Region:Global

Author(s):Shubham

Product Code:KRAA1769

Pages:84

Published On:August 2025

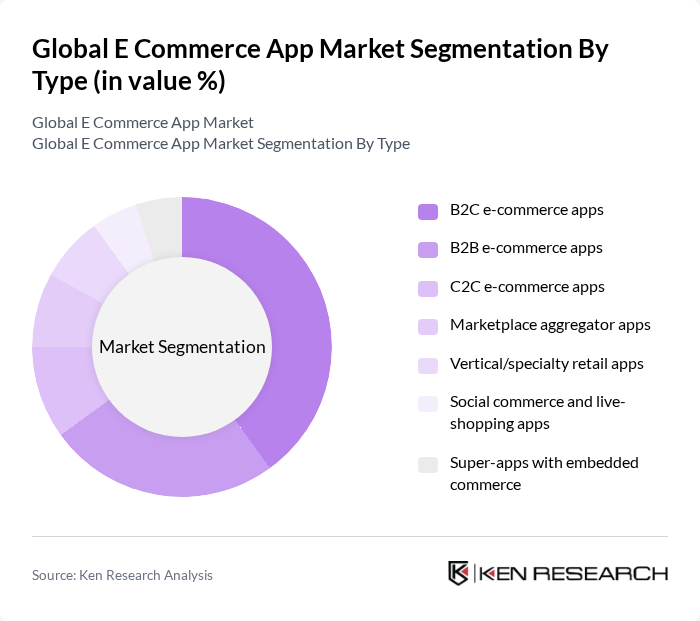

By Type:The e-commerce app market can be segmented into various types, including B2C e-commerce apps, B2B e-commerce apps, C2C e-commerce apps, marketplace aggregator apps, vertical/specialty retail apps, social commerce and live-shopping apps, and super-apps with embedded commerce. Each of these segments caters to different consumer needs and business models, contributing to the overall market dynamics.

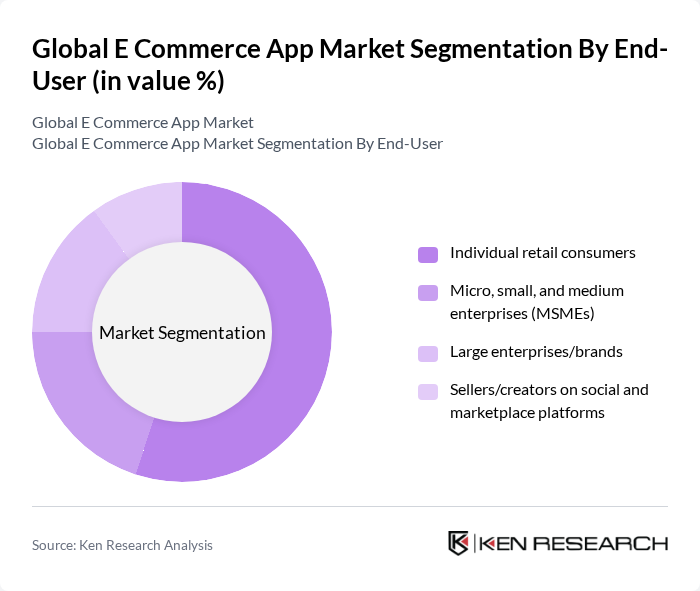

By End-User:The end-user segmentation of the e-commerce app market includes individual retail consumers, micro, small, and medium enterprises (MSMEs), large enterprises/brands, and sellers/creators on social and marketplace platforms. Each segment has unique requirements and behaviors, influencing the design and functionality of e-commerce applications.

The Global E Commerce App Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.com, Inc., Alibaba Group Holding Limited, eBay Inc., Shopify Inc., Walmart Inc., Rakuten Group, Inc., Flipkart Internet Private Limited, JD.com, Inc., Zalando SE, MercadoLibre, Inc., Target Corporation, Best Buy Co., Inc., Wayfair Inc., ASOS plc, Etsy, Inc., Pinduoduo Inc. (PDD Holdings), Sea Limited (Shopee), Coupang, Inc., Otto Group, The Home Depot, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-commerce app market appears promising, driven by technological advancements and evolving consumer preferences. As mobile commerce continues to grow, businesses will increasingly leverage AI and machine learning to enhance user experiences and streamline operations. Additionally, the integration of augmented reality in shopping will likely transform how consumers interact with products, making online shopping more immersive and engaging. These trends indicate a dynamic landscape where innovation will be key to capturing market opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C e-commerce apps B2B e-commerce apps C2C e-commerce apps Marketplace aggregator apps Vertical/specialty retail apps (single-brand or category-focused) Social commerce and live-shopping apps Super-apps with embedded commerce |

| By End-User | Individual retail consumers Micro, small, and medium enterprises (MSMEs) Large enterprises/brands Sellers/creators on social and marketplace platforms |

| By Sales Channel | Brand-owned apps (direct-to-consumer) Third-party marketplaces Social commerce (e.g., TikTok Shop, Instagram Shopping) In-app mini programs (e.g., within super-apps) |

| By Payment Method | Cards (credit/debit) Digital wallets (e.g., Apple Pay, Google Pay, PayPal) Account-to-account/real-time payments (e.g., UPI, Pix, iDEAL) Cash on delivery and pay on pickup Buy Now, Pay Later (BNPL) |

| By Product Category | Electronics Fashion and apparel Home and furniture Health, beauty, and personal care Grocery and quick commerce Others (books, toys, auto parts, etc.) |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Customer Demographics | Age group Income level Urban vs rural Digital maturity and device type |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retail Market Insights | 120 | E-commerce Managers, Marketing Directors |

| Consumer Electronics E-commerce | 100 | Product Managers, Customer Experience Leads |

| Fashion and Apparel E-commerce | 80 | Brand Managers, Supply Chain Coordinators |

| Grocery Delivery Services | 70 | Operations Managers, Logistics Coordinators |

| Health and Beauty Online Sales | 90 | Category Managers, Digital Marketing Specialists |

The Global E Commerce App Market is valued at approximately USD 3.9 trillion, driven by factors such as smartphone penetration, digital payment solutions, and a shift towards mobile-first shopping experiences.