Region:Global

Author(s):Shubham

Product Code:KRAD0690

Pages:98

Published On:August 2025

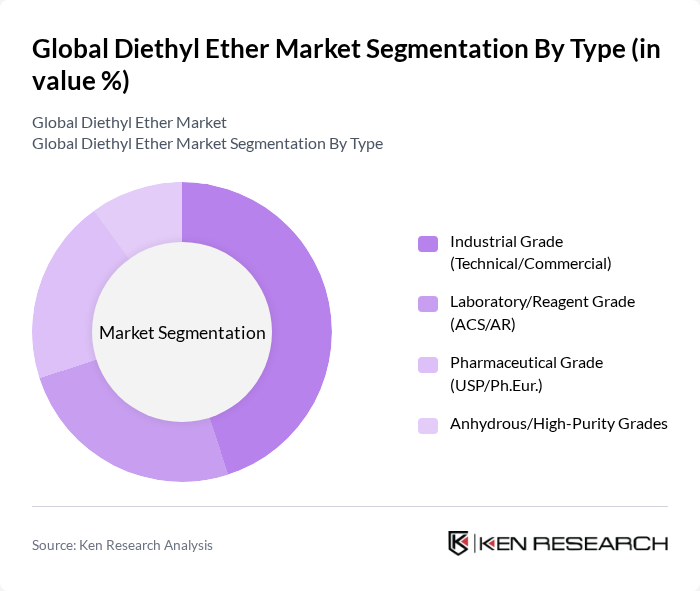

By Type:The market is segmented into four types: Industrial Grade (Technical/Commercial), Laboratory/Reagent Grade (ACS/AR), Pharmaceutical Grade (USP/Ph.Eur.), and Anhydrous/High-Purity Grades. Each type serves different applications, with industrial grade widely used in chemical processing, blending for starting fluids, and general-purpose solvent duties, while reagent and pharmaceutical grades serve analytical, GMP-related, and synthesis needs; anhydrous/high-purity grades are used where water-sensitive reactions and specialty applications are critical .

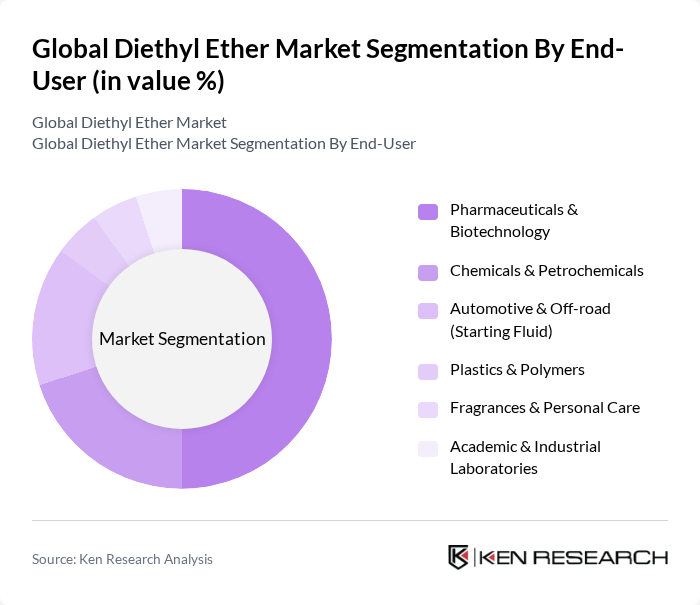

By End-User:The end-user segmentation includes Pharmaceuticals & Biotechnology, Chemicals & Petrochemicals, Automotive & Off-road (Starting Fluid), Plastics & Polymers, Fragrances & Personal Care, and Academic & Industrial Laboratories. Pharmaceutical and laboratory demand is a major consumer due to ether’s role as a reaction/extraction solvent and reagent medium; chemicals and petrochemicals use ether in synthesis and processing; automotive/off-road uses it in starting fluids owing to high volatility and ignition properties .

The Global Diethyl Ether Market is characterized by a dynamic mix of regional and international players. Leading participants such as LyondellBasell Industries N.V., INEOS Group Holdings S.A., Sasol Limited, Royal Dutch Shell plc (Shell Chemicals), Eastman Chemical Company, TPC Group Inc., OQ Chemicals GmbH (formerly Oxea GmbH), Mitsubishi Gas Chemical Company, Inc., Merck KGaA, Thermo Fisher Scientific Inc., Honeywell International Inc. (Riedel-de Haën), Solvay S.A., BASF SE, Brenntag SE, Univar Solutions Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the diethyl ether market appears promising, driven by increasing demand in pharmaceuticals and the chemical industry. Innovations in production processes are expected to enhance efficiency and reduce costs, while the shift towards sustainable chemicals will likely open new avenues for growth. Additionally, the expansion of applications in biofuels and specialty chemicals will further solidify diethyl ether's position in the market, making it a vital component in various industrial sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade (Technical/Commercial) Laboratory/Reagent Grade (ACS/AR) Pharmaceutical Grade (USP/Ph.Eur.) Anhydrous/High-Purity Grades |

| By End-User | Pharmaceuticals & Biotechnology Chemicals & Petrochemicals Automotive & Off-road (Starting Fluid) Plastics & Polymers Fragrances & Personal Care Academic & Industrial Laboratories |

| By Application | Solvent (Synthesis, Recrystallization, Cleaning) Fuel and Fuel Additives (Ignition Improver/Starting Fluid) Extraction Agent (Pharma/Natural Products) Chemical Intermediate/Propellant Carrier |

| By Distribution Channel | Direct Sales (Producers to End Users) Authorized Distributors/Resellers E-commerce/Catalog Suppliers Contract/Bulk Supply Agreements |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Drums (Steel/HDPE) IBC Totes Bulk (ISO Tank/Truck) Cans/Bottles (Lab Packs) |

| By Price Range | Low (Industrial/Technical Grade) Medium (Reagent/High-Purity Industrial) High (Pharmaceutical/Anhydrous Specialty) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 120 | R&D Managers, Quality Control Analysts |

| Agrochemical Sector | 90 | Product Development Scientists, Regulatory Affairs Specialists |

| Industrial Solvents Market | 80 | Procurement Managers, Production Supervisors |

| Research Institutions | 50 | Academic Researchers, Laboratory Managers |

| Environmental Compliance | 60 | Compliance Officers, Environmental Scientists |

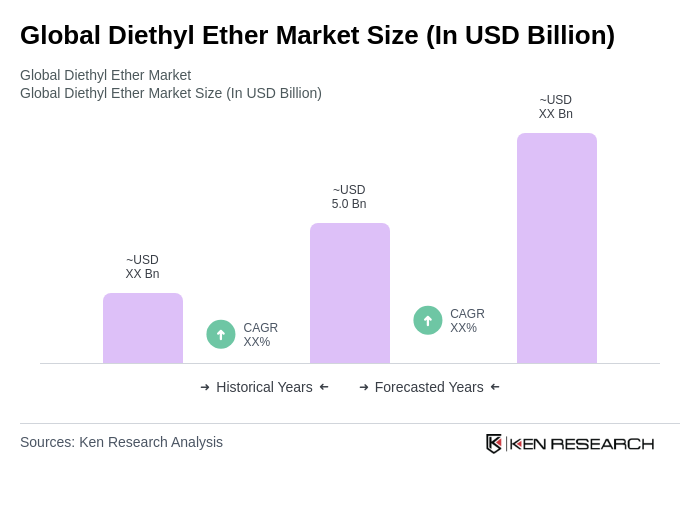

The Global Diethyl Ether Market is valued at approximately USD 5.0 billion, reflecting its expanded use in solvents, fuel additives, and steady demand from pharmaceuticals and chemical synthesis over the past five years.