Region:Global

Author(s):Shubham

Product Code:KRAA1724

Pages:90

Published On:August 2025

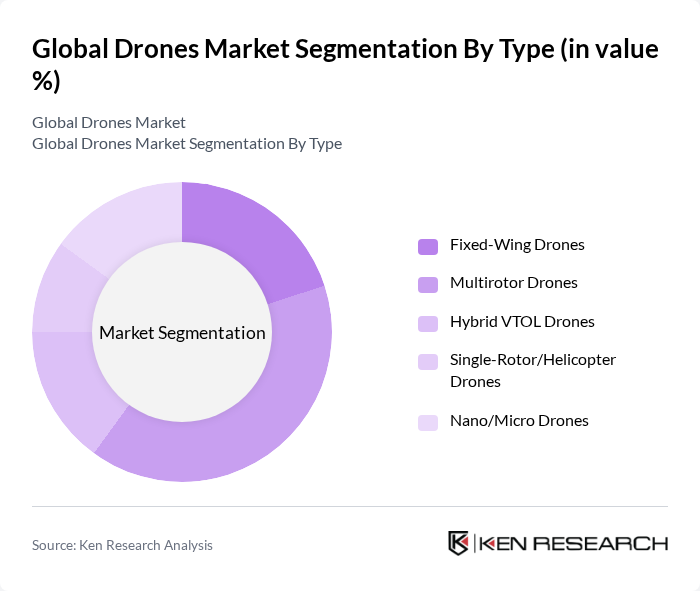

By Type:The drones market is segmented into various types, including Fixed-Wing Drones, Multirotor Drones, Hybrid VTOL Drones, Single-Rotor/Helicopter Drones, and Nano/Micro Drones. Among these, Multirotor Drones are currently dominating the market due to their versatility, ease of deployment, lower acquisition and operating cost, and suitability for close-range inspection, mapping, and imaging. They are widely adopted in sectors such as agriculture (field scouting, spraying), surveillance and public safety, construction progress monitoring, and logistics pilots, making them a preferred choice for commercial and recreational users .

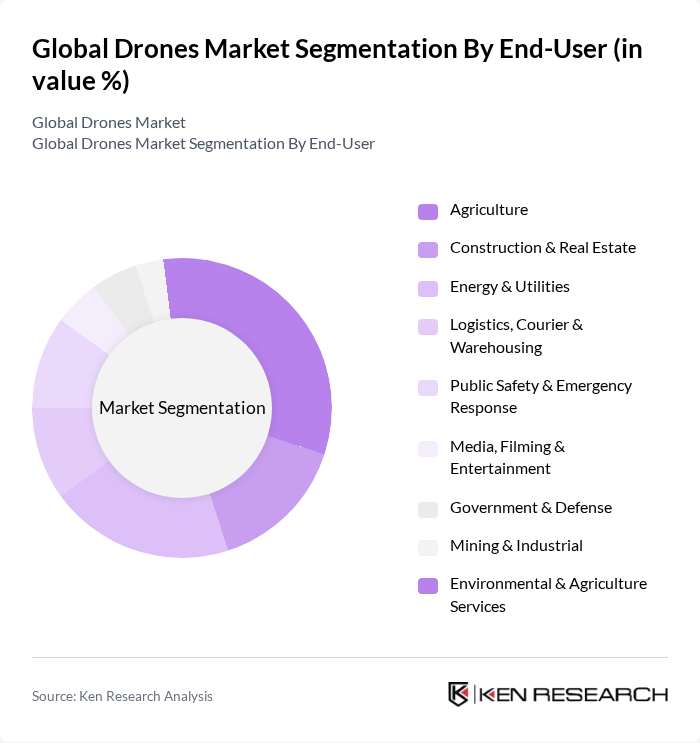

By End-User:The market is further segmented by end-user applications, including Agriculture, Construction & Real Estate, Energy & Utilities, Logistics, Public Safety, Media, Government & Defense, Mining & Industrial, and Environmental Services. The Agriculture sector is a leading commercial adopter, driven by precision farming, multispectral crop scouting, and targeted spraying for inputs optimization. Drones are being utilized for variable-rate spraying, plant health mapping, soil and moisture analysis, and yield estimation, while Energy & Utilities, Construction, and Public Safety also show rapid adoption for inspection, progress monitoring, and incident response .

The Global Drones Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., SZ DJI Technology Co., Ltd. (DJI Enterprise), Parrot Drones S.A., Skydio, Inc., Autel Robotics Co., Ltd., Yuneec International Co., Ltd., AeroVironment, Inc., Insitu, Inc. (a Boeing Company), The Boeing Company (Defense, Space & Security), Northrop Grumman Corporation, General Atomics Aeronautical Systems, Inc. (GA-ASI), Textron Systems Corporation, Teledyne FLIR LLC (FLIR Systems), EHang Holdings Limited, Quantum-Systems GmbH, senseFly SA (AgEagle Aerial Systems, Inc.), Delair SAS, Flyability SA, AgEagle Aerial Systems, Inc., Zipline International Inc., Wing (Alphabet Inc.), Matternet, Inc., Percepto Robotics Ltd., Airobotics Ltd. (Ondas Holdings), DroneShield Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the drone market in future appears promising, driven by technological advancements and increasing applications across various sectors. As regulatory frameworks become more defined, businesses are expected to adopt drones more widely, particularly in logistics and agriculture. The integration of AI and machine learning will further enhance drone capabilities, making them indispensable tools for data collection and analysis. This evolution will likely lead to a more robust market environment, fostering innovation and investment in drone technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Drones Multirotor Drones Hybrid VTOL Drones Single-Rotor/Helicopter Drones Nano/Micro Drones |

| By End-User | Agriculture Construction & Real Estate Energy & Utilities (Oil & Gas, Power, Renewables) Logistics, Courier & Warehousing Public Safety & Emergency Response Media, Filming & Entertainment Government & Defense Mining & Industrial Environmental & Agriculture Services (Forestry, Wildlife, Conservation) |

| By Application | Mapping & Surveying Inspection & Monitoring Aerial Photography & Videography Precision Agriculture (Spraying, Seeding, Crop Health) Public Safety (Search & Rescue, Fire/Disaster Response) Cargo & Last-Mile Delivery Remote Sensing & Environmental Monitoring Others |

| By Distribution Channel | Direct (Manufacturer to Enterprise/Government) Specialized Distributors/Resellers Online Retail (Brand Stores & Marketplaces) Offline Retail (Electronics & Hobby Stores) |

| By Payload Capacity | Less than 2 kg kg to 5 kg kg to 25 kg More than 25 kg |

| By Power/Propulsion | Electric (LiPo, Li-ion) Hybrid (Engine-Electric) Internal Combustion/Jet Hydrogen Fuel Cell |

| By Price Range | Below $500 (Consumer/Recreational) $500 to $1,500 (Prosumer) $1,500 to $10,000 (Enterprise) Above $10,000 (Industrial/Defense) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Drone Applications | 120 | Agronomists, Farm Managers |

| Logistics and Delivery Drones | 100 | Logistics Coordinators, Supply Chain Managers |

| Military Drone Utilization | 80 | Defense Analysts, Military Procurement Officers |

| Drone Photography and Videography | 70 | Creative Directors, Media Producers |

| Drone Maintenance and Repair Services | 60 | Service Technicians, Operations Managers |

The Global Drones Market is valued at approximately USD 73 billion, driven by advancements in technology and increasing applications across various sectors such as inspection, mapping, public safety, and delivery services.