Region:Global

Author(s):Geetanshi

Product Code:KRAB0121

Pages:80

Published On:August 2025

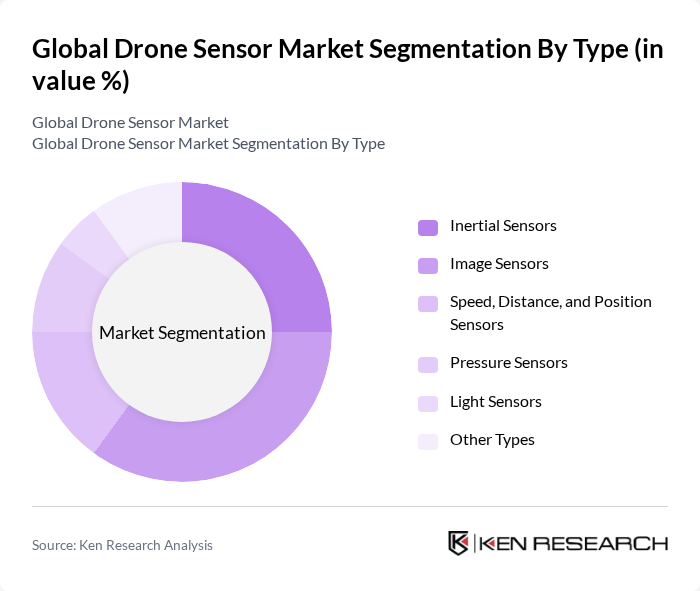

By Type:The market is segmented into various types of sensors that are integral to drone functionality. The leading sub-segment is Image Sensors, which are widely used for capturing high-resolution images and videos for applications such as aerial mapping, surveillance, and inspection. Inertial Sensors also hold a significant share, providing essential data for navigation, flight stabilization, and orientation. The demand for these sensors is driven by advancements in imaging technology, sensor miniaturization, and the increasing need for accurate and real-time data collection in diverse industries.

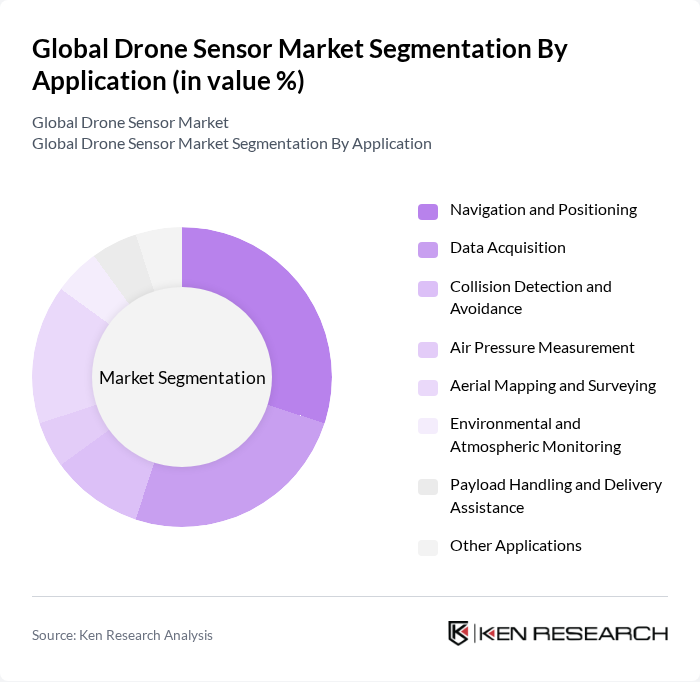

By Application:The applications of drone sensors are diverse, with Navigation and Positioning being the most prominent. This segment is crucial for ensuring the accurate and safe flight of drones, especially in complex and dynamic environments. Data Acquisition is also a major segment, as organizations increasingly leverage drones for real-time data collection in sectors such as agriculture, infrastructure inspection, and environmental monitoring. The growth in these applications is driven by the need for efficient, precise, and automated data collection methods across industries.

The Global Drone Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Parrot Drones S.A., Teledyne FLIR LLC, senseFly SA, Yuneec International Co., Ltd., 3D Robotics, Inc., Insitu, Inc. (a Boeing Company), AeroVironment, Inc., Skydio, Inc., Delair SAS, Quantum Systems GmbH, Wingtra AG, Flyability SA, Kespry, Inc., EHang Holdings Limited, Trimble Inc., Velodyne Lidar, Inc., Bosch Sensortec GmbH, Honeywell International Inc., and STMicroelectronics N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the drone sensor market appears promising, driven by technological advancements and increasing adoption across various sectors. As industries continue to recognize the value of aerial data, the integration of AI and machine learning is expected to enhance data analysis capabilities. Furthermore, the expansion of drone applications in emerging markets will likely create new opportunities, fostering innovation and driving growth in the sector. The focus on sustainability and environmental monitoring will also shape future developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Inertial Sensors Image Sensors Speed, Distance, and Position Sensors Pressure Sensors Light Sensors Other Types |

| By Application | Navigation and Positioning Data Acquisition Collision Detection and Avoidance Air Pressure Measurement Aerial Mapping and Surveying Environmental and Atmospheric Monitoring Payload Handling and Delivery Assistance Other Applications |

| By Drone Type | Fixed-Wing Drones Rotary-Wing Drones Hybrid Drones |

| By End-User | Military & Defense Agriculture Energy and Utilities Construction Public Safety & Law Enforcement Environmental Monitoring Media & Entertainment Others |

| By Region | North America United States Canada Europe Germany United Kingdom France Rest of Europe Asia-Pacific China India Japan South Korea Rest of Asia-Pacific Latin America Brazil Rest of Latin America Middle East and Africa United Arab Emirates Saudi Arabia Egypt Rest of Middle East and Africa |

| By Payload Capacity | Less than 5 kg kg to 10 kg kg to 25 kg More than 25 kg |

| By Price Range | Budget Drones Mid-Range Drones Premium Drones Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Drone Sensors | 100 | Agronomists, Farm Managers |

| Commercial Drone Applications | 80 | Business Owners, Operations Managers |

| Defense and Surveillance Drones | 60 | Defense Analysts, Security Experts |

| Logistics and Delivery Drones | 75 | Logistics Coordinators, Supply Chain Managers |

| Drone Sensor Technology Providers | 90 | Product Development Engineers, Technology Officers |

The Global Drone Sensor Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by advancements in drone technology and the increasing adoption of drones across various sectors, including agriculture, construction, and public safety.