Region:Global

Author(s):Dev

Product Code:KRAC0500

Pages:85

Published On:August 2025

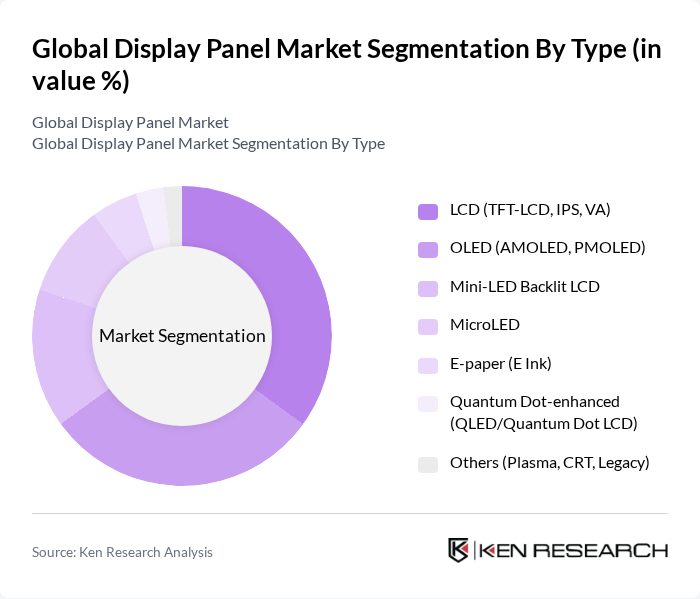

By Type:The display panel market can be segmented into various types, including LCD, OLED, Mini-LED Backlit LCD, MicroLED, E-paper, Quantum Dot-enhanced, and others. Each type has unique characteristics and applications, catering to different consumer needs and technological advancements.

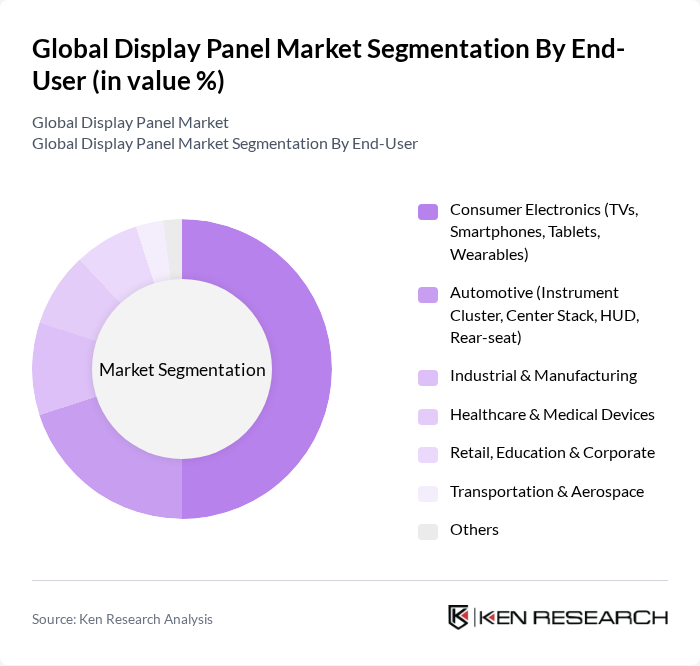

By End-User:The end-user segmentation includes various industries such as consumer electronics, automotive, industrial & manufacturing, healthcare & medical devices, retail, education & corporate, transportation & aerospace, and others. Each sector utilizes display panels for specific applications, driving demand across different markets. Recent demand strength is concentrated in smartphones, TVs, IT monitors, and in-vehicle displays, with automotive cockpit digitization accelerating adoption of center-stack, instrument clusters, and HUDs.

The Global Display Panel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Display Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., AU Optronics Corp. (AUO Corporation), Innolux Corporation, Sharp Corporation, Japan Display Inc. (JDI), Tianma Microelectronics Co., Ltd., E Ink Holdings Inc., Panasonic Holdings Corporation, Sony Group Corporation, Corning Incorporated, Universal Display Corporation (UDC), Hisense Visual Technology Co., Ltd., TCL China Star Optoelectronics Technology Co., Ltd. (TCL CSOT), Visionox Technology Inc., HKC Corporation Limited, BOE Varitronix Limited, HannStar Display Corporation, JOLED Inc. (in bankruptcy proceedings; IP assets) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the display panel market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the shift towards OLED and MicroLED technologies continues, manufacturers are expected to invest heavily in R&D to enhance display quality and energy efficiency. Additionally, the integration of AI in display technologies will likely create smarter, more interactive user experiences, further driving market growth. The focus on sustainability will also shape production practices, aligning with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | LCD (TFT-LCD, IPS, VA) OLED (AMOLED, PMOLED) Mini-LED Backlit LCD MicroLED E-paper (E Ink) Quantum Dot-enhanced (QLED/Quantum Dot LCD) Others (Plasma, CRT, Legacy) |

| By End-User | Consumer Electronics (TVs, Smartphones, Tablets, Wearables) Automotive (Instrument Cluster, Center Stack, HUD, Rear-seat) Industrial & Manufacturing Healthcare & Medical Devices Retail, Education & Corporate Transportation & Aerospace Others |

| By Application | Televisions Smartphones & Feature Phones Tablets & Laptops Monitors Automotive Displays Digital Signage & Public Displays Wearables (Smartwatches, AR/VR) Others |

| By Distribution Channel | OEM/ODM Supply Direct Enterprise Sales Distributors/Value-Added Resellers Online B2B Marketplaces Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry/Budget Mid-Range Premium/Flagship |

| By Technology | Active-Matrix (AM) Passive-Matrix (PM) Flexible & Foldable Displays Transparent & See-Through Displays D and Holographic Displays Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Display Panels | 150 | Product Managers, Marketing Directors |

| Automotive Display Technologies | 100 | Engineering Managers, R&D Heads |

| Commercial Display Solutions | 80 | Sales Managers, Business Development Executives |

| Emerging Display Technologies (OLED, MicroLED) | 70 | Technology Analysts, Innovation Managers |

| Display Panel Supply Chain Dynamics | 90 | Supply Chain Managers, Procurement Specialists |

The Global Display Panel Market is valued at approximately USD 160 billion, driven by the increasing demand for high-resolution displays in consumer electronics, automotive applications, and digital signage, along with advancements in technologies like OLED and Mini-LED.