Region:Global

Author(s):Dev

Product Code:KRAB0350

Pages:100

Published On:August 2025

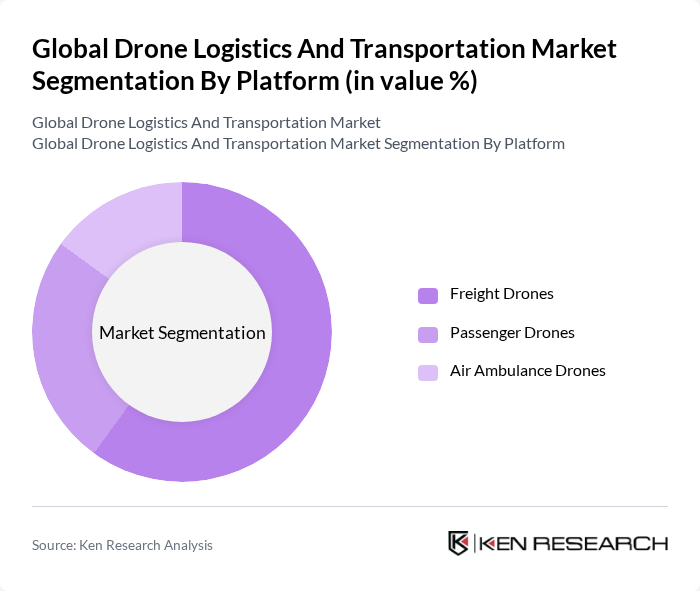

By Platform:The platform segmentation includes various types of drones utilized for logistics and transportation. The subsegments are Freight Drones, Passenger Drones, and Air Ambulance Drones. Freight Drones are primarily used for transporting goods, including e-commerce parcels and medical supplies, while Passenger Drones are designed for human transport and urban air mobility. Air Ambulance Drones are specialized for emergency medical services, providing rapid response capabilities in critical situations. The Freight Drones subsegment is currently leading the market due to the increasing demand for efficient last-mile delivery solutions and the expansion of e-commerce .

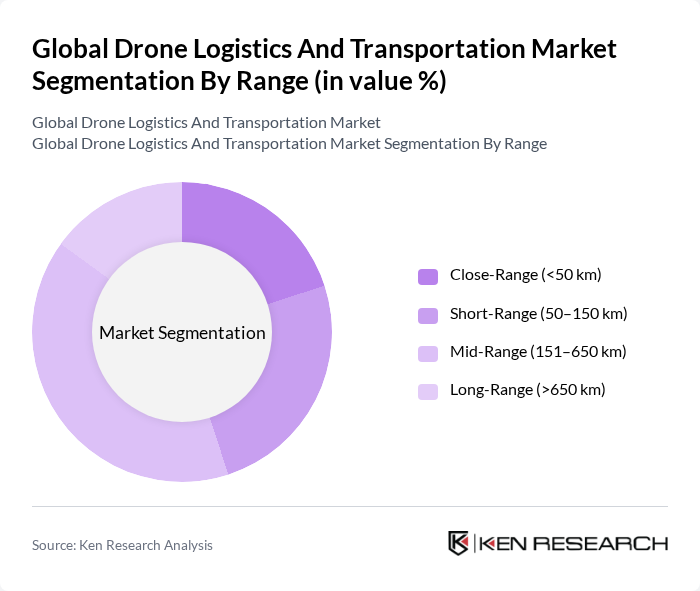

By Range:This segmentation categorizes drones based on their operational range, which includes Close-Range (<50 km), Short-Range (50–150 km), Mid-Range (151–650 km), and Long-Range (>650 km). The Close-Range segment is gaining traction due to its suitability for urban deliveries, especially for e-commerce and food delivery. The Mid-Range segment is significant for regional logistics, including medical supply drops and industrial deliveries. The Short-Range segment is popular for local deliveries, and the Long-Range segment is emerging for intercity transport and cross-border logistics. The Mid-Range segment is currently dominating the market due to its versatility in various applications and the ability to serve both urban and rural areas .

The Global Drone Logistics And Transportation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Prime Air, Zipline, UPS Flight Forward, Wing (Alphabet Inc.), DHL Parcelcopter, Matternet, Flirtey, Drone Delivery Canada, EHang, Volansi, Skycart, Flytrex, AirMap, PrecisionHawk, DroneUp contribute to innovation, geographic expansion, and service delivery in this space.

The future of drone logistics and transportation is poised for transformative growth, driven by technological advancements and increasing consumer demand for rapid delivery. As urbanization continues, cities are likely to adopt drone delivery systems to alleviate traffic congestion and improve logistics efficiency. Furthermore, the integration of artificial intelligence and machine learning will enhance route optimization and operational safety, making drone logistics a vital component of modern supply chains in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Platform | Freight Drones Passenger Drones Air Ambulance Drones |

| By Range | Close-Range (<50 km) Short-Range (50–150 km) Mid-Range (151–650 km) Long-Range (>650 km) |

| By Sector | Civil & Commercial Military |

| By Application | Last-Mile Delivery Warehouse & Inventory Management Emergency Medical Supply Delivery Surveillance & Monitoring Food & Retail Delivery |

| By Payload Capacity | Less than 5 kg kg to 20 kg More than 20 kg |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Subsidies for Drone Development Tax Incentives for Drone Operations Regulatory Support for Testing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Drone Deliveries | 100 | Logistics Coordinators, Hospital Administrators |

| Retail Drone Logistics | 80 | Supply Chain Managers, E-commerce Directors |

| Agricultural Drone Applications | 60 | Agronomists, Farm Operations Managers |

| Urban Delivery Systems | 90 | City Planners, Transportation Officials |

| Drone Regulatory Compliance | 50 | Regulatory Affairs Specialists, Compliance Officers |

The Global Drone Logistics and Transportation Market is valued at approximately USD 1.6 billion, driven by advancements in drone technology and increasing demand for efficient delivery solutions across various sectors, including healthcare and e-commerce.