostering a new generation of skilled professionals.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Manikin-based Dental Simulators (Phantom Heads) Virtual Reality (VR) Dental Simulators Haptic-enabled Dental Simulators Hybrid Simulators (Mechanical + Digital) Others (Accessories, Add-on Modules) |

| By Component | Hardware Software |

| By Application | Dental Training & Education Clinical Treatment Planning & Patient Simulation Skills Assessment & Competency Evaluation Product Demonstration & Continuing Education Others |

| By End-User | Dental Schools & Universities Hospitals Dental Clinics & Private Practices Research & Training Institutes Others |

| By Technology | D Modeling & Imaging Technology Software-based Simulation Platforms Interactive & Immersive Learning Platforms (VR/AR/MR) Others |

| By Distribution Channel | Direct Sales to Institutions Distributors / Dealers Online / Digital Sales Channels Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Schools and Training Institutions | 120 | Deans, Program Directors, Faculty Members |

| Dental Equipment Manufacturers | 90 | Product Managers, R&D Heads, Sales Directors |

| Dental Practitioners | 100 | General Dentists, Specialists, Dental Educators |

| Healthcare Regulators | 60 | Policy Makers, Compliance Officers, Regulatory Analysts |

| Dental Technology Innovators | 50 | Start-up Founders, Tech Developers, Industry Analysts |

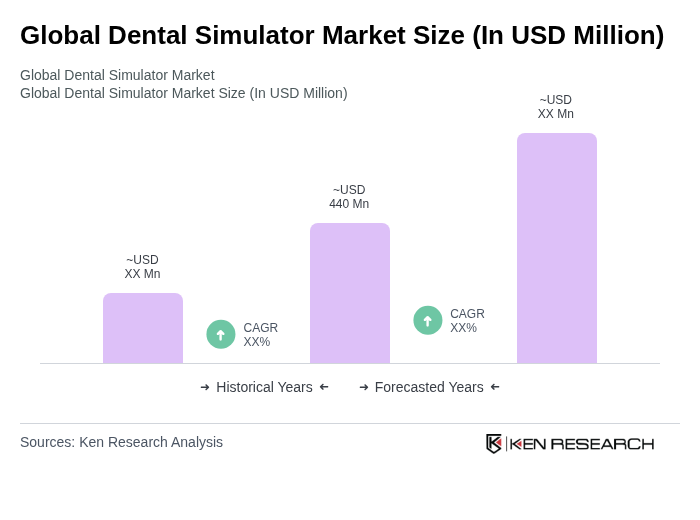

The Global Dental Simulator Market is valued at approximately USD 440 million, reflecting a significant growth trend driven by advancements in dental education tools and increasing demand for practical training in dental curricula.