Region:Global

Author(s):Dev

Product Code:KRAC0419

Pages:95

Published On:August 2025

By Type:The directional drilling market can be segmented into four main types: Rotary Steerable Directional Drilling, Conventional Motor-Based Directional Drilling, Multilateral and Extended-Reach Drilling, and Horizontal Directional Drilling (Trenchless). Each of these types serves different operational needs and applications, with varying levels of complexity and technological requirements.

The Rotary Steerable Directional Drilling segment is currently dominating the market due to its ability to provide precise control over the drilling trajectory, which is essential for complex well designs. This technology is increasingly favored in both onshore and offshore applications, as it enhances drilling efficiency and reduces non-productive time. The growing trend towards deeper and more complex drilling operations is further driving the adoption of rotary steerable systems, making it the leading subsegment in the directional drilling market.

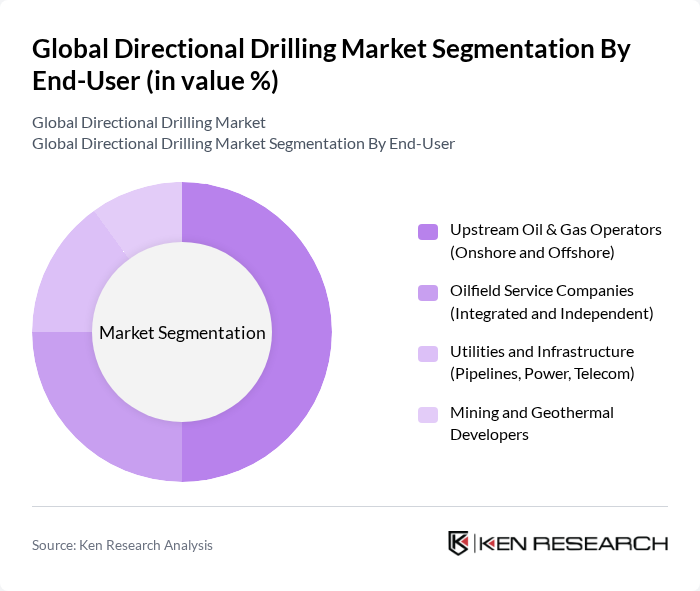

By End-User:The market can be segmented into four key end-users: Upstream Oil & Gas Operators (Onshore and Offshore), Oilfield Service Companies (Integrated and Independent), Utilities and Infrastructure (Pipelines, Power, Telecom), and Mining and Geothermal Developers. Each end-user category has distinct requirements and applications for directional drilling services.

The Upstream Oil & Gas Operators segment is the largest end-user of directional drilling services, accounting for a significant portion of the market. This dominance is driven by the continuous exploration and production activities in both onshore and offshore fields, where directional drilling techniques are essential for accessing hard-to-reach reserves. The increasing complexity of oil and gas extraction projects further solidifies the position of upstream operators as the leading consumers of directional drilling services.

The Global Directional Drilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as SLB (Schlumberger Limited), Halliburton Company, Baker Hughes Company, NOV Inc. (National Oilwell Varco), Weatherford International plc, Nabors Industries Ltd., Precision Drilling Corporation, Ensign Energy Services Inc., Patterson-UTI Energy, Inc., Helmerich & Payne, Inc., KCA Deutag, Transocean Ltd., Superior Energy Services, Inc., Hunting PLC, Ulterra Drilling Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the directional drilling market appears promising, driven by technological advancements and a growing emphasis on sustainable practices. As companies increasingly adopt automation and digital technologies, operational efficiencies are expected to improve significantly. Furthermore, the shift towards renewable energy sources will likely create new opportunities for directional drilling in geothermal and offshore wind projects, enhancing the sector's adaptability and resilience in a changing energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary Steerable Directional Drilling Conventional Motor-Based Directional Drilling Multilateral and Extended-Reach Drilling Horizontal Directional Drilling (Trenchless) |

| By End-User | Upstream Oil & Gas Operators (Onshore and Offshore) Oilfield Service Companies (Integrated and Independent) Utilities and Infrastructure (Pipelines, Power, Telecom) Mining and Geothermal Developers |

| By Application | Shale and Tight Reservoir Development Offshore Deepwater and Ultra-Deepwater Wells Brownfield/Workover and Re-Entry Wells Trenchless Crossings for Pipeline and Utility Installation |

| By Region | North America Europe Asia-Pacific Middle East & Africa |

| By Technology | Rotary Steerable Systems (RSS) Measurement While Drilling (MWD) Logging While Drilling (LWD) Downhole Mud Motors and Drive Systems |

| By Investment Source | Private Investments Public Funding Joint Ventures Government Grants |

| By Policy Support | Local Content and Energy Security Policies Fiscal Regimes and Tax Incentives for E&P Environmental and Safety Compliance Frameworks Technology Innovation and Digitalization Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Directional Drilling Projects | 120 | Project Managers, Drilling Engineers |

| Offshore Directional Drilling Operations | 90 | Operations Managers, Marine Engineers |

| Directional Drilling Equipment Suppliers | 55 | Sales Directors, Product Managers |

| Geological Survey and Analysis | 75 | Geologists, Data Analysts |

| Regulatory Compliance in Drilling | 45 | Compliance Officers, Environmental Managers |

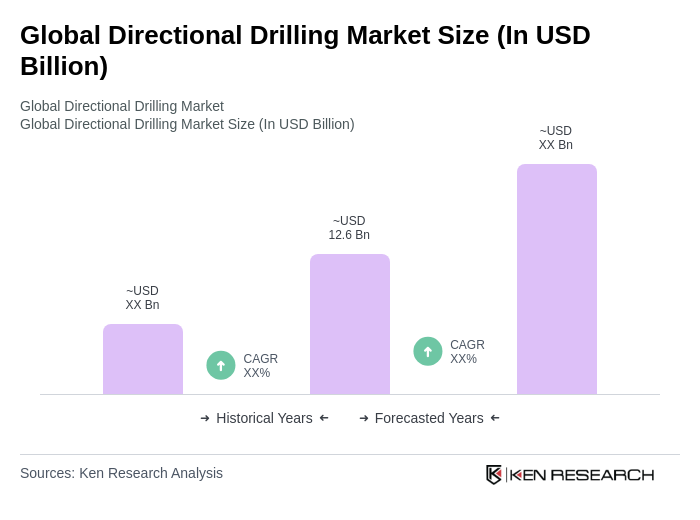

The Global Directional Drilling Market is valued at approximately USD 12.6 billion, reflecting a robust segment driven by oilfield services and advancements in drilling technologies. This valuation is based on a comprehensive five-year historical analysis of the market.