Region:Global

Author(s):Geetanshi

Product Code:KRAA1309

Pages:99

Published On:August 2025

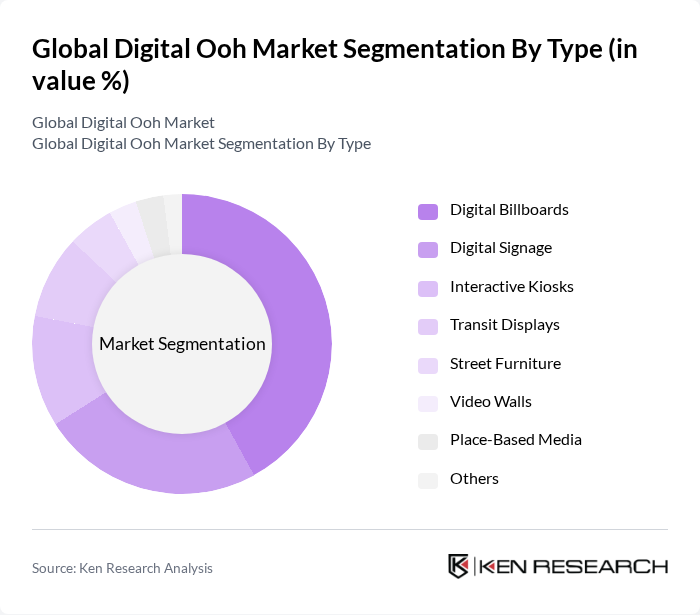

By Type:The digital out-of-home advertising market is segmented into various types, including Digital Billboards, Digital Signage, Interactive Kiosks, Transit Displays, Street Furniture, Video Walls, Place-Based Media, and Others. Among these, Digital Billboards are leading the market due to their high visibility and effectiveness in capturing consumer attention. The trend towards urbanization and the increasing number of outdoor events have further propelled the demand for this segment, making it a preferred choice for advertisers looking to maximize their reach.

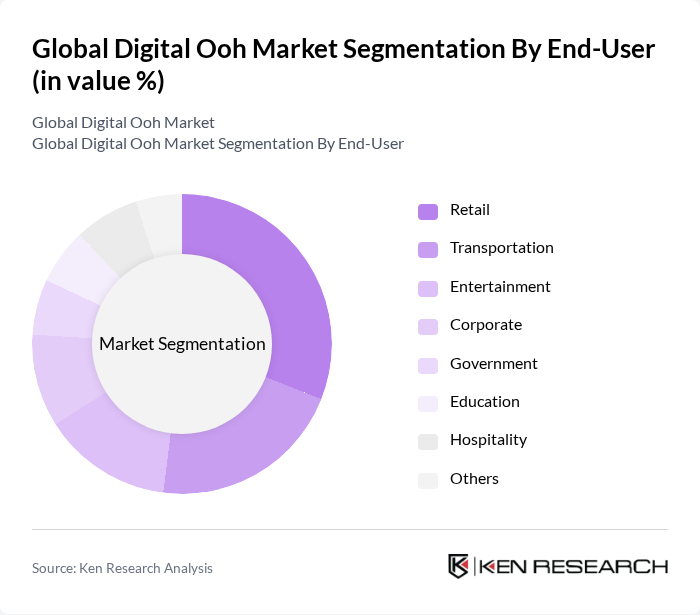

By End-User:The market is also segmented by end-user, which includes Retail, Transportation, Entertainment, Corporate, Government, Education, Hospitality, and Others. The Retail sector is the dominant end-user, driven by the need for effective advertising solutions that can attract foot traffic and enhance customer engagement. Retailers are increasingly utilizing digital OOH advertising to promote sales, new products, and brand awareness, making it a critical component of their marketing strategies.

The Global Digital OOH Market is characterized by a dynamic mix of regional and international players. Leading participants such as Clear Channel Outdoor Holdings, Inc., JCDecaux SA, Lamar Advertising Company, Outfront Media Inc., Ströer SE & Co. KGaA, Global Media & Entertainment Limited, Focus Media Holding Limited, Daktronics, Inc., Adomni, Inc., VGI Global Media Public Company Limited, Intersection Holdings, LLC, Broadsign International, LLC, Ayuda Media Systems, Signagelive (Remote Media Group Ltd.), ZetaDisplay AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital OOH market appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues to rise, advertisers will increasingly leverage digital platforms to engage audiences in real-time. The integration of artificial intelligence and machine learning will enhance targeting capabilities, allowing for more personalized advertising experiences. Additionally, the shift towards sustainable advertising practices will likely gain momentum, as brands seek to align with environmentally conscious consumers, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Billboards Digital Signage Interactive Kiosks Transit Displays Street Furniture Video Walls Place-Based Media Others |

| By End-User | Retail Transportation Entertainment Corporate Government Education Hospitality Others |

| By Application | Advertising Information Display Event Promotion Wayfinding Brand Awareness Public Service Messaging Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Agencies Programmatic Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Pricing Model | Cost Per Impression (CPI) Cost Per Click (CPC) Flat Rate Programmatic Bidding Others |

| By Content Type | Static Content Dynamic Content Interactive Content Video Content Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Digital Billboards | 100 | Media Buyers, Advertising Executives |

| Transit Advertising Networks | 80 | Transit Authority Managers, Marketing Directors |

| Retail Digital Signage | 70 | Store Managers, Brand Strategists |

| Event and Venue Advertising | 60 | Event Coordinators, Sponsorship Managers |

| Programmatic DOOH Advertising | 50 | Data Analysts, Digital Marketing Managers |

The Global Digital Out-of-Home (DOOH) Market is valued at approximately USD 19 billion, driven by advancements in digital advertising technologies and the increasing demand for real-time data analytics in marketing strategies.