Global Duty Free And Travel Retail Market Overview

- The Global Duty Free and Travel Retail Market is valued at USD 76 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing number of international travelers, rising disposable incomes, and the growing demand for luxury and premium goods among consumers. The market has seen a significant rebound post-pandemic, with a surge in travel activities, expansion of airport infrastructure, and digital innovation—such as contactless payments and app-based ordering—contributing to its expansion. Enhanced digital engagement and improved customer targeting are also supporting market growth.

- Key players in this market include major cities and countries such as Dubai, Singapore, and London, which dominate due to their strategic locations as international travel hubs. These regions benefit from high passenger traffic, a diverse range of retail offerings, and favorable government policies that promote tourism and duty-free shopping. Asia-Pacific currently holds the largest market share, driven by robust travel activity and infrastructure investment.

- Recent regulatory initiatives in the European Union have aimed to streamline duty-free allowances and harmonize traveler experiences, enhancing consumer confidence and encouraging spending in duty-free shops. These efforts are designed to support the recovery and growth of the travel retail sector by making cross-border shopping more convenient and transparent for international travelers.

Global Duty Free And Travel Retail Market Segmentation

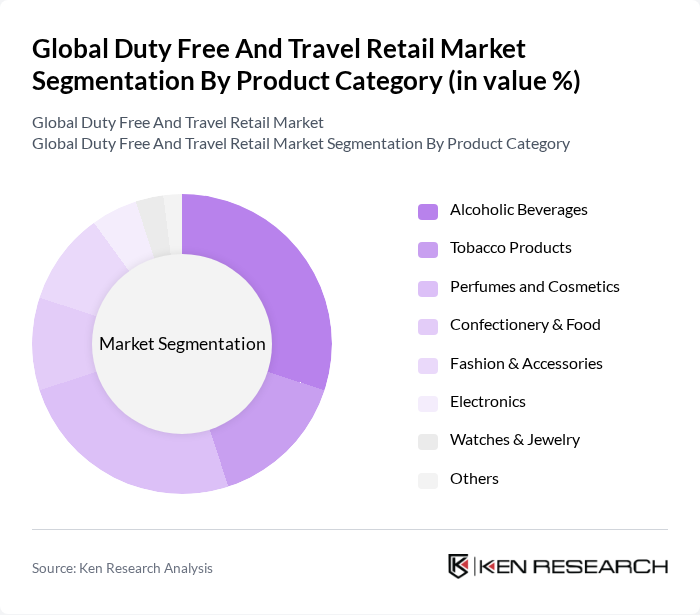

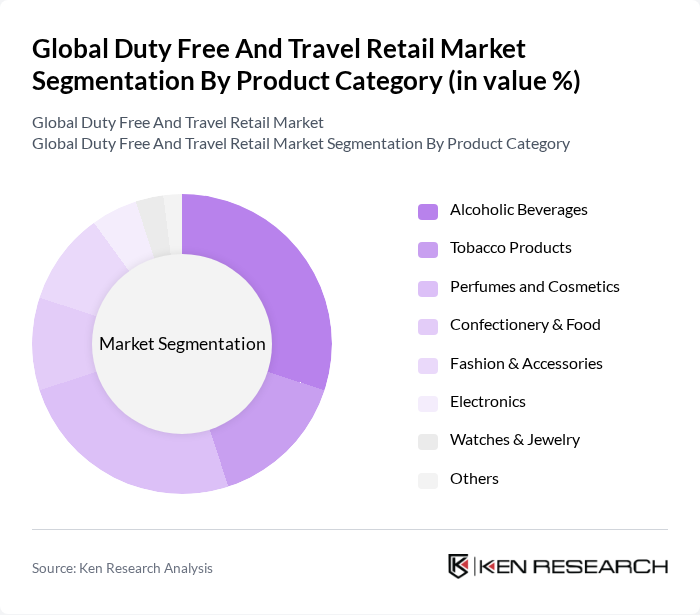

By Product Category:The product categories in the duty-free and travel retail market encompass a broad selection of items tailored to international travelers. The primary subsegments are Alcoholic Beverages, Tobacco Products, Perfumes and Cosmetics, Confectionery & Food, Fashion & Accessories, Electronics, Watches & Jewelry, and Others. Among these, Alcoholic Beverages and Perfumes and Cosmetics remain the most sought-after, reflecting the high demand for luxury and premium products in travel retail environments.

By Sales Channel:The sales channels in the duty-free and travel retail market include Airport Retail, Cruise Ship Retail, Border Shops, Downtown/City Center Duty Free, Online Retail, and Others. Airport Retail is the dominant channel, driven by the high volume of international travelers and the convenience of shopping before departure or upon arrival. Cruise ship and border shop retail also play significant roles, particularly in regions with high cross-border travel or cruise tourism. Online retail is emerging, supported by digital transformation and pre-order services.

Global Duty Free And Travel Retail Market Competitive Landscape

The Global Duty Free And Travel Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dufry AG, Lotte Duty Free, DFS Group, Gebr. Heinemann SE & Co. KG, Lagardère Travel Retail, King Power International Co., Ltd., The Shilla Duty Free, China Duty Free Group Co., Ltd., Duty Free Americas, Inc., Aelia Duty Free (Lagardère Travel Retail), Nuance Group (Dufry AG), World Duty Free Group (Dufry AG), Travel Retail Norway AS, T Galleria by DFS, Flemingo International Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Duty Free And Travel Retail Market Industry Analysis

Growth Drivers

- Increase in International Travel:The number of international tourist arrivals reached approximately 1.3 billion, according to the United Nations World Tourism Organization (UNWTO). This surge in travel is expected to continue, with projections indicating a rise to approximately 1.8 billion in future. Increased travel directly correlates with higher foot traffic in duty-free shops, leading to increased sales. Additionally, the average spend per traveler in duty-free outlets is estimated at $100, further driving revenue growth in the sector.

- Rising Disposable Incomes:Global disposable income is projected to increase by approximately $3 trillion in future, according to the World Bank. This rise in disposable income, particularly in emerging markets, is expected to enhance consumer spending on luxury goods and travel retail products. As consumers have more disposable income, they are more likely to indulge in duty-free shopping, which is often perceived as a premium experience, thus boosting overall market growth.

- Expansion of Retail Outlets in Airports:As of 2023, there are over 2,000 duty-free retail outlets in airports worldwide, with a projected increase of approximately 10% in future. This expansion is driven by airport authorities seeking to enhance passenger experience and increase non-aeronautical revenue. The growing number of retail outlets provides travelers with more shopping options, thereby increasing the likelihood of purchases and contributing to the overall growth of the duty-free market.

Market Challenges

- Regulatory Restrictions:Regulatory frameworks governing duty-free sales vary significantly across countries, creating challenges for retailers. For instance, the European Union has strict regulations on the sale of tobacco and alcohol, limiting quantities that can be sold to travelers. These restrictions can hinder sales potential, as consumers may seek alternatives in local markets where regulations are less stringent, impacting overall revenue in the duty-free sector.

- Economic Uncertainty:Global economic uncertainty, exacerbated by geopolitical tensions and inflationary pressures, poses a significant challenge to the duty-free market. The International Monetary Fund (IMF) forecasts global GDP growth to slow to approximately 2.8% in future, which may lead to reduced consumer spending on non-essential items, including luxury goods. This economic climate can adversely affect the travel retail sector, as consumers prioritize essential expenditures over discretionary purchases.

Global Duty Free And Travel Retail Market Future Outlook

The future of the duty-free and travel retail market appears promising, driven by increasing international travel and rising disposable incomes. As more travelers seek unique shopping experiences, retailers are likely to enhance their offerings through personalized services and exclusive products. Additionally, the integration of technology, such as mobile payment solutions and augmented reality, will further enrich the shopping experience, making it more convenient and engaging for consumers. This evolution will likely attract a broader customer base and stimulate market growth.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for duty-free retailers. With a projected increase in middle-class consumers, estimated to reach approximately 1.5 billion in future, retailers can tap into this demographic's growing purchasing power, enhancing their market presence and sales potential in these regions.

- Development of Exclusive Product Lines:Creating exclusive product lines tailored for duty-free shoppers can drive sales and enhance brand loyalty. Retailers can collaborate with luxury brands to offer limited-edition items, appealing to travelers seeking unique products. This strategy not only boosts sales but also enhances the overall shopping experience, making duty-free outlets more attractive to consumers.