Region:Global

Author(s):Shubham

Product Code:KRAA1841

Pages:81

Published On:August 2025

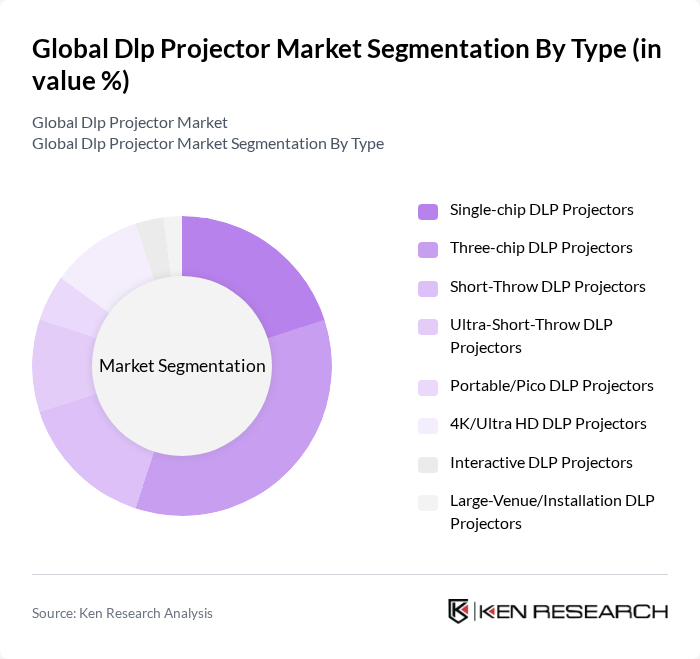

By Type:The DLP projector market can be segmented into various types, including Single-chip DLP Projectors, Three-chip DLP Projectors, Short-Throw DLP Projectors, Ultra-Short-Throw DLP Projectors, Portable/Pico DLP Projectors, 4K/Ultra HD DLP Projectors, Interactive DLP Projectors, and Large-Venue/Installation DLP Projectors. Among these, the Three-chip DLP Projectors are prominent in cinema and large?venue installations due to superior color accuracy, brightness, and reliability, whereas single?chip DLP dominates volume in business/education and home categories. The demand for high-quality visual experiences in corporate presentations and educational institutions, along with the shift to solid?state (laser/LED) light sources, supports these professional segments.

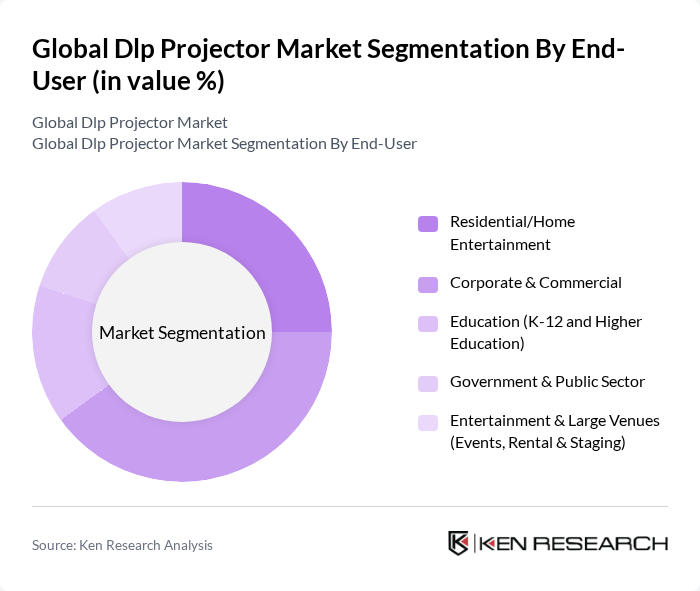

By End-User:The market can also be segmented by end-user categories, including Residential/Home Entertainment, Corporate & Commercial, Education (K-12 and Higher Education), Government & Public Sector, and Entertainment & Large Venues (Events, Rental & Staging). The Corporate & Commercial segment is currently the dominant end-user category, driven by the need for high-quality presentations and visual displays in meetings and conferences; interactive and collaboration use cases in education and enterprises are also contributing, with interactive projector demand growing within education and corporate deployments. The rise of hybrid work and video?first meeting rooms sustains demand for reliable, bright, and easy?to?integrate projectors in corporate settings.

The Global Dlp Projector Market is characterized by a dynamic mix of regional and international players. Leading participants such as BenQ Corporation, Optoma Corporation (Coretronic Group), ViewSonic Corporation, Acer Inc., Xiaomi Corporation (Mi/Global Ecosystem DLP projectors), Anker Innovations (Nebula), LG Electronics Inc., Samsung Electronics Co., Ltd. (The Premiere), Sony Group Corporation, Panasonic Holdings Corporation, NEC Corporation (Sharp NEC Display Solutions), Christie Digital Systems USA, Inc., Digital Projection Limited, Barco NV, Texas Instruments Incorporated (DLP chipsets) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the DLP projector market appears promising, driven by ongoing technological advancements and increasing consumer demand for high-quality visual experiences. As more households and businesses seek versatile projection solutions, the integration of smart technologies and enhanced connectivity features will likely become standard. Additionally, the growing emphasis on sustainability may lead to the development of eco-friendly projectors, further expanding market reach and consumer appeal in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Single?chip DLP Projectors Three?chip DLP Projectors Short?Throw DLP Projectors Ultra?Short?Throw DLP Projectors Portable/Pico DLP Projectors K/Ultra HD DLP Projectors Interactive DLP Projectors Large?Venue/Installation DLP Projectors |

| By End-User | Residential/Home Entertainment Corporate & Commercial Education (K?12 and Higher Education) Government & Public Sector Entertainment & Large Venues (Events, Rental & Staging) |

| By Application | Home Theater/Media Rooms Business & Conference Presentation Classroom & Lecture Hall Cinema & Immersive Venues Digital Signage & Simulation |

| By Distribution Channel | Online Retail/Marketplaces Specialty AV & Electronics Retail Direct Sales (OEM/Enterprise) Value?Added Resellers & Distributors |

| By Price Range | Entry/Budget (Sub?$500) Mid?Range ($500–$2,000) Premium/Professional (>$2,000) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Light Source | Lamp?based DLP Laser DLP LED DLP Hybrid (Laser/LED) DLP |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Sector DLP Usage | 100 | IT Managers, AV Coordinators |

| Educational Institutions Adoption | 80 | School Administrators, IT Directors |

| Home Entertainment Systems | 75 | Home Theater Enthusiasts, Retail Sales Staff |

| Event Management and AV Rental | 60 | Event Planners, AV Technicians |

| Consumer Electronics Retail Insights | 90 | Store Managers, Sales Representatives |

The Global DLP Projector Market is valued at approximately USD 6.1 billion, reflecting significant growth driven by advancements in display technology and increasing demand for high-quality visual presentations in various sectors, including corporate, education, and home entertainment.