Region:Global

Author(s):Shubham

Product Code:KRAA1800

Pages:92

Published On:August 2025

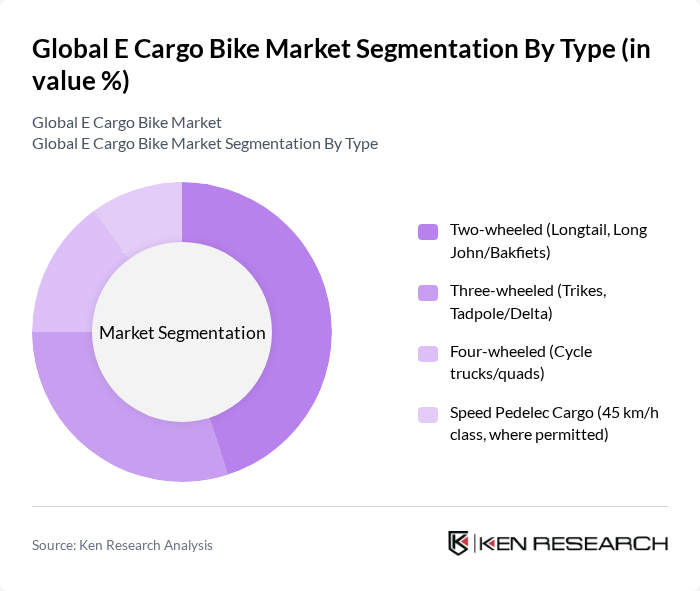

By Type:The market is segmented into various types of e cargo bikes, including two-wheeled, three-wheeled, four-wheeled, and speed pedelec cargo bikes. Among these, two-wheeled cargo bikes, particularly longtail and long john models, are gaining popularity due to their versatility, maneuverability, and suitability for dense urban streets and bike lanes. The three-wheeled segment is also significant, appealing to users seeking stability, larger box volumes, and higher payloads for commercial logistics and family transport. Four-wheeled formats are emerging for heavy-duty urban logistics niches. Speed pedelec cargo models exist in some markets but face regulatory constraints and licensing requirements that limit their share compared to standard 25 km/h pedelecs .

By End-User:The e cargo bike market serves various end-users, including courier and parcel services, grocery and food delivery, retail and large suppliers, municipal and public services, and personal use. The courier and parcel segment is the largest, propelled by e-commerce growth and the cost-efficiency of replacing urban van routes with e-cargo bikes. Grocery and food delivery continues to expand as Q?commerce and restaurant delivery adopt e-cargo bikes for speed and sustainability. Municipal services use e-cargo bikes for maintenance, parks, and waste collection pilots, while personal and family use is growing, encouraged by local subsidies and family-oriented designs .

The Global E Cargo Bike Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rad Power Bikes, Tern Bicycles, Yuba Bicycles, Riese & Müller, Urban Arrow, Bakfiets.nl, Larry vs Harry (Bullitt), CERO Bikes, Douze Cycles, Babboe, Xtracycle, Benno Bikes, Carla Cargo, Butchers & Bicycles, Triobike contribute to innovation, geographic expansion, and service delivery in this space .

The future of the e-cargo bike market appears promising, driven by increasing urbanization and a growing emphasis on sustainability. As cities continue to implement stricter environmental regulations, the demand for zero-emission delivery solutions will rise. Additionally, advancements in battery technology and smart logistics systems are expected to enhance the efficiency and appeal of e-cargo bikes. Companies are likely to invest in innovative designs and features, making e-cargo bikes a staple in urban logistics in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Two-wheeled (Longtail, Long John/Bakfiets) Three-wheeled (Trikes, Tadpole/Delta) Four-wheeled (Cycle trucks/quads) Speed Pedelec Cargo (45 km/h class, where permitted) |

| By End-User | Courier & Parcel/Express (CEP) Grocery & Food Delivery (Q-commerce, restaurants) Retail & Large Suppliers (B2B intra-city) Municipal & Public Services (waste, parks, utilities) Personal & Family Use |

| By Payload Capacity | Up to 100 kg –200 kg –300 kg Above 300 kg |

| By Battery Type | Lithium-ion (NMC, NCA, LFP) Lead-acid Nickel-based (NiMH/NiCd) Swappable Battery Systems |

| By Sales Channel | Direct-to-Consumer (Online) Dealer/Showroom (Offline Retail) Direct B2B & Fleet Sales |

| By Distribution Mode | Direct Distribution Third-party Logistics Subscription/Leasing & Bike-as-a-Service |

| By Price Range | Budget (Under USD 2,500) Mid-range (USD 2,500–5,000) Premium (Above USD 5,000) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Delivery Services | 120 | Logistics Coordinators, Delivery Fleet Managers |

| Municipal Transportation Initiatives | 90 | City Planners, Transportation Policy Makers |

| Retail Distribution Networks | 70 | Supply Chain Managers, Retail Operations Directors |

| Environmental NGOs and Advocacy Groups | 50 | Sustainability Advocates, Program Directors |

| Consumer Feedback on E-Cargo Bikes | 80 | End-users, Delivery Personnel, Urban Commuters |

The Global E Cargo Bike Market is valued at approximately USD 1.9 billion, reflecting significant growth driven by increased adoption for both commercial and family use, as well as supportive policies and infrastructure in key regions like Europe and the United States.