Region:Global

Author(s):Dev

Product Code:KRAD0433

Pages:94

Published On:August 2025

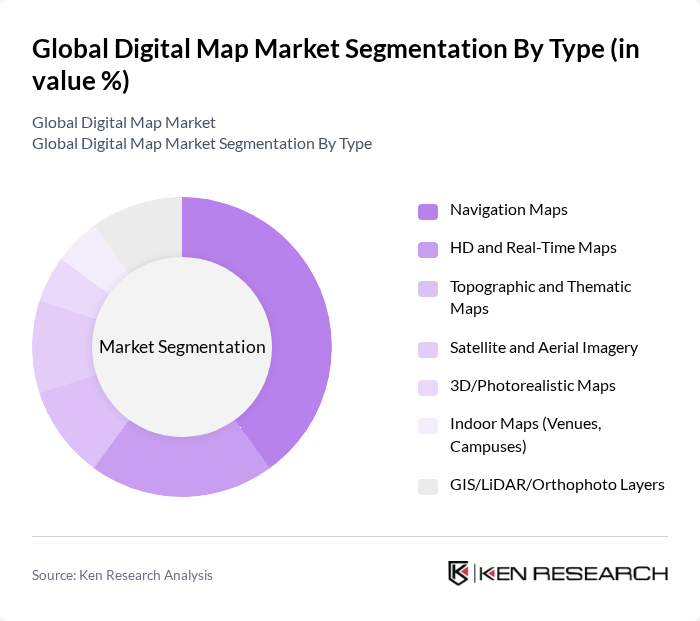

By Type:The digital map market can be segmented into various types, including Navigation Maps, HD and Real-Time Maps, Topographic and Thematic Maps, Satellite and Aerial Imagery, 3D/Photorealistic Maps, Indoor Maps (Venues, Campuses), and GIS/LiDAR/Orthophoto Layers. Among these, Navigation Maps remain a core and widely adopted segment due to reliance on GPS-enabled navigation across smartphones and vehicles, while HD and real-time map layers are gaining momentum with connected and autonomous features requiring high-precision localization, fresh traffic data, and lane-level detail.

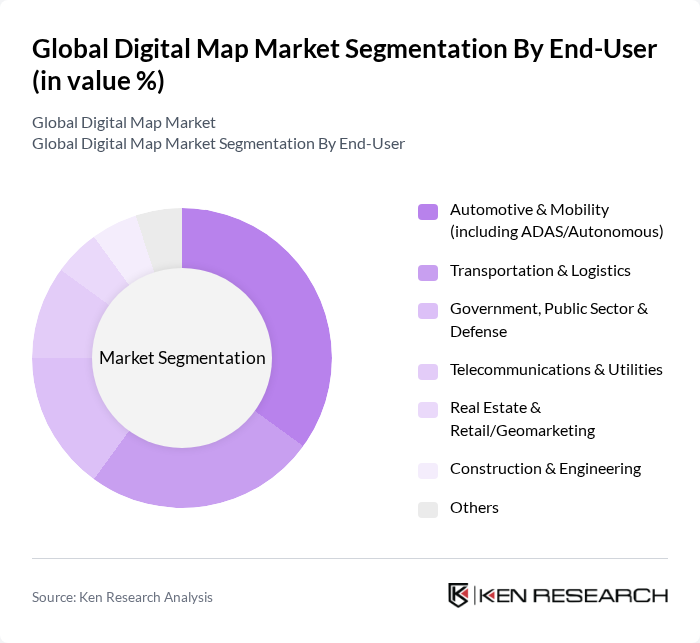

By End-User:The digital map market is also segmented by end-user applications, including Automotive & Mobility (including ADAS/Autonomous), Transportation & Logistics, Government, Public Sector & Defense, Telecommunications & Utilities, Real Estate & Retail/Geomarketing, Construction & Engineering, and Others. The Automotive & Mobility segment continues to be a leading demand center given the expansion of connected vehicles, ADAS, and autonomous testing programs that use HD and real-time map content for perception, localization, and routing, while logistics and government also represent significant users of mapping and GIS solutions.

The Global Digital Map Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC (Google Maps Platform), HERE Technologies, TomTom N.V., Esri, Mapbox, OpenStreetMap Foundation, Maxar Technologies (includes DigitalGlobe heritage), Trimble Inc., Garmin Ltd., Apple Inc. (Apple Maps), Bentley Systems, Incorporated, Hexagon AB (including Leica Geosystems), Precisely Inc. (formerly Pitney Bowes Software & Data), MapQuest (System1), CARTO contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital map market appears promising, driven by technological advancements and increasing consumer expectations. As AI and machine learning continue to enhance mapping accuracy and functionality, businesses will increasingly leverage these technologies to provide innovative solutions. Furthermore, the integration of augmented reality in navigation and mapping applications is expected to create new user experiences, fostering greater engagement and utility in various sectors, including tourism and real estate.

| Segment | Sub-Segments |

|---|---|

| By Type | Navigation Maps HD and Real-Time Maps Topographic and Thematic Maps Satellite and Aerial Imagery D/Photorealistic Maps Indoor Maps (Venues, Campuses) GIS/LiDAR/Orthophoto Layers |

| By End-User | Automotive & Mobility (including ADAS/Autonomous) Transportation & Logistics Government, Public Sector & Defense Telecommunications & Utilities Real Estate & Retail/Geomarketing Construction & Engineering Others |

| By Application | Routing & Navigation Asset Tracking & Fleet Management Geocoding/Geopositioning & Location Analytics Urban Planning & Smart Cities Risk Assessment & Disaster Management Field Surveying & Remote Sensing Others |

| By Distribution Mode | Cloud APIs & SDKs Mobile Applications On-Premise/Enterprise Licensing Partnerships with OEMs & Tier-1s Others |

| By Pricing Model | Subscription (Seat, MAU, or SLA-based) Usage-Based (per API call/transaction) Freemium/Developer tiers Enterprise License/One-Time Others |

| By Geographic Coverage | Global Regional Local/Hyperlocal Others |

| By Data Source | Satellite Aerial (Aircraft/Drone) Ground Surveys/Probe Data User-Generated/Open Data Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Planning Applications | 120 | City Planners, Urban Development Officers |

| Logistics and Supply Chain Mapping | 90 | Logistics Managers, Supply Chain Analysts |

| Environmental Monitoring Solutions | 70 | Environmental Scientists, Policy Makers |

| Navigation and Fleet Management | 100 | Fleet Managers, Transportation Coordinators |

| Consumer Mapping Applications | 60 | Product Managers, Marketing Directors |

The Global Digital Map Market is valued at approximately USD 2223 billion, reflecting a steady growth trajectory driven by the increasing demand for location-based services and advancements in GPS and GIS technologies.