Region:Global

Author(s):Dev

Product Code:KRAA2544

Pages:84

Published On:August 2025

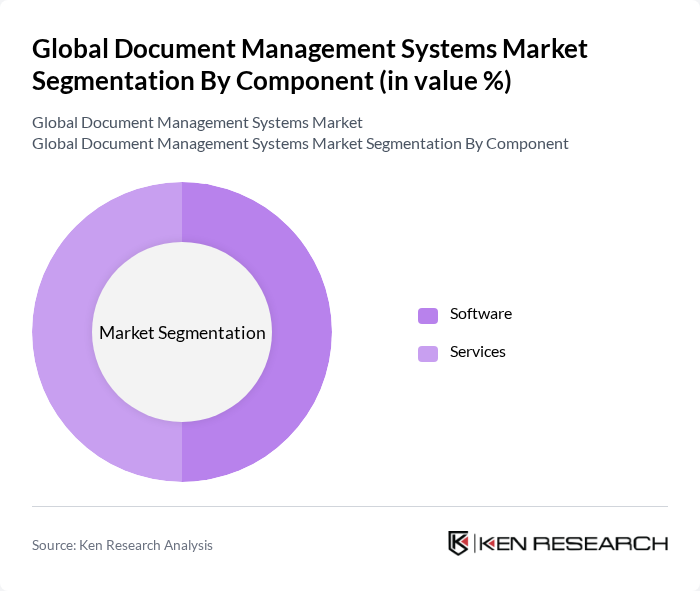

By Component:The document management systems market is segmented into software and services. The software segment includes applications that facilitate document creation, storage, retrieval, and workflow automation, while the services segment encompasses consulting, implementation, integration, and ongoing support. The software segment is currently leading the market due to the increasing demand for automated solutions that enhance productivity, support regulatory compliance, and offer advanced security features .

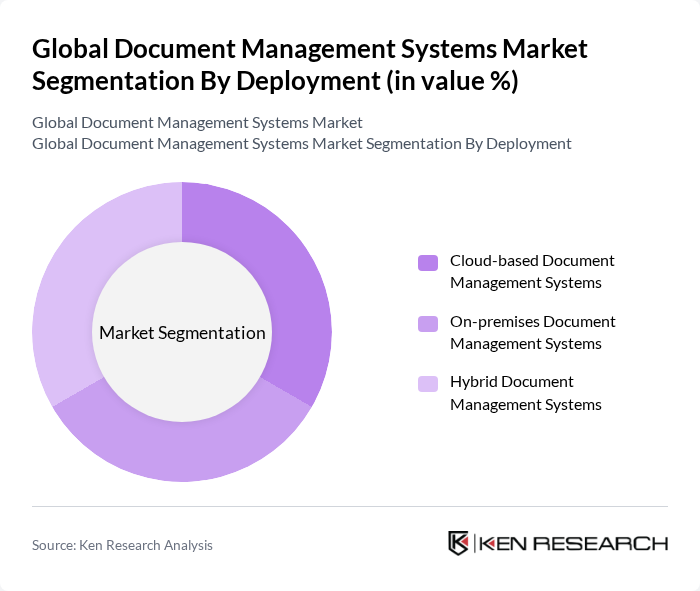

By Deployment:The market is categorized into cloud-based, on-premises, and hybrid document management systems. Cloud-based solutions are gaining traction due to their scalability, cost-effectiveness, and ease of remote access, while on-premises systems are preferred by organizations with stringent data security and compliance requirements. Hybrid solutions offer a balanced approach, combining the benefits of both cloud and on-premises deployments, and are increasingly adopted by enterprises seeking flexibility and regulatory compliance .

The Global Document Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as DocuWare, M-Files, OpenText, IBM, Microsoft, Hyland Software, Laserfiche, Box, Microsoft SharePoint, Alfresco Software, Evernote Corporation, Zoho Corporation (Zoho Docs), Citrix Systems (ShareFile), Dropbox, Inc. (Dropbox Business), and Google LLC (Google Workspace) contribute to innovation, geographic expansion, and service delivery in this space .

The future of document management systems is poised for significant evolution, driven by technological advancements and changing workplace dynamics. As organizations increasingly prioritize digital transformation, the integration of artificial intelligence and machine learning into DMS will enhance automation and data analysis capabilities. Furthermore, the growing emphasis on mobile solutions will cater to the needs of a remote workforce, ensuring that document management remains agile and responsive to the demands of modern business environments.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Services |

| By Deployment | Cloud-based Document Management Systems On-premises Document Management Systems Hybrid Document Management Systems |

| By Enterprise Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By End-User Industry | Banking, Financial Services, and Insurance (BFSI) Government Healthcare IT and Telecom Retail Manufacturing and Construction Legal Education Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Document Management | 100 | Healthcare Administrators, IT Directors |

| Legal Document Automation | 60 | Law Firm Partners, Document Control Managers |

| Financial Services Compliance | 80 | Compliance Officers, Risk Management Executives |

| Manufacturing Process Documentation | 50 | Operations Managers, Quality Assurance Leads |

| Education Sector Document Handling | 40 | IT Administrators, Academic Registrars |

The Global Document Management Systems Market is valued at approximately USD 8.6 billion, driven by the increasing need for efficient document handling, regulatory compliance, and digital transformation across various industries.