Global Digestive Enzymes Market Overview

- The Global Digestive Enzymes Market is valued at USD 2.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding digestive health, the rising prevalence of digestive disorders such as irritable bowel syndrome and lactose intolerance, and the growing demand for dietary supplements and functional foods. The market has seen a significant uptick in product innovation, with companies focusing on developing enzyme formulations that cater to specific dietary needs, including plant-based and microbial-derived options.

- Key players in this market include the United States, Germany, and Japan, which dominate due to their advanced healthcare systems, high disposable incomes, and a strong focus on health and wellness. The presence of established companies and a growing trend towards preventive healthcare further bolster the market in these regions, making them pivotal in the global landscape. North America holds the largest market share, while Asia-Pacific is experiencing the fastest growth due to rising health awareness and changing dietary patterns.

- There have been ongoing regulatory updates in the United States and other major markets regarding dietary supplements, including digestive enzymes. However, as of now, the U.S. Food and Drug Administration (FDA) has not implemented new regulations in 2023 that specifically require all dietary supplements, including digestive enzymes, to undergo rigorous pre-market safety and efficacy testing. Dietary supplements remain regulated under the Dietary Supplement Health and Education Act (DSHEA), which mandates good manufacturing practices and post-market surveillance but does not require pre-market approval.

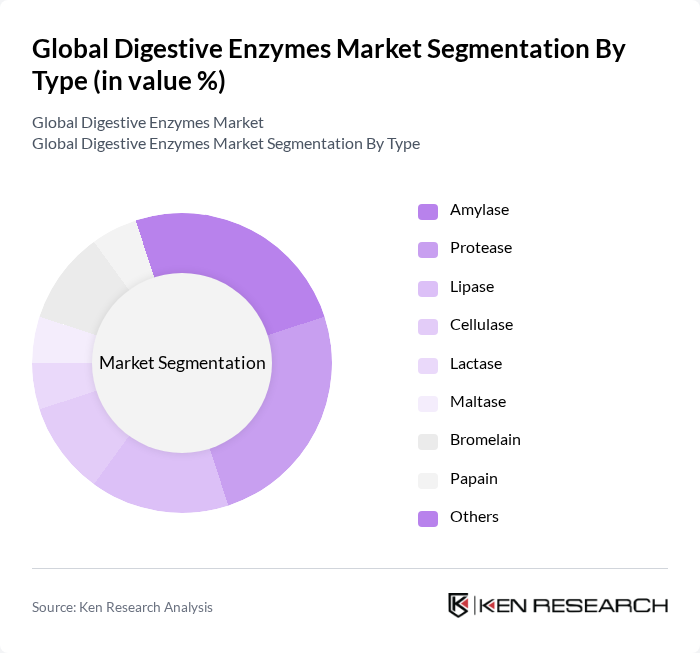

Global Digestive Enzymes Market Segmentation

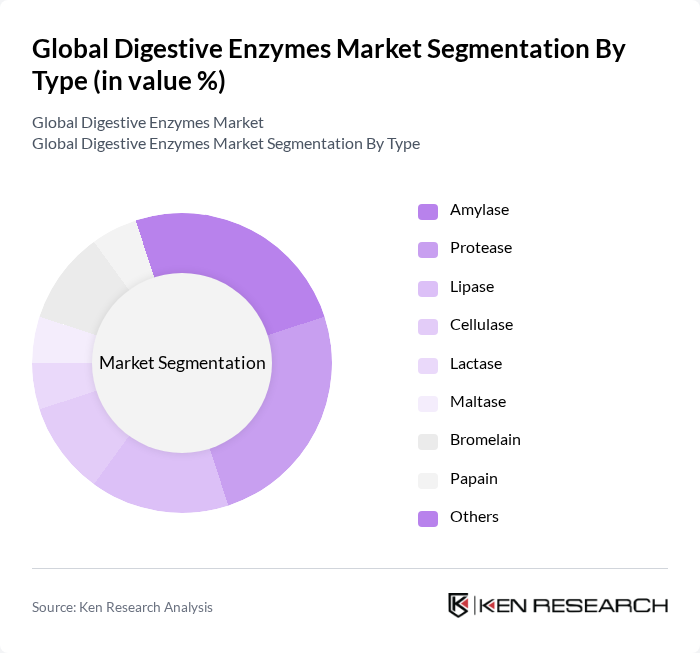

By Type:The digestive enzymes market can be segmented into various types, including Amylase, Protease, Lipase, Cellulase, Lactase, Maltase, Bromelain, Papain, and Others. Each type serves a specific function in the digestive process, catering to different dietary needs and preferences. Protease and amylase blends are especially in demand due to the prevalence of high-protein and low-fiber diets, while plant-based enzymes like bromelain and papain are gaining traction among consumers seeking natural and vegan-friendly solutions.

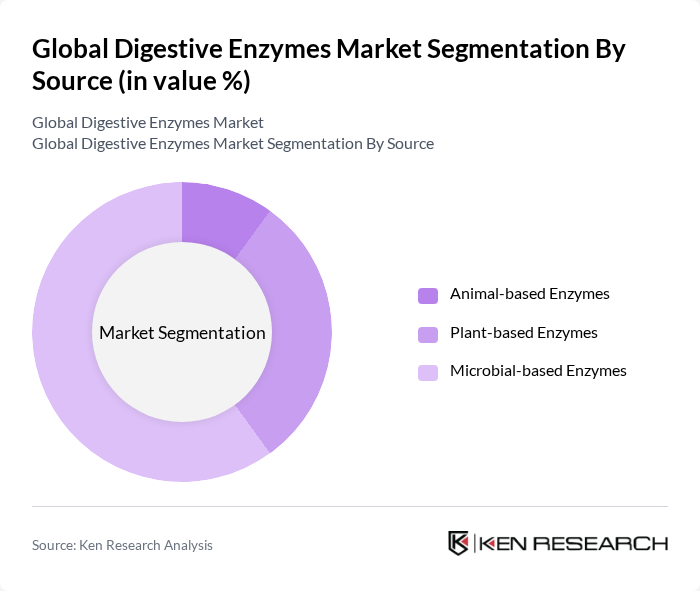

By Source:The market can also be categorized based on the source of enzymes, which includes Animal-based Enzymes, Plant-based Enzymes, and Microbial-based Enzymes. Each source offers unique benefits and caters to different consumer preferences, particularly in terms of dietary restrictions and ethical considerations. Microbial-derived enzymes are gaining significant market share due to their high stability, productivity, and suitability for vegan and vegetarian consumers.

Global Digestive Enzymes Market Competitive Landscape

The Global Digestive Enzymes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Enzymedica, Inc., NOW Foods, Garden of Life, Source Naturals, Digestive Advantage (Schiff Nutrition/ Reckitt Benckiser Group plc), Thorne Research, Inc., Life Extension, Pure Encapsulations (Nestlé Health Science), Jarrow Formulas, Biotics Research Corporation, Klaire Labs (SFI Health), Metagenics, Inc., Solgar, Inc., Herbalife Nutrition Ltd., Procter & Gamble Co., Integrative Therapeutics, Douglas Laboratories, Nestlé Health Science, Amway Corporation, Country Life Vitamins contribute to innovation, geographic expansion, and service delivery in this space.

Global Digestive Enzymes Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Digestive Disorders:The World Health Organization reported that approximately 1 in 5 adults experience digestive disorders, translating to over 1.5 billion individuals globally. In future, the prevalence of conditions such as irritable bowel syndrome (IBS) and lactose intolerance is rising, with an estimated 15% of the population affected. This growing incidence drives demand for digestive enzymes, as consumers seek effective solutions to alleviate symptoms and improve gut health, thereby boosting market growth.

- Rising Consumer Awareness about Gut Health:A survey by the International Food Information Council found that 70% of consumers in future are increasingly aware of the importance of gut health. This awareness is leading to a surge in demand for digestive enzyme products, as consumers actively seek supplements that promote digestive wellness. The focus on preventive health measures is further supported by the growing body of research linking gut health to overall well-being, driving market expansion.

- Growth in the Dietary Supplements Market:The dietary supplements market in future is projected to reach $5.5 billion, driven by a shift towards health-conscious consumer behavior. Digestive enzymes are a significant segment within this market, as they cater to the increasing demand for natural health solutions. The rise in e-commerce platforms has also facilitated access to these products, further propelling their popularity and contributing to the overall growth of the digestive enzymes market.

Market Challenges

- Regulatory Hurdles in Product Approval:The regulatory landscape for dietary supplements in future is complex, with stringent guidelines imposed by health authorities. For instance, the approval process for new enzyme formulations can take up to 12 months, delaying market entry. This lengthy process can hinder innovation and limit the availability of new products, posing a significant challenge for companies looking to capitalize on the growing demand for digestive enzymes.

- High Competition from Alternative Products:The digestive health market is saturated with various alternatives, including probiotics and herbal supplements. In future, the competition is fierce, with over 150 brands offering similar products. This high level of competition can lead to price wars and reduced profit margins for companies specializing in digestive enzymes, making it challenging to maintain market share and profitability in a crowded marketplace.

Global Digestive Enzymes Market Future Outlook

The future of the digestive enzymes market in future appears promising, driven by increasing consumer interest in health and wellness. As more individuals prioritize preventive healthcare, the demand for effective digestive solutions is expected to rise. Additionally, advancements in enzyme technology and personalized nutrition are likely to create new product opportunities, allowing companies to cater to specific consumer needs and preferences, thereby enhancing market growth and innovation in the sector.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets in future present significant growth opportunities for digestive enzyme products. With rising disposable incomes and increasing health awareness, the demand for dietary supplements is expected to surge. Companies can leverage this trend by tailoring their marketing strategies to local preferences, thus capturing a larger share of the market and driving revenue growth.

- Development of Personalized Enzyme Supplements:The trend towards personalized nutrition is gaining traction in future, with consumers seeking tailored health solutions. Developing personalized enzyme supplements based on individual dietary needs and health conditions can create a competitive advantage. This approach not only meets consumer demand but also enhances product efficacy, potentially leading to increased customer loyalty and market penetration.