Region:Global

Author(s):Geetanshi

Product Code:KRAC0105

Pages:99

Published On:August 2025

By Type:The dolomite market is segmented into Calcined Dolomite, Sintered Dolomite, Agglomerated Dolomite, Dolomitic Limestone, Dolomite Powder, and Others. Among these, Calcined Dolomite is the leading subsegment, accounting for the largest share due to its extensive use in the steelmaking process as a flux and refractory material. The increasing demand for high-quality steel and growth in the construction sector are driving the preference for calcined dolomite, which enhances steel quality and efficiency in production.

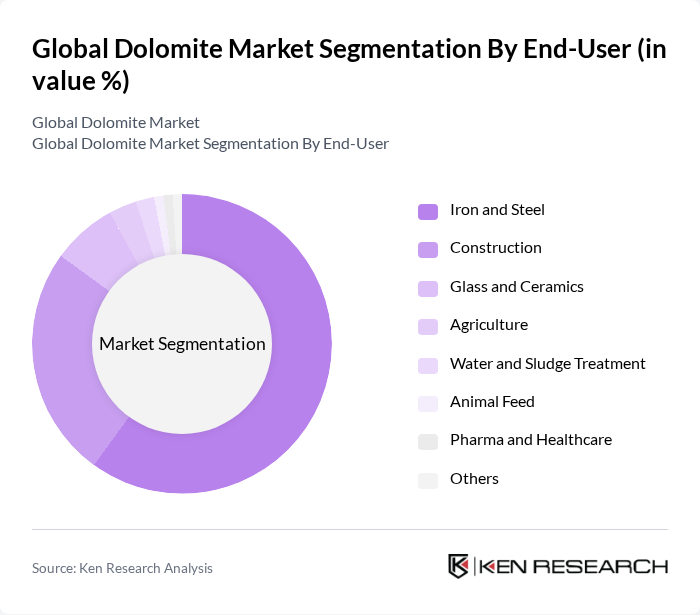

By End-User:The end-user segmentation of the dolomite market includes Iron and Steel, Construction, Glass and Ceramics, Agriculture, Water and Sludge Treatment, Animal Feed, Pharma and Healthcare, and Others. The Iron and Steel sector is the dominant end-user, accounting for the majority of dolomite consumption due to its essential role as a flux and refractory material in steel production. The growth of the automotive and construction industries further fuels the demand for steel, thereby increasing the consumption of dolomite in these sectors.

The Global Dolomite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imerys S.A., Minerals Technologies Inc., Carmeuse Lime & Stone, Omya AG, Schaefer Kalk GmbH, Nordkalk Corporation, Ube Material Industries, Ltd., Sibelco N.V., Lhoist Group, RHI Magnesita N.V., Calcinor S.A., JFE Minerals Co., Ltd., CEMEX S.A.B. de C.V., C. E. Minerals, Inc., and Cargill, Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dolomite market in future appears promising, driven by increasing applications across various industries. The construction sector's growth, coupled with rising demand in agriculture and manufacturing, is expected to sustain market momentum. Additionally, advancements in mining technology and a shift towards sustainable practices will likely enhance operational efficiency. As companies adapt to regulatory changes and consumer preferences for eco-friendly products, the dolomite market is poised for significant evolution and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Calcined Dolomite Sintered Dolomite Agglomerated Dolomite Dolomitic Limestone Dolomite Powder Others |

| By End-User | Iron and Steel Construction Glass and Ceramics Agriculture Water and Sludge Treatment Animal Feed Pharma and Healthcare Others |

| By Application | Flux in Steelmaking Soil Conditioning Filler in Plastics Refractory Production Clinker Production (Cement) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| By Quality Grade | Industrial Grade Agricultural Grade High-Purity Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Usage | 100 | Project Managers, Procurement Officers |

| Agricultural Applications | 60 | Agronomists, Farm Managers |

| Glass Manufacturing Sector | 40 | Production Supervisors, Quality Control Managers |

| Environmental Impact Assessments | 50 | Environmental Consultants, Regulatory Affairs Specialists |

| Mining and Extraction Insights | 70 | Mining Engineers, Operations Managers |

The Global Dolomite Market is valued at approximately USD 1.9 billion, driven by increasing demand in construction, agriculture, and iron and steel production. This growth reflects the mineral's versatility and rising consumption, particularly in emerging economies focused on infrastructure development.