Region:Global

Author(s):Rebecca

Product Code:KRAC0289

Pages:82

Published On:August 2025

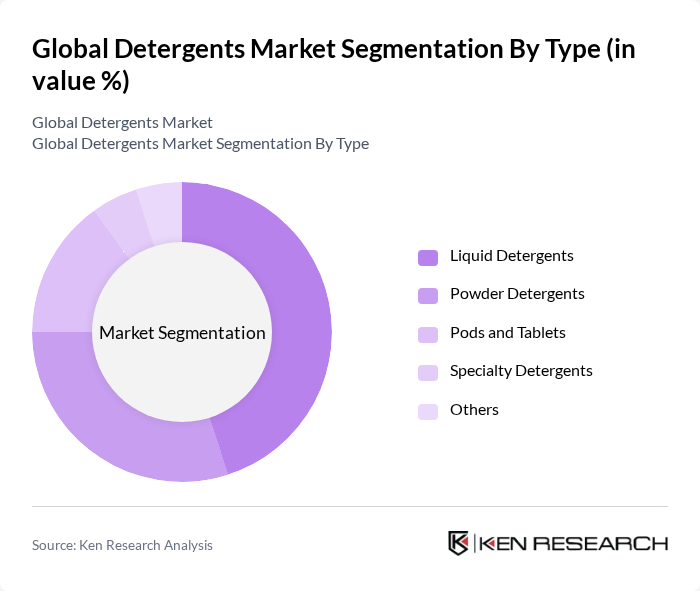

By Type:The detergents market can be segmented into various types, including liquid detergents, powder detergents, pods and tablets, specialty detergents, and others. Among these, liquid detergents have gained significant popularity due to their ease of use and effectiveness in various cleaning applications. The trend towards convenience and efficiency has led to a surge in demand for liquid formulations, making them the leading subsegment in the market .

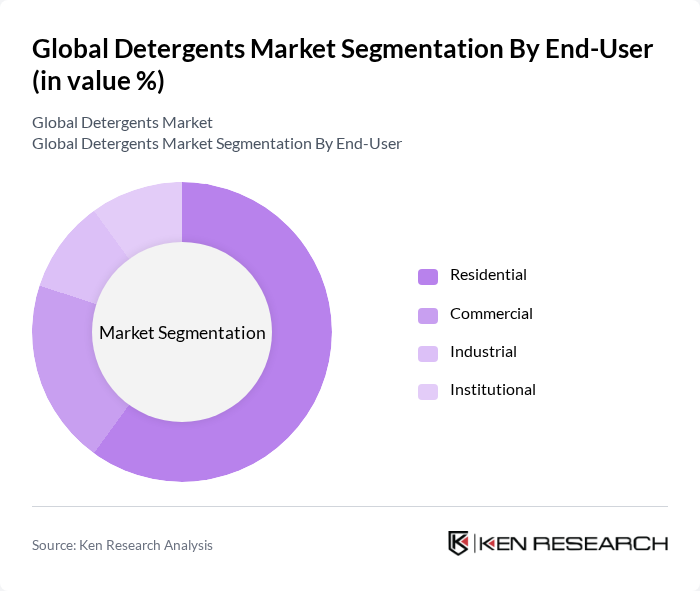

By End-User:The end-user segmentation includes residential, commercial, industrial, and institutional users. The residential segment dominates the market, driven by the increasing number of households and the growing trend of home cleaning. Consumers are increasingly opting for effective and convenient cleaning solutions, which has led to a rise in demand for various detergent products tailored for home use .

The Global Detergents Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Unilever PLC, Henkel AG & Co. KGaA, Reckitt Benckiser Group PLC, Colgate-Palmolive Company, Church & Dwight Co., Inc., Ecover, SC Johnson & Son, Inc., The Clorox Company, Kao Corporation, PZ Cussons PLC, Lion Corporation, Amway Corporation, Seventh Generation, Inc., Method Products, PBC, Fena Private Limited, RSPL Group (Ghadi Detergent), Nice Group Co., Ltd., Liby Group Co., Ltd., Wings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the detergents market appears promising, driven by ongoing trends towards sustainability and technological innovation. As consumers increasingly demand eco-friendly and multi-purpose cleaning solutions, manufacturers are likely to invest in research and development to meet these needs. Additionally, the rise of smart technology in household products is expected to enhance user experience, making cleaning more efficient. These trends will shape the market landscape, fostering growth and adaptation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Detergents Powder Detergents Pods and Tablets Specialty Detergents Others |

| By End-User | Residential Commercial Industrial Institutional |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Direct Sales |

| By Packaging Type | Bottles Pouches Boxes Sachets Others |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | National Brands Private Labels Regional/Local Brands Generic Brands |

| By Product Formulation | Bio-Based Formulations Conventional Formulations Enzyme-Based Formulations Phosphate-Free Formulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Detergent Usage | 150 | Household Managers, Primary Grocery Shoppers |

| Commercial Cleaning Products | 90 | Facility Managers, Procurement Officers |

| Eco-friendly Detergent Preferences | 70 | Environmentally Conscious Consumers, Sustainability Advocates |

| Online Detergent Purchases | 100 | eCommerce Managers, Digital Marketing Specialists |

| Detergent Brand Loyalty | 80 | Brand Managers, Market Research Analysts |

The Global Detergents Market is valued at approximately USD 119 billion, reflecting a significant growth trend driven by increasing consumer demand for effective cleaning solutions and a focus on sustainability and eco-friendly products.