Region:Global

Author(s):Dev

Product Code:KRAD0446

Pages:84

Published On:August 2025

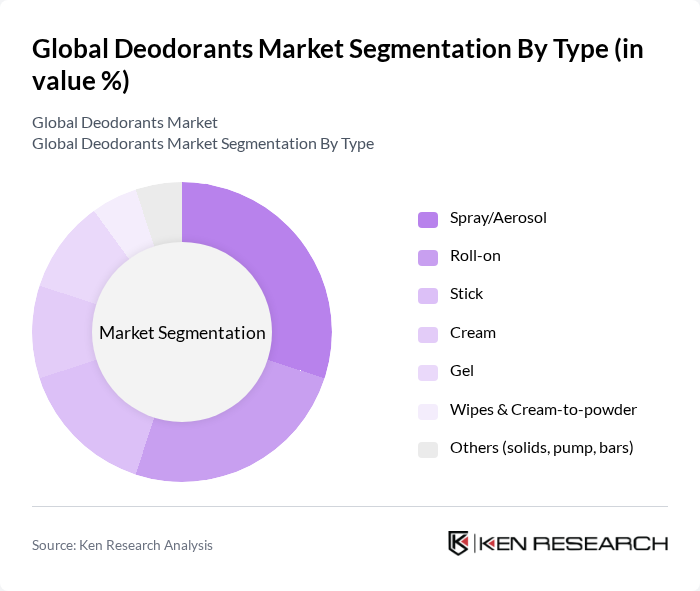

By Type:The deodorants market can be segmented into various types, including Spray/Aerosol, Roll-on, Stick, Cream, Gel, Wipes & Cream-to-powder, and Others (solids, pump, bars). Each type caters to different consumer preferences and usage scenarios, with specific formulations and packaging styles that appeal to various demographics. Recent launches highlight aluminum-free sticks, gas-free/aerosol-light sprays, and pocket-size formats catering to on-the-go use and sustainability preferences.

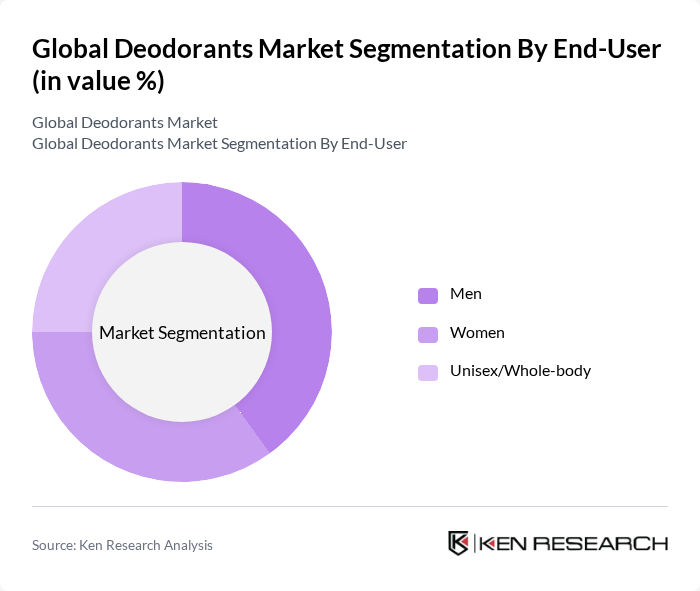

By End-User:The market can also be segmented based on end-users, which include Men, Women, and Unisex/Whole-body. Each segment has distinct preferences and purchasing behaviors, influenced by brand positioning, fragrance profiles, and cultural norms. Growth in unisex and gender-neutral scents and products aligns with inclusivity trends and younger consumer preferences.

The Global Deodorants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever PLC, Procter & Gamble Co., Beiersdorf AG, Colgate-Palmolive Company, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, L'Oréal S.A., Edgewell Personal Care Company, Church & Dwight Co., Inc., Coty Inc., Estée Lauder Companies Inc., Shiseido Company, Limited, Kao Corporation, Lion Corporation, Godrej Consumer Products Limited contribute to innovation, geographic expansion, and service delivery in this space.

The deodorants market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability will likely lead to a rise in eco-friendly packaging solutions, while innovations in product formulations will cater to diverse consumer needs. Additionally, the integration of digital marketing strategies will enhance brand visibility and consumer engagement, positioning companies to capitalize on emerging trends and preferences in the None region.

| Segment | Sub-Segments |

|---|---|

| By Type | Spray/Aerosol Roll-on Stick Cream Gel Wipes & Cream-to-powder Others (solids, pump, bars) |

| By End-User | Men Women Unisex/Whole-body |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Specialty & Beauty Stores Convenience Stores Pharmacies/Drugstores Others (direct selling, salons) |

| By Packaging Type | Aerosol Cans Plastic Bottles & Roll-on Containers Sticks & Tubes Glass Bottles Refillable & Recyclable Formats |

| By Price Range | Economy/Mass Mid-range Premium |

| By Fragrance Type | Fresh/Aquatic Citrus Floral Woody/Oriental Fragrance-free/Hypoallergenic |

| By Product Formulation | Antiperspirants (aluminum-based) Deodorants (aluminum-free) Clinical/Prescription-strength Natural/Clean (plant-based) Whole-body & Sensitive-skin |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Deodorants | 150 | General Consumers, Age 18-45 |

| Retail Insights on Deodorant Sales | 100 | Store Managers, Category Buyers |

| Market Trends from Industry Experts | 60 | Market Analysts, Brand Managers |

| Product Development Feedback | 75 | R&D Managers, Product Designers |

| Brand Loyalty and Switching Behavior | 120 | Frequent Deodorant Users, Brand Switchers |

The Global Deodorants Market is valued at approximately USD 30 billion, reflecting a significant growth driven by increasing consumer awareness of personal hygiene, rising disposable incomes, and a shift towards natural and eco-friendly products.