Region:Global

Author(s):Geetanshi

Product Code:KRAB0008

Pages:95

Published On:August 2025

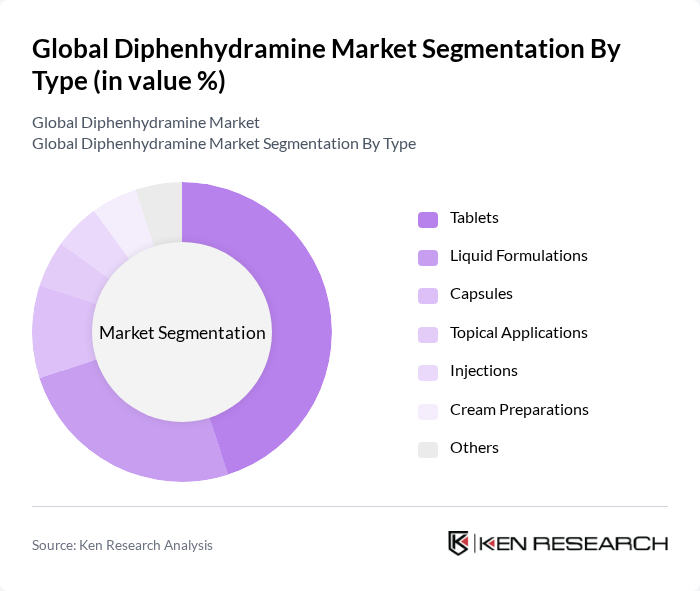

By Type:The market is segmented into various types, including tablets, liquid formulations, capsules, topical applications, injections, cream preparations, and others. Among these, tablets are the most widely used form due to their convenience and ease of administration. Liquid formulations are also gaining traction, particularly among children and those who have difficulty swallowing pills. The demand for topical applications is increasing as consumers seek localized relief from allergic reactions. The continued introduction of new delivery formats, such as extended-release and combination products, is further diversifying the product landscape .

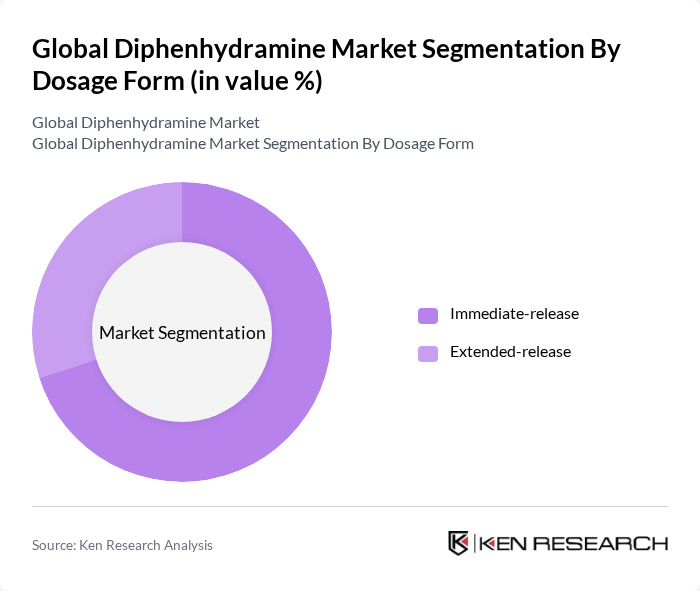

By Dosage Form:The market is categorized into immediate-release and extended-release formulations. Immediate-release formulations dominate the market due to their rapid onset of action, making them the preferred choice for consumers seeking quick relief from allergy symptoms. Extended-release formulations are also gaining popularity, particularly among patients requiring prolonged symptom control, such as those suffering from chronic allergies. Manufacturers are increasingly focusing on patient compliance and convenience through innovative dosage forms .

The Global Diphenhydramine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, Pfizer Inc., GlaxoSmithKline plc, Sanofi S.A., Bayer AG, Teva Pharmaceutical Industries Ltd., Mylan N.V., Novartis AG, Fresenius Kabi, PAI Pharma, Souvin Pharmaceuticals Pvt. Ltd., Aurobindo Pharma Ltd., Hikma Pharmaceuticals PLC, Sun Pharmaceutical Industries Ltd., Cipla Ltd., Amgen Inc., Reckitt Benckiser Group plc contribute to innovation, geographic expansion, and service delivery in this space .

The future of the diphenhydramine market appears promising, driven by increasing consumer awareness and the growing prevalence of allergies. As more individuals seek effective solutions for sleep disorders and allergic reactions, the demand for diphenhydramine is expected to rise. Additionally, advancements in drug delivery systems and the expansion of e-commerce platforms will facilitate greater accessibility, allowing manufacturers to reach a broader audience and enhance market penetration in emerging regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Tablets Liquid Formulations Capsules Topical Applications Injections Cream Preparations Others |

| By Dosage Form | Immediate-release Extended-release |

| By Application | Allergy Relief Sleep Aid (Insomnia) Cold and Cough Relief Motion Sickness Others |

| By End-User | Hospitals Retail Pharmacies Online Pharmacies Clinics Others |

| By Distribution Channel | Direct Sales Wholesalers Retail Pharmacies Online Pharmacies Hospital Pharmacies Others |

| By Age Group | Children Adults Elderly |

| By Packaging Type | Blister Packs Bottles Sachets Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacy Retail Insights | 150 | Pharmacy Managers, Retail Pharmacists |

| Healthcare Provider Perspectives | 100 | General Practitioners, Allergists |

| Consumer Usage Patterns | 150 | End-users, Allergy Sufferers |

| Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Market Distribution Channels | 120 | Distributors, Supply Chain Managers |

The Global Diphenhydramine Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing allergies and sleep disorders, as well as a rising preference for over-the-counter medications.