Region:Global

Author(s):Dev

Product Code:KRAB0499

Pages:90

Published On:August 2025

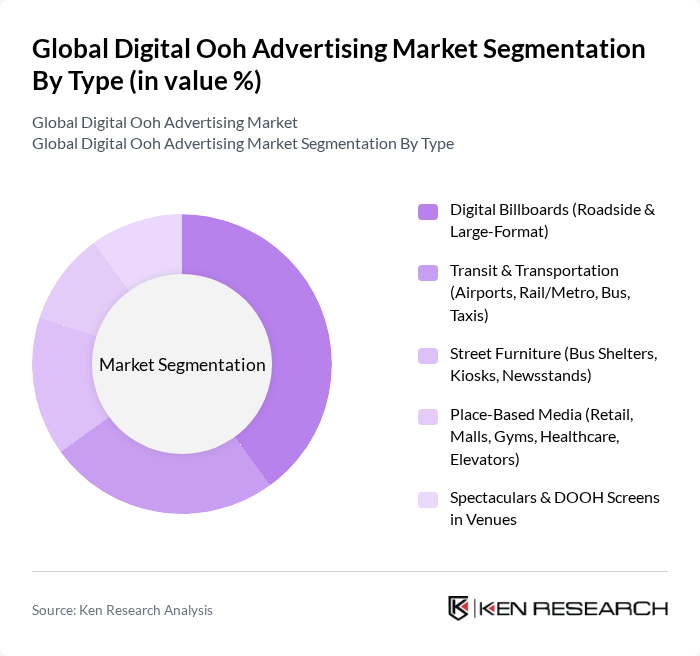

By Type:The market is segmented into various types, including Digital Billboards, Transit & Transportation, Street Furniture, Place-Based Media, and Spectaculars & DOOH Screens in Venues. Each of these segments caters to different advertising needs and consumer interactions, with digital billboards leading the market due to their high visibility and effectiveness in urban areas; leading sources identify billboards as the largest format segment globally .

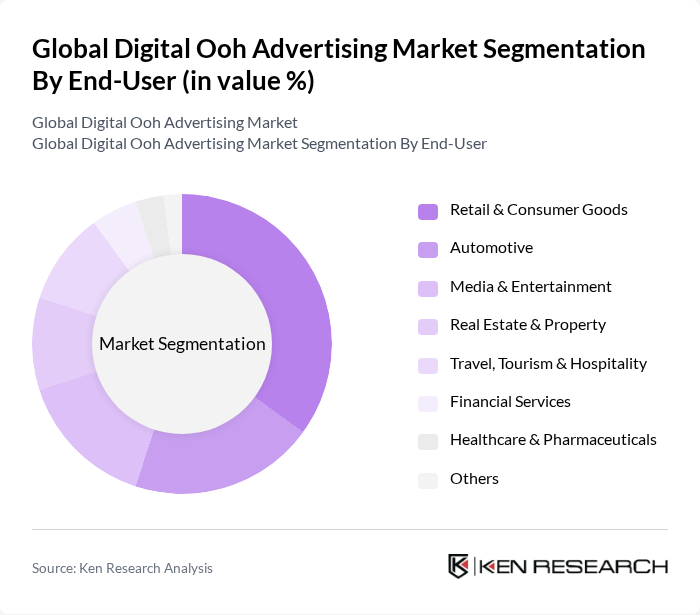

By End-User:The end-user segmentation includes Retail & Consumer Goods, Automotive, Media & Entertainment, Real Estate & Property, Travel, Tourism & Hospitality, Financial Services, Healthcare & Pharmaceuticals, and Others. The retail sector is the most significant contributor, leveraging digital out-of-home advertising to enhance brand visibility and drive foot traffic to stores. This aligns with market observations of strong adoption in retail and place?based environments where DOOH influences shopper journeys and in?venue engagement .

The Global Digital Ooh Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Clear Channel Outdoor Holdings, Inc., JCDecaux SE, Lamar Advertising Company, OUTFRONT Media Inc., Ströer SE & Co. KGaA, Global (Global Media & Entertainment Limited), oOh!media Limited, Captivate, LLC, Intersection Co., Adomni Inc., VGI Public Company Limited, Daktronics, Inc., Focus Media Information Technology Co., Ltd., Hivestack (Now part of Broadsign), Broadsign International Inc., Ocean Outdoor Limited, APG|SGA SA, Talon Outdoor Ltd., Posterscope Worldwide (Dentsu), Pikasso S.A.L. contribute to innovation, geographic expansion, and service delivery in this space. Market analyses consistently list these firms among key DOOH and OOH ecosystem participants, spanning media owners, programmatic platforms, and technology providers .

The future of digital out-of-home advertising appears promising, driven by technological advancements and evolving consumer behaviors. As urbanization continues, advertisers will increasingly leverage data analytics to enhance targeting and engagement. The integration of augmented reality and interactive content is expected to redefine consumer experiences in future, making advertising more immersive. Additionally, sustainability trends will push brands to adopt eco-friendly practices, aligning with consumer preferences for responsible advertising. Overall, the DOOH landscape is set for significant transformation, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Billboards (Roadside & Large-Format) Transit & Transportation (Airports, Rail/Metro, Bus, Taxis) Street Furniture (Bus Shelters, Kiosks, Newsstands) Place-Based Media (Retail, Malls, Gyms, Healthcare, Elevators) Spectaculars & DOOH Screens in Venues |

| By End-User | Retail & Consumer Goods Automotive Media & Entertainment Real Estate & Property Travel, Tourism & Hospitality Financial Services Healthcare & Pharmaceuticals Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Brand Awareness Campaigns Product Launches Event & Venue Promotions Contextual & Real-Time Messaging Public Service & Government Notices Others |

| By Sales Channel | Direct Sales (Media Owners) Programmatic DOOH Platforms Advertising & Media Agencies Others |

| By Distribution Mode | Urban Areas (Tier-1 Cities, CBDs) Suburban Areas Transport Hubs (Airports, Metro, Rail, Bus Terminals) On-Premise/Indoor Networks Others |

| By Pricing Strategy | CPM/Impression-Based (Audience Metrics) Dynamic Pricing (Daypart, Location, Demand) Fixed/Flat Rate Performance-Linked (Attribution-Based) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Brand Advertisers in Retail | 120 | Marketing Directors, Brand Managers |

| Advertising Agencies Specializing in Digital OOH | 100 | Media Buyers, Account Executives |

| Technology Providers for Digital OOH Solutions | 80 | Product Managers, Sales Executives |

| Consumers Engaged with Digital OOH Campaigns | 120 | General Public, Target Demographic Groups |

| Market Analysts and Industry Experts | 40 | Industry Analysts, Research Consultants |

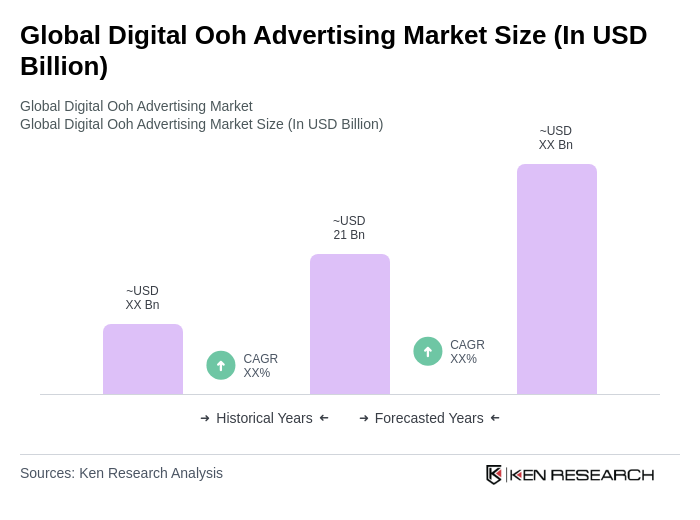

The Global Digital Out-of-Home (DOOH) Advertising Market is valued at approximately USD 21 billion, reflecting significant growth driven by the adoption of digital technologies and programmatic advertising solutions.