Region:Global

Author(s):Geetanshi

Product Code:KRAA0093

Pages:83

Published On:August 2025

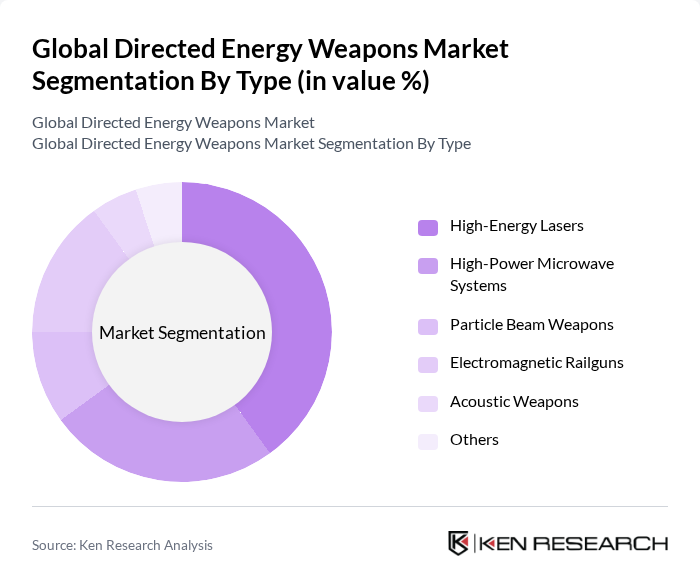

By Type:The market is segmented into various types of directed energy weapons, including High-Energy Lasers, High-Power Microwave Systems, Particle Beam Weapons, Electromagnetic Railguns, Acoustic Weapons, and Others. Among these, High-Energy Lasers are currently leading the market due to their effectiveness in precision targeting, rapid engagement capability, and cost efficiency in operations. The increasing focus on air and missile defense systems, counter-unmanned aerial systems (C-UAS), and the need for advanced military capabilities are driving the demand for these technologies .

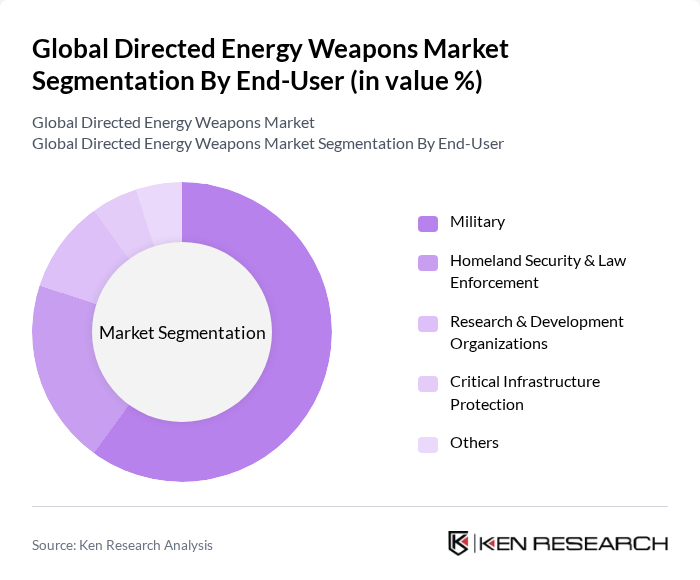

By End-User:The end-user segmentation includes Military, Homeland Security & Law Enforcement, Research & Development Organizations, Critical Infrastructure Protection, and Others. The Military segment dominates the market, driven by the increasing need for advanced defense systems and the integration of directed energy weapons into military strategies. The focus on enhancing national security, countering emerging threats such as drones and hypersonic missiles, and modernizing armed forces is propelling investments in this segment .

The Global Directed Energy Weapons Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin, Raytheon Technologies, Northrop Grumman, Boeing, BAE Systems, General Dynamics, Thales Group, L3Harris Technologies, Elbit Systems, Rheinmetall AG, Leonardo S.p.A., Kratos Defense & Security Solutions, Textron, SAIC, General Atomics, Rafael Advanced Defense Systems, MBDA, CACI International, QinetiQ Group, Leidos contribute to innovation, geographic expansion, and service delivery in this space.

The future of directed energy weapons appears promising, driven by ongoing technological advancements and increasing defense budgets. As nations continue to modernize their military capabilities, the integration of artificial intelligence and modular systems will enhance DEW effectiveness. Furthermore, the focus on non-lethal applications will likely expand, addressing ethical concerns while meeting operational needs. Collaboration between governments and private defense contractors will be crucial in overcoming regulatory challenges and fostering innovation in this evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Energy Lasers High-Power Microwave Systems Particle Beam Weapons Electromagnetic Railguns Acoustic Weapons Others |

| By End-User | Military Homeland Security & Law Enforcement Research & Development Organizations Critical Infrastructure Protection Others |

| By Application | Air Defense (Anti-Drone, Anti-Missile) Naval Defense (Shipborne Systems) Ground Defense (Vehicle & Man-Portable Systems) Space-Based Defense Crowd Control & Area Denial Others |

| By Technology | Solid-State Lasers Fiber Lasers Chemical Lasers Free Electron Lasers High-Power Microwave (HPM) Particle Beam Technology Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships Defense R&D Grants Others |

| By Policy Support | Defense Grants Research and Development Incentives Tax Benefits for Defense Contractors Export Control Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Applications of Directed Energy Weapons | 100 | Defense Analysts, Military Strategists |

| Commercial Use Cases in Security | 60 | Security Consultants, Law Enforcement Officials |

| Research and Development Insights | 40 | R&D Managers, Technology Innovators |

| Government Procurement Processes | 80 | Procurement Officers, Policy Makers |

| International Defense Collaborations | 50 | Defense Attachés, International Relations Experts |

The Global Directed Energy Weapons Market is valued at approximately USD 7.7 billion, driven by increasing defense budgets, advancements in laser and microwave technologies, and the demand for non-lethal precision weapon systems across military applications.