Region:Global

Author(s):Shubham

Product Code:KRAC0694

Pages:83

Published On:August 2025

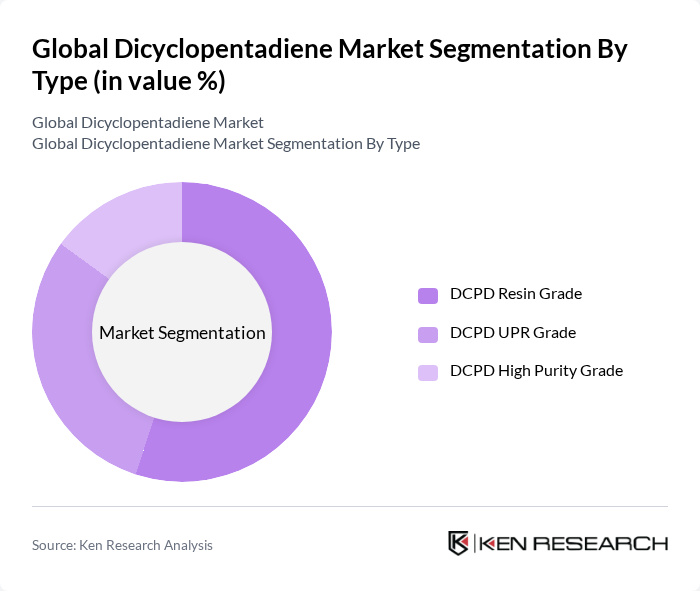

By Type:The market is segmented into three main types: DCPD Resin Grade, DCPD UPR Grade, and DCPD High Purity Grade. Among these, the DCPD Resin Grade is the most dominant due to its extensive use in the production of composite materials and hydrocarbon resins for coatings and adhesives. Rising demand for lightweight, high-performance materials in automotive, marine, and construction supports this segment. The DCPD UPR Grade follows closely, as it is widely utilized in unsaturated polyester resins for fiberglass-reinforced components, sanitary ware, panels, and marine structures .

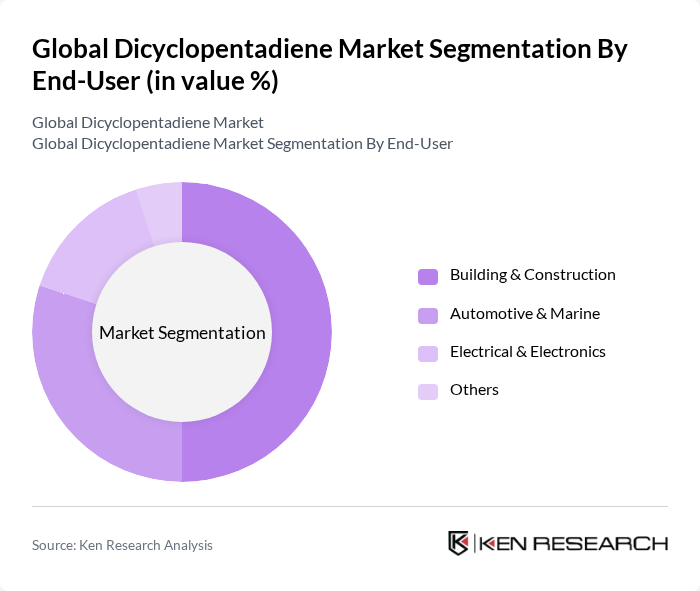

By End-User:The end-user segmentation includes Building & Construction, Automotive & Marine, Electrical & Electronics, and Others. The Building & Construction sector is the leading end-user, driven by the use of UPR-based composites in panels, cladding, sanitary ware, and infrastructure components. The Automotive & Marine sector remains significant, leveraging poly-DCPD and UPR composites to reduce weight and improve durability and corrosion resistance. The Electrical & Electronics sector is growing steadily with applications in insulation, encapsulation, and electronic component housings using DCPD-derived resins .

The Global Dicyclopentadiene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dow Chemical Company, ExxonMobil Chemical, LyondellBasell Industries, Shell Chemicals, Chevron Phillips Chemical, Braskem S.A., ZEON Corporation, ENEOS Corporation (formerly JX Nippon Oil & Energy), Sinopec Shanghai Petrochemical Co., Ltd., Shandong Yuhuang Chemical Co., Ltd., Fushun Yikesi New Material Co., Ltd., KOLON Industries, Inc., Texmark Chemicals, Inc., Cymetech Corporation, Ningbo Jinhai Chenguang Chemical Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Additional notes on market drivers and trends - Lightweighting and durability: Use of poly-DCPD body panels and UPR composites in vehicles and marine craft to reduce weight and improve fuel efficiency and corrosion resistance . - Infrastructure and construction demand: UPR-based laminates and molded parts in sanitary ware, cladding, and tanks sustain large-volume consumption in construction . - Process and environmental improvements: Producers are adopting improved fractionation and purification technologies for higher-purity DCPD grades and implementing emissions controls aligned with U.S. EPA MACT/NESHAP requirements for chemical manufacturing . Citations: - IMARC Group, Dicyclopentadiene Market Size, Share, Trends. - U.S. EPA, Hazardous Organic NESHAP (HON) for chemical manufacturing. - Polaris Market Research, Dicyclopentadiene (DCPD) Market Size & Trends.

The future of the dicyclopentadiene market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in production methods are expected to enhance efficiency and reduce environmental impact, aligning with global trends towards greener practices. Additionally, the increasing focus on bio-based alternatives and circular economy principles will likely create new avenues for growth, enabling manufacturers to adapt to changing consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | DCPD Resin Grade DCPD UPR Grade DCPD High Purity Grade |

| By End-User | Building & Construction Automotive & Marine Electrical & Electronics Others |

| By Application | Unsaturated Polyester Resin (UPR) Hydrocarbon Resins EPDM Elastomers Poly-DCPD Cyclic Olefin Copolymer (COC) & Cyclic Olefin Polymer (COP) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 120 | Product Development Engineers, Procurement Managers |

| Adhesives and Sealants | 85 | Manufacturing Managers, Quality Control Specialists |

| Coatings and Paints | 95 | Formulation Chemists, Technical Sales Representatives |

| Polymer Production | 75 | Process Engineers, Operations Managers |

| Research and Development | 60 | R&D Directors, Innovation Managers |

The Global Dicyclopentadiene Market is valued at approximately USD 860 million, based on a five-year historical analysis. This valuation reflects the market's growth driven by demand in various applications, including automotive, construction, and electrical sectors.