Region:Global

Author(s):Dev

Product Code:KRAC0495

Pages:93

Published On:August 2025

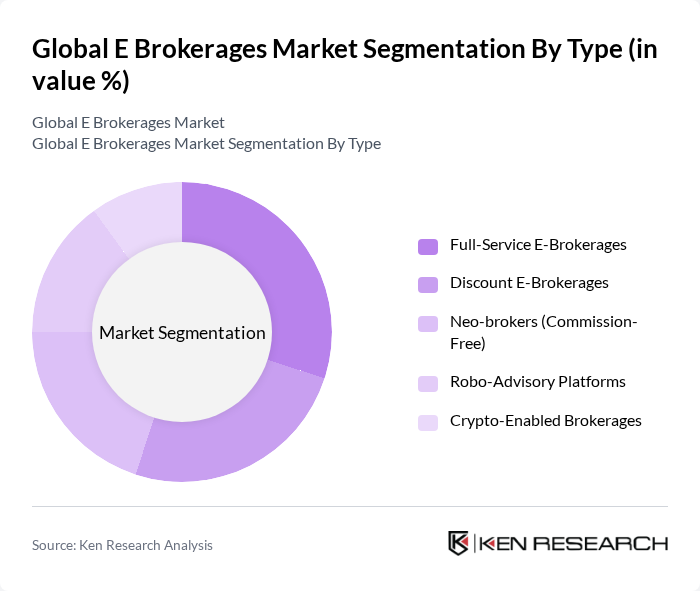

By Type:This segmentation includes various types of e-brokerages that cater to different investor needs and preferences.

The Full-Service E-Brokerages segment is currently dominating the market due to their comprehensive offerings, which include personalized financial advice, research, and a wide range of investment products. These brokerages cater to high-net-worth individuals and institutional investors who seek tailored services and expert guidance. The demand for such services has been bolstered by increasing market complexity and the need for strategic investment planning.

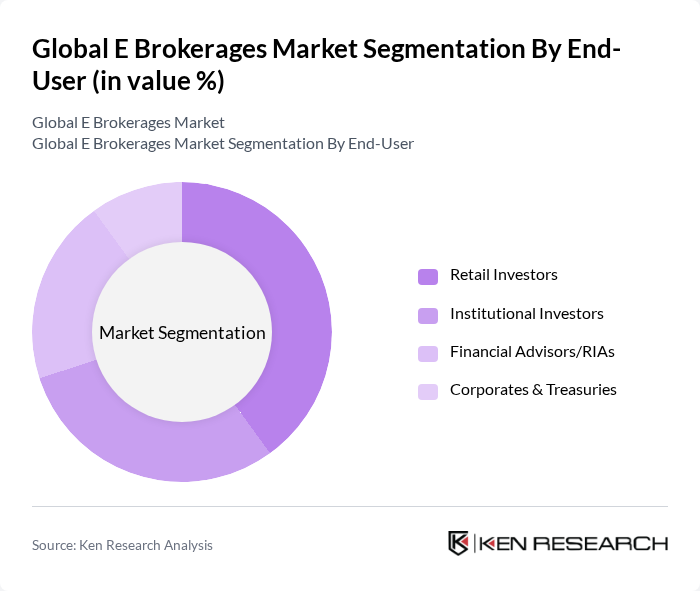

By End-User:This segmentation focuses on the different types of users who engage with e-brokerage services.

Retail Investors represent the largest segment in the e-brokerage market, driven by the rise of mobile trading apps and the increasing accessibility of financial markets. The trend of self-directed investing has gained momentum, particularly among younger demographics who prefer low-cost trading options and the ability to manage their portfolios independently. This shift has led to a significant increase in the number of retail accounts and trading volumes.

The Global E Brokerages Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Charles Schwab Corporation, Fidelity Investments, Interactive Brokers Group, Inc., Robinhood Markets, Inc., E*TRADE from Morgan Stanley, TD Ameritrade (a Charles Schwab company), IG Group Holdings plc, CMC Markets plc, Saxo Bank A/S, Plus500 Ltd., eToro Group Ltd., XTB S.A., OANDA Corporation, TradeStation Group, Inc., SoFi Invest (Social Finance, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The e-brokerage market is poised for significant evolution, driven by technological advancements and changing investor preferences. As more individuals seek accessible investment opportunities, platforms that integrate artificial intelligence and machine learning will likely gain traction. Additionally, the demand for personalized trading experiences will shape the development of new features. Firms that adapt to these trends while ensuring robust security measures will be well-positioned to thrive in this competitive landscape, fostering sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service E-Brokerages Discount E-Brokerages Neo-brokers (Commission-Free) Robo-Advisory Platforms Crypto-Enabled Brokerages |

| By End-User | Retail Investors Institutional Investors Financial Advisors/RIAs Corporates & Treasuries |

| By Trading Platform | Web-Based Platforms Mobile-Based Platforms Hybrid/Cross-Platform |

| By Asset Class | Equity Trading Derivatives (Options & Futures) Forex & CFDs Mutual Funds & ETFs Fixed Income Digital Assets (Crypto) |

| By Service Type | Execution-Only Trading Research & Advisory Portfolio & Wealth Management Margin & Securities Lending Clearing & Custody (Self/Clearing Partner) |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Segment | Retail (Mass Market) High-Net-Worth & Affluent Active Traders/Day Traders SMEs & Startups (Treasury/ESOP Liquidity) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 120 | Individual Traders, Investment Enthusiasts |

| Institutional Brokerage Services | 90 | Portfolio Managers, Institutional Investors |

| Market Trends in Forex Trading | 80 | Forex Traders, Financial Analysts |

| Impact of Technology on Trading | 70 | IT Managers, Trading Platform Developers |

| Regulatory Compliance in E-Brokerages | 60 | Compliance Officers, Risk Management Executives |

The Global E Brokerages Market is valued at approximately USD 14.1 billion, reflecting significant growth driven by the increasing adoption of digital trading platforms and the rise of retail investors. This market has expanded due to technological advancements enhancing trading efficiency.