Region:Global

Author(s):Rebecca

Product Code:KRAA1354

Pages:91

Published On:August 2025

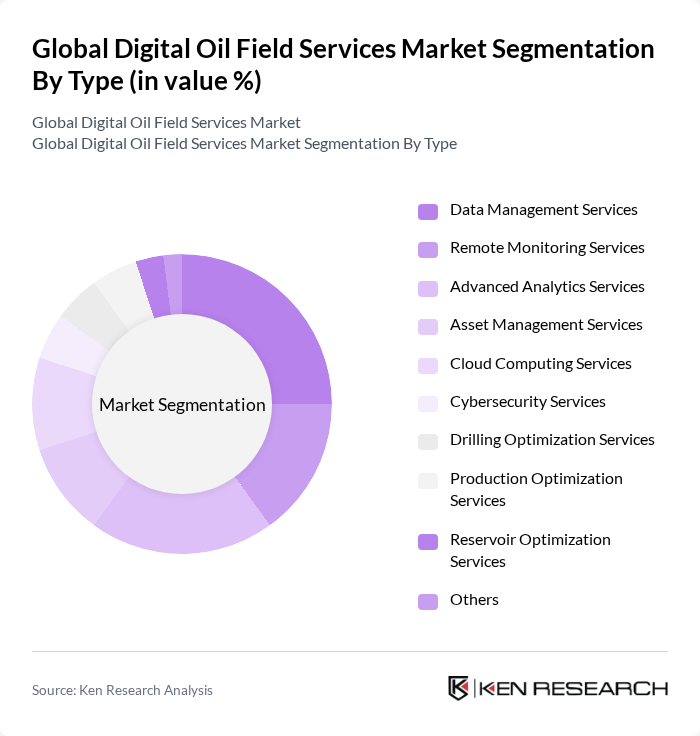

By Type:The market is segmented into various types of services that cater to the needs of oil and gas companies. The subsegments include Data Management Services, Remote Monitoring Services, Advanced Analytics Services, Asset Management Services, Cloud Computing Services, Cybersecurity Services, Drilling Optimization Services, Production Optimization Services, Reservoir Optimization Services, and Others. Among these, Data Management Services and Advanced Analytics Services are particularly prominent due to the increasing need for data-driven decision-making and real-time operational insights in the industry .

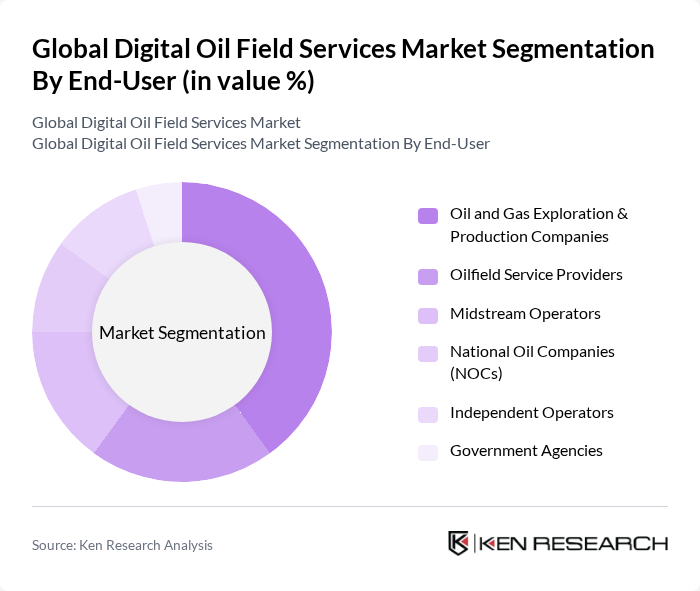

By End-User:The end-user segmentation includes Oil and Gas Exploration & Production Companies, Oilfield Service Providers, Midstream Operators, National Oil Companies (NOCs), Independent Operators, and Government Agencies. Oil and Gas Exploration & Production Companies are the largest segment, driven by their need for advanced technologies to enhance production efficiency, optimize asset performance, and reduce operational costs .

The Global Digital Oil Field Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, Siemens AG, Honeywell International Inc., ABB Ltd., Emerson Electric Co., Kongsberg Gruppen ASA, Aker Solutions ASA, TechnipFMC plc, CGG SA, Pason Systems Inc., IHS Markit Ltd., Accenture plc, Rockwell Automation, Inc., Yokogawa Electric Corporation, Katalyst Data Management, Aspen Technology, Inc., Infosys Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital oil field services is poised for significant transformation, driven by technological advancements and evolving industry needs. As companies increasingly prioritize sustainability, the integration of renewable energy sources and digital solutions will become essential. Furthermore, the rise of remote monitoring and cloud-based services will enhance operational flexibility and data accessibility. These trends indicate a shift towards more resilient and adaptive operational models, positioning the industry for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Data Management Services Remote Monitoring Services Advanced Analytics Services Asset Management Services Cloud Computing Services Cybersecurity Services Drilling Optimization Services Production Optimization Services Reservoir Optimization Services Others |

| By End-User | Oil and Gas Exploration & Production Companies Oilfield Service Providers Midstream Operators National Oil Companies (NOCs) Independent Operators Government Agencies |

| By Application | Production Optimization Asset Integrity Management Drilling Optimization Reservoir Management Supply Chain Management Health, Safety, and Environment (HSE) |

| By Deployment Mode | On-Premises Cloud-Based |

| By Service Model | Managed Services Professional Services |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-Per-Use Fixed Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Oil Field Implementation | 120 | IT Managers, Operations Directors |

| Data Analytics in Oil Production | 90 | Data Scientists, Field Engineers |

| IoT Solutions for Oil Fields | 60 | Technology Officers, Project Managers |

| Remote Monitoring Services | 50 | Field Supervisors, Safety Managers |

| Digital Transformation Strategies | 70 | Consultants, Business Development Managers |

The Global Digital Oil Field Services Market is valued at approximately USD 29 billion, reflecting significant growth driven by the adoption of digital technologies in oil and gas operations, which enhance efficiency and reduce operational costs.