Region:Global

Author(s):Shubham

Product Code:KRAA1760

Pages:92

Published On:August 2025

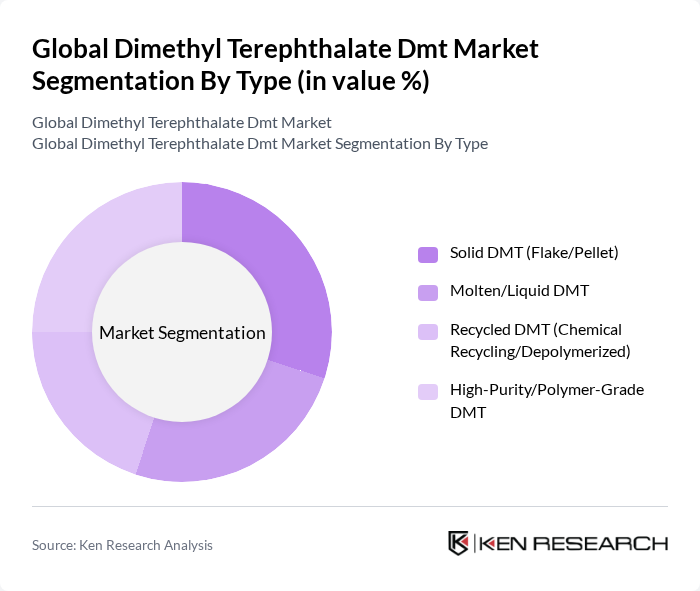

By Type:The DMT market can be segmented into four main types: Solid DMT (Flake/Pellet), Molten/Liquid DMT, Recycled DMT (Chemical Recycling/Depolymerized), and High-Purity/Polymer-Grade DMT. Each type serves different applications and industries, with varying degrees of demand based on specific requirements. Solid forms account for the largest usage due to handling, storage, and stability advantages across polymer production environments.

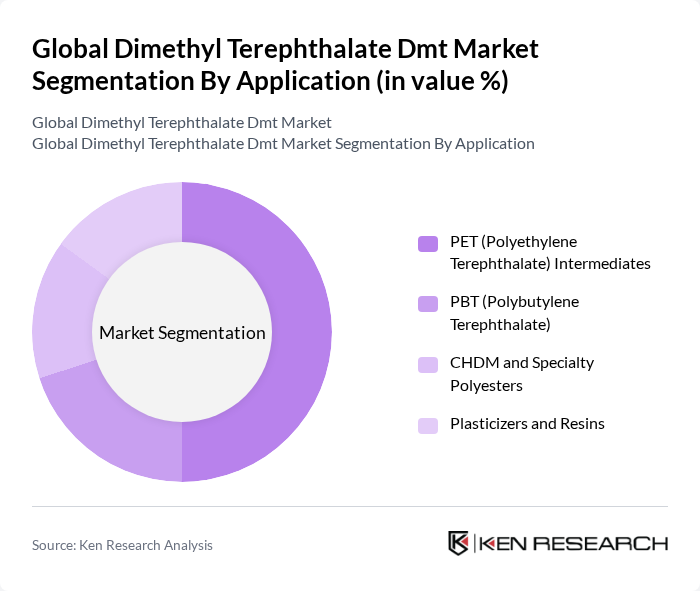

By Application:The applications of DMT are diverse, including PET (Polyethylene Terephthalate) intermediates, PBT (Polybutylene Terephthalate), CHDM and specialty polyesters, and plasticizers and resins. Each application has unique characteristics and market dynamics that influence the demand for DMT. PET and PBT remain the primary demand centers in packaging, fibers, and engineering plastics, with specialty polyesters and plasticizers as important niche outlets.

The Global Dimethyl Terephthalate Dmt Market is characterized by a dynamic mix of regional and international players. Leading participants such as OQ Chemicals GmbH (formerly Oxea), SASA Polyester Sanayi A.?., Indorama Ventures Public Company Limited, Eastman Chemical Company, Teijin Limited, INVISTA S.à r.l., Jiangyin Chengxing Industrial Group Co., Ltd., Reliance Industries Limited, Sinopec Yizheng Chemical Fibre Co., Ltd., JBF Industries Ltd., Far Eastern New Century Corporation, Lotte Chemical Corporation, Nan Ya Plastics Corporation, Tongkun Group Co., Ltd., Alpek, S.A.B. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dimethyl terephthalate market in future appears promising, driven by technological advancements and a shift towards sustainable production methods. As manufacturers adopt innovative processes to enhance efficiency and reduce waste, the market is likely to witness increased adoption of DMT in various applications. Furthermore, the growing emphasis on recycling and the development of biodegradable alternatives will create new avenues for growth, positioning DMT as a vital component in the evolving landscape of materials science.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid DMT (Flake/Pellet) Molten/Liquid DMT Recycled DMT (Chemical Recycling/Depolymerized) High-Purity/Polymer-Grade DMT |

| By Application | PET (Polyethylene Terephthalate) Intermediates PBT (Polybutylene Terephthalate) CHDM and Specialty Polyesters Plasticizers and Resins |

| By End-User | Textiles and Apparel (Polyester Fiber/Yarn) Packaging (Bottles, Films, Sheets) Automotive and Electrical/Electronics Industrial and Others |

| By Distribution Channel | Direct (Producer-to-Converter/OEM) Traders and Distributors Contract/Toll Manufacturing Online Tendering and E-commerce |

| By Region | North America Europe Asia-Pacific Latin America |

| By Price Range | Spot Market (Monthly Index-Linked) Contract Pricing (Quarterly/Annual) Premium Grades (High-Purity/Specialty) |

| By Packaging Type | Bulk (Tankers/ISO Tanks) Big Bags and Drums Customized Packaging for Specialty Grades |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Applications | 110 | Textile Manufacturers, Product Development Managers |

| Plastics and Packaging Sector | 90 | Packaging Engineers, Procurement Managers |

| Automotive Component Manufacturing | 80 | Production Managers, Quality Assurance Officers |

| Consumer Goods Sector | 100 | Product Managers, Supply Chain Analysts |

| Research and Development in Chemical Engineering | 60 | R&D Scientists, Chemical Engineers |

The Global Dimethyl Terephthalate (DMT) market is valued at approximately USD 1.1 billion, driven by the increasing demand for polyester fibers and engineering resins across various industries, including textiles, packaging, and automotive.