Region:Global

Author(s):Shubham

Product Code:KRAD0697

Pages:80

Published On:August 2025

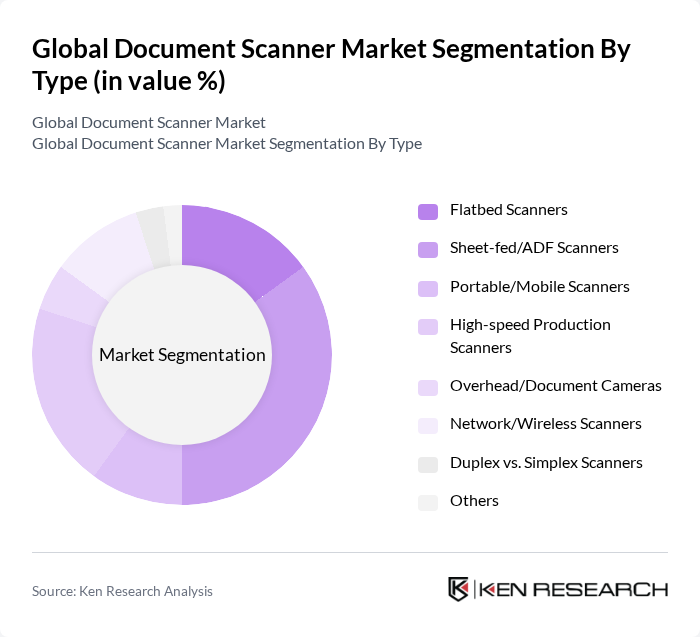

By Type:The document scanner market is segmented into various types, including Flatbed Scanners, Sheet-fed/ADF Scanners, Portable/Mobile Scanners, High-speed Production Scanners, Overhead/Document Cameras, Network/Wireless Scanners, Duplex vs. Simplex Scanners, and Others. Among these, Sheet-fed/ADF Scanners are currently leading the market due to their efficiency in handling multiple pages quickly, making them ideal for businesses with high-volume scanning needs.

By End-User:The end-user segmentation includes Government & Public Sector, Banking, Financial Services & Insurance (BFSI), Healthcare Providers, Legal & Professional Services, Education, IT & Telecom, Retail & E-commerce, Small and Medium Enterprises, Large Enterprises, and Others. The BFSI sector is the dominant segment, driven by secure, compliant document workflows, customer onboarding (KYC), loan processing, and archival digitization; BFSI has been cited as the largest share end-user historically.

The Global Document Scanner Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Inc., PFU Limited (A Ricoh Company), Seiko Epson Corporation, HP Inc., Brother Industries, Ltd., Panasonic Holdings Corporation, Xerox Holdings Corporation, Kodak Alaris Holdings Limited, Plustek Inc., Avision Inc., Visioneer, Inc., IRIS S.A. (Canon Group), Microtek International Inc., Mustek Systems Inc., Ambir Technology, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the document scanner market appears promising, driven by ongoing technological advancements and the increasing need for efficient document management solutions. As businesses continue to embrace digital transformation, the integration of AI and cloud services into scanning solutions will enhance productivity and streamline workflows. Additionally, the growing emphasis on eco-friendly practices will likely lead to the development of sustainable scanning technologies, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Flatbed Scanners Sheet-fed/ADF Scanners Portable/Mobile Scanners High-speed Production Scanners Overhead/Document Cameras Network/Wireless Scanners Duplex vs. Simplex Scanners Others |

| By End-User | Government & Public Sector Banking, Financial Services & Insurance (BFSI) Healthcare Providers Legal & Professional Services Education IT & Telecom Retail & E-commerce Small and Medium Enterprises Large Enterprises Others |

| By Application | Document Management Archiving & Records Preservation Data Entry & OCR/ICR Automation Workflow & Business Process Optimization Compliance, KYC & Auditing Mailroom & Backfile Conversion Others |

| By Distribution Channel | Online Retail & Marketplaces Offline Retail (Electronics & Office Supply Stores) Direct Sales (OEM/Enterprise) Value-Added Resellers & System Integrators Distributors/Wholesale Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Budget Scanners (Sub-$200) Mid-range Scanners ($200–$800) Premium/Enterprise Scanners ($800+) Subscription/Hardware-as-a-Service Others |

| By Brand | Canon Fujitsu (PFU / Ricoh) Epson HP Brother Panasonic Xerox Kodak Alaris Plustek Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Document Management | 120 | IT Managers, Compliance Officers |

| Education Sector Scanning Solutions | 85 | Administrative Heads, IT Coordinators |

| Financial Services Document Processing | 95 | Operations Managers, Risk Management Officers |

| Legal Document Automation | 75 | Legal Administrators, IT Support Staff |

| Government Records Management | 80 | Records Managers, IT Directors |

The Global Document Scanner Market is valued at approximately USD 6.5 billion, reflecting a significant growth trend driven by the increasing demand for digitization across various sectors, including healthcare, finance, and education.