Region:Global

Author(s):Geetanshi

Product Code:KRAD0092

Pages:86

Published On:August 2025

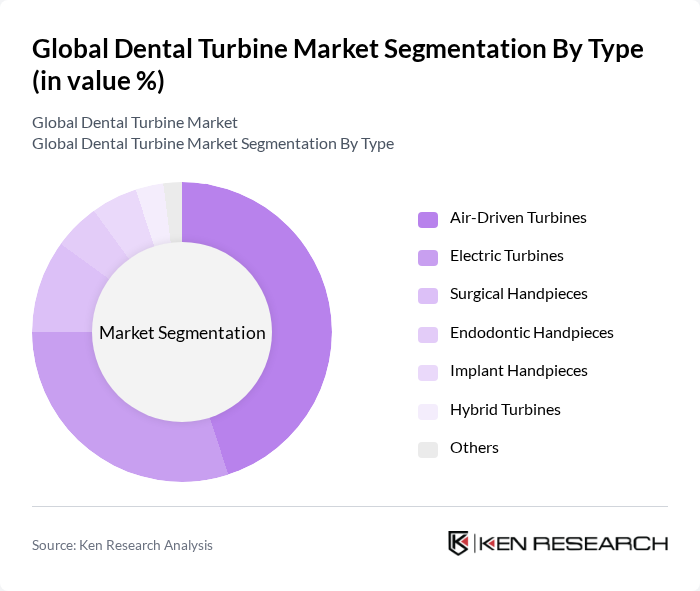

By Type:The dental turbine market is segmented into Air-Driven Turbines, Electric Turbines, Surgical Handpieces, Endodontic Handpieces, Implant Handpieces, Hybrid Turbines, and Others. Among these, Air-Driven Turbines are currently leading the market due to their widespread use in dental clinics and hospitals. Their reliability, ease of use, and cost-effectiveness make them a preferred choice for dental professionals. Electric Turbines are also gaining traction, particularly in advanced dental practices, due to their precision and reduced noise levels .

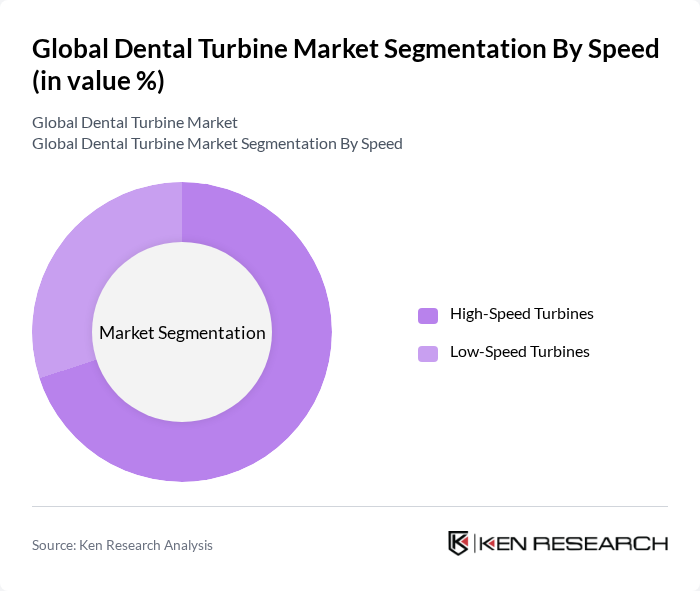

By Speed:The market is also segmented by speed into High-Speed Turbines and Low-Speed Turbines. High-Speed Turbines dominate the market due to their efficiency in performing various dental procedures, such as cutting and polishing. They are preferred for restorative and cosmetic dentistry, where precision is crucial. Low-Speed Turbines, while less common, are still essential for specific applications, such as endodontics and surgical procedures, where control and torque are more important than speed .

The Global Dental Turbine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dentsply Sirona, KaVo Kerr, NSK Ltd., Bien-Air Dental, W&H Dentalwerk Bürmoos GmbH, A-dec Inc., The Yoshida Dental Mfg. Co., Ltd., Morita Corporation, Hu-Friedy Mfg. Co., LLC, DentalEZ Group, Planmeca Oy, VDW GmbH, Cattani S.p.A., Guilin Woodpecker Medical Instrument Co., Ltd., BA International Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental turbine market appears promising, driven by ongoing technological advancements and a growing emphasis on oral health. As dental practices increasingly adopt digital technologies, including CAD/CAM systems, the demand for high-performance dental turbines will likely rise. Additionally, the trend towards minimally invasive procedures is expected to further propel the market, as practitioners seek efficient tools that enhance patient comfort and treatment outcomes, ensuring a robust growth trajectory in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Air-Driven Turbines Electric Turbines Surgical Handpieces Endodontic Handpieces Implant Handpieces Hybrid Turbines Others |

| By Speed | High-Speed Turbines Low-Speed Turbines |

| By End-User | Dental Clinics Hospitals Dental Laboratories Academic Institutions Others |

| By Application | Restorative Dentistry Cosmetic Dentistry Orthodontics Oral Surgery Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Turbines Mid-Range Turbines High-End Turbines |

| By Brand | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics | 100 | Dentists, Clinic Owners |

| Dental Equipment Distributors | 60 | Sales Managers, Product Specialists |

| Dental Schools and Training Institutions | 50 | Instructors, Program Coordinators |

| Dental Technicians | 40 | Laboratory Managers, Technicians |

| Dental Associations | 40 | Policy Makers, Research Directors |

The Global Dental Turbine Market is valued at approximately USD 210 million, driven by increasing demand for dental procedures, advancements in turbine technology, and heightened awareness of oral health among consumers.