Region:Global

Author(s):Geetanshi

Product Code:KRAA2344

Pages:91

Published On:August 2025

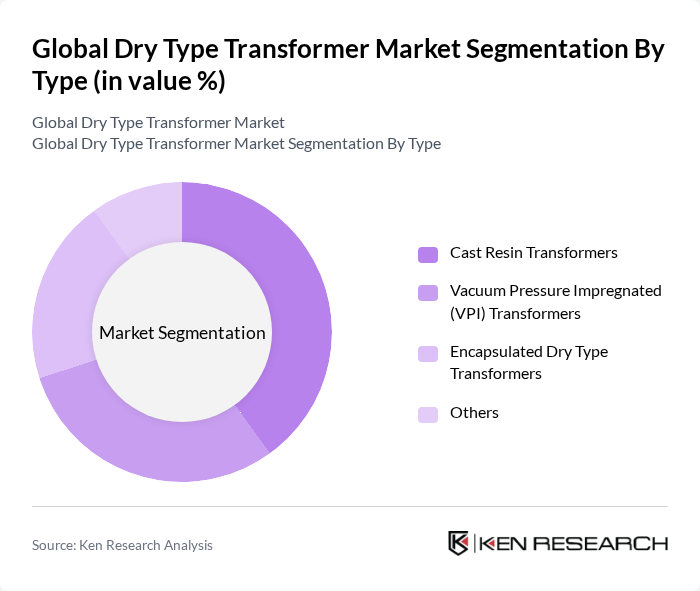

By Type:The market is segmented into various types of dry type transformers, including Cast Resin Transformers, Vacuum Pressure Impregnated (VPI) Transformers, Encapsulated Dry Type Transformers, and Others. Each type serves specific applications and industries, catering to diverse customer needs. Cast Resin Transformers are widely used for their superior fire resistance and low maintenance, while VPI Transformers are preferred for industrial applications requiring high reliability and environmental resilience. Encapsulated Dry Type Transformers are commonly adopted in environments with high moisture or dust levels .

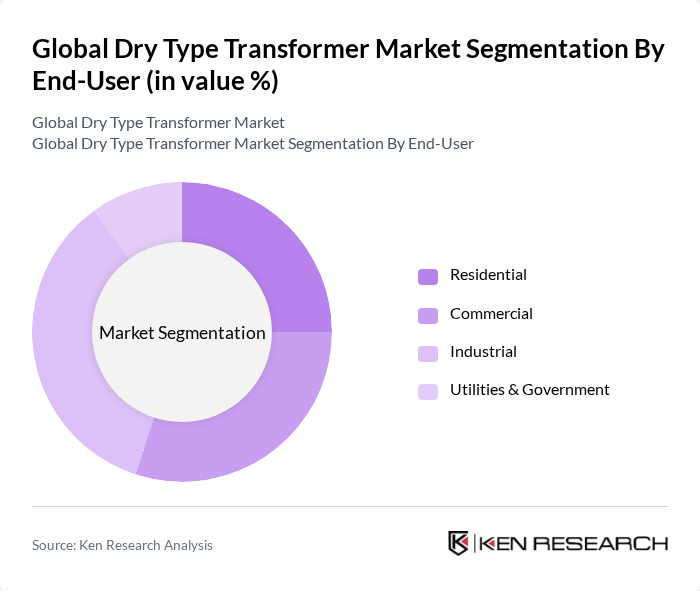

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Utilities & Government sectors. Each segment has unique requirements and applications for dry type transformers, influencing their market dynamics. The industrial segment leads due to the need for robust, safe, and efficient power distribution in manufacturing and processing plants. The commercial sector is driven by increasing construction of office buildings, shopping malls, and hospitals, while utilities focus on grid modernization and renewable integration. Residential adoption is growing in multi-unit dwellings and urban developments .

The Global Dry Type Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, ABB Ltd., Eaton Corporation plc, General Electric Company, Mitsubishi Electric Corporation, Toshiba Corporation, CG Power and Industrial Solutions Limited, Fuji Electric Co., Ltd., Bharat Heavy Electricals Limited (BHEL), Siemens Energy AG, Hitachi, Ltd., Nissin Electric Co., Ltd., Hyosung Heavy Industries, Hammond Power Solutions Inc., SGB-SMIT Group, Kirloskar Electric Company Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dry type transformer market appears promising, driven by technological advancements and increasing regulatory support for energy efficiency. As smart grid technologies gain traction, the integration of advanced monitoring systems will enhance operational efficiency and reliability. Additionally, the growing emphasis on sustainability will likely lead to increased investments in green technologies, further propelling the demand for dry type transformers. The market is expected to adapt to these trends, positioning itself for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cast Resin Transformers Vacuum Pressure Impregnated (VPI) Transformers Encapsulated Dry Type Transformers Others |

| By End-User | Residential Commercial Industrial Utilities & Government |

| By Application | Power Generation Renewable Energy Integration (Solar, Wind, etc.) Transmission & Distribution Transportation (Railways, Airports, Metros) Data Centers & Critical Infrastructure Others |

| By Sales Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Distribution Mode | Bulk Distribution Retail Distribution Direct Delivery Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Applications | 100 | Facility Managers, Electrical Engineers |

| Industrial Manufacturing Sector | 80 | Operations Managers, Plant Engineers |

| Renewable Energy Installations | 60 | Project Managers, Renewable Energy Consultants |

| Utility Providers | 70 | Grid Managers, Procurement Officers |

| Research & Development in Electrical Engineering | 40 | R&D Managers, Technical Directors |

The Global Dry Type Transformer Market is valued at approximately USD 7 billion, driven by the increasing demand for energy-efficient and environmentally friendly transformers, along with investments in renewable energy projects and infrastructure development.