Region:Global

Author(s):Dev

Product Code:KRAA1649

Pages:95

Published On:August 2025

By Service Type:The service type segmentation includes various categories such as preclinical services, clinical services (Phase I–IV), discovery/translational services, regulatory & medical writing, clinical monitoring & data management, biostatistics & pharmacovigilance, site management & patient recruitment, and others. Among these, clinical services (Phase I–IV) dominate the market due to the increasing number and complexity of dermatology trials and the need for specialized oversight, quality, safety, and regulatory compliance in skin-focused studies; recent industry data indicate the clinical segment is the largest component within dermatology CRO services.

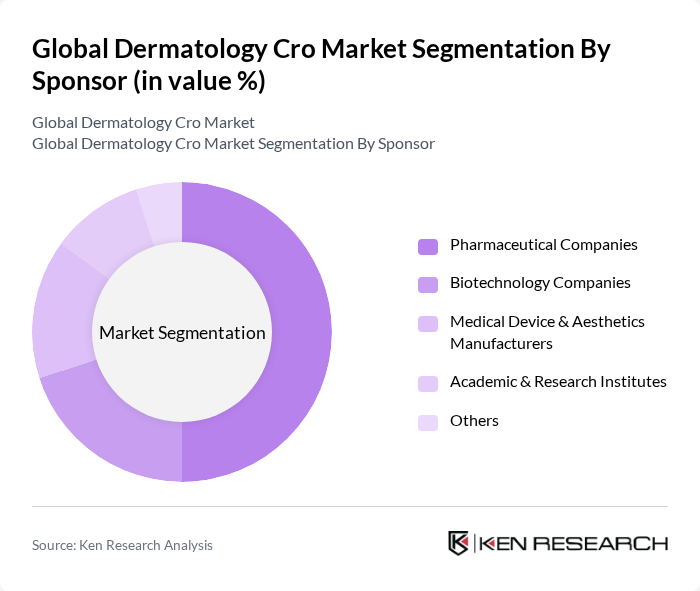

By Sponsor:The sponsor segmentation includes pharmaceutical companies, biotechnology companies, medical device & aesthetics manufacturers, academic & research institutes, and others. Pharmaceutical companies lead this segment, driven by sustained dermatology R&D investment, broad pipelines spanning small molecules, biologics, and topicals, and established global clinical networks that increasingly outsource to specialized CROs. Collaboration between pharma sponsors and CROs continues to expand to accelerate timelines and manage trial complexity.

The Global Dermatology CRO Market is characterized by a dynamic mix of regional and international players. Leading participants such as IQVIA Holdings Inc., Labcorp Drug Development (Laboratory Corporation of America Holdings), PPD, part of Thermo Fisher Scientific Inc., Parexel International Corporation, ICON plc, Syneos Health, Inc., Medpace Holdings, Inc., Charles River Laboratories International, Inc., WuXi AppTec Co., Ltd., Pharmaron Beijing Co., Ltd., Aragen Life Sciences Ltd., CTI Clinical Trial & Consulting Services, Biorasi, LLC, TFS HealthScience, proDERM Institute for Applied Dermatological Research GmbH, bioskin GmbH, Proinnovera GmbH, Javara, Inc., Medidata Solutions, Inc. (a Dassault Systèmes company), CROMSOURCE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dermatology market in future appears promising, driven by technological advancements and a growing focus on preventive care. The integration of artificial intelligence in diagnostics and treatment planning is expected to enhance patient outcomes significantly. Additionally, the increasing popularity of teledermatology is likely to bridge the gap in service accessibility, particularly in underserved areas, fostering a more inclusive healthcare environment and expanding the market's reach.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Preclinical Services Clinical Services (Phase I–IV) Discovery/Translational Services Regulatory & Medical Writing Clinical Monitoring & Data Management Biostatistics & Pharmacovigilance Site Management & Patient Recruitment Others |

| By Sponsor | Pharmaceutical Companies Biotechnology Companies Medical Device & Aesthetics Manufacturers Academic & Research Institutes Others |

| By Indication | Acne & Rosacea Psoriasis Atopic Dermatitis & Eczema Skin Cancer (Non-melanoma, Melanoma) Fungal & Infectious Skin Diseases Wound Care & Ulcers Aesthetic/Cosmetic Dermatology Rare & Orphan Dermatological Diseases Others |

| By Trial Phase | Phase I Phase II Phase III Phase IV (Post-Marketing) |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application (Operational) | Laboratory/Imaging Medical Writing Clinical Monitoring Data Management & EDC Patient Recruitment & Retention Others |

| By Client Size | Large Pharma/Biotech Mid-size Pharma/Biotech Emerging Biotech |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 140 | Dermatologists, Clinic Managers |

| Pharmaceutical Companies | 90 | Product Managers, R&D Directors |

| Patient Focus Groups | 80 | Patients with chronic skin conditions, Caregivers |

| Healthcare Providers | 120 | General Practitioners, Nurse Practitioners |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Policy Makers |

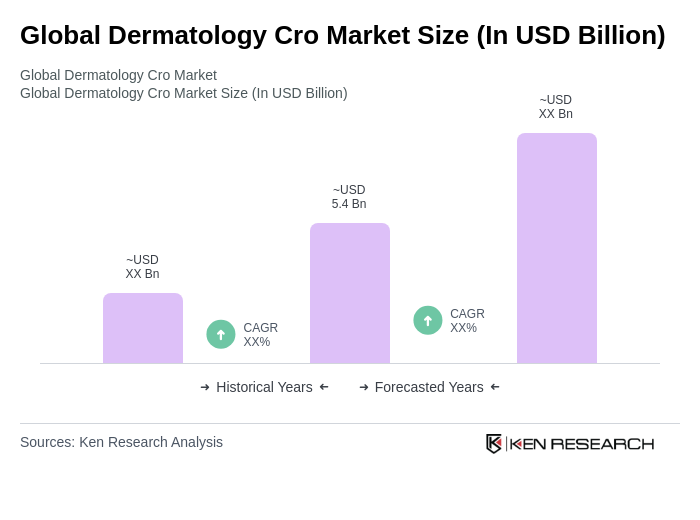

The Global Dermatology CRO Market is valued at approximately USD 5.4 billion, reflecting a sustained expansion driven by the increasing prevalence of skin disorders and rising demand for dermatological treatments, alongside advancements in clinical research operations.