Region:Global

Author(s):Dev

Product Code:KRAA0413

Pages:86

Published On:August 2025

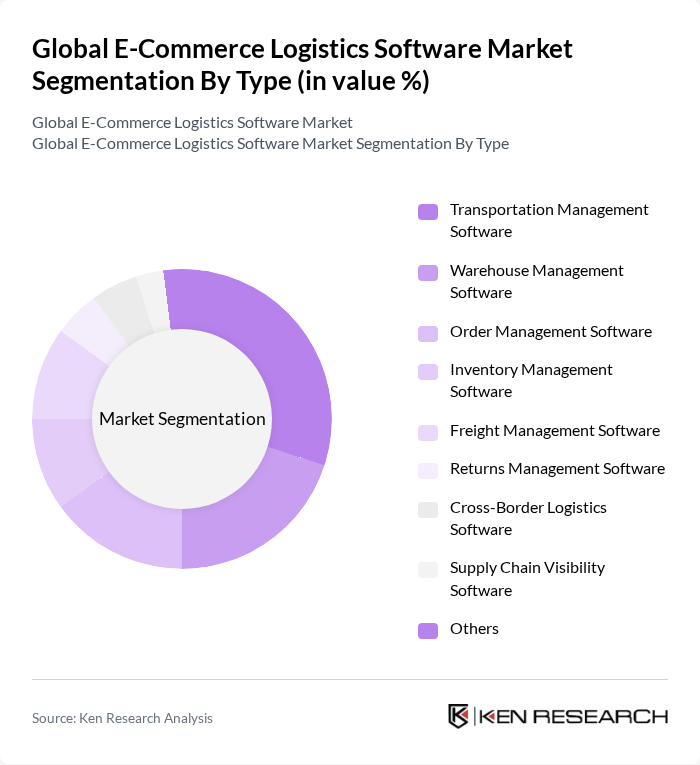

By Type:The market is segmented into various types of logistics software, each catering to specific operational needs. The subsegments include Transportation Management Software, Warehouse Management Software, Order Management Software, Inventory Management Software, Freight Management Software, Returns Management Software, Cross-Border Logistics Software, Supply Chain Visibility Software, and Others. Among these, Transportation Management Software is currently the leading subsegment due to its critical role in optimizing shipping routes, reducing transportation costs, and enabling real-time tracking and route optimization through advanced analytics and automation .

By End-User:The end-user segmentation includes Retailers (Online & Omnichannel), Third-Party Logistics Providers (3PLs), E-Commerce Marketplaces, Direct-to-Consumer Brands, Wholesalers & Distributors, Manufacturers, and Others. Retailers, particularly those operating online and through omnichannel strategies, dominate this segment as they require robust logistics solutions to manage their complex supply chains, integrate multiple sales channels, and meet customer expectations for fast, transparent delivery .

The Global E-Commerce Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shopify, ShipBob, Easyship, ShipStation, Logiwa, Cin7, Brightpearl, 3PL Central, Flexport, AfterShip, Zencargo, Freightos, ShipHero, SkuVault, EasyPost, Manhattan Associates, Oracle (Oracle SCM Cloud), SAP (SAP Logistics Business Network), Blue Yonder, Descartes Systems Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of e-commerce logistics software is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt AI and machine learning, logistics operations will become more efficient and responsive. Additionally, the emphasis on sustainability will shape logistics strategies, with companies seeking eco-friendly solutions. The integration of blockchain technology will enhance transparency and trust in supply chains, further revolutionizing the logistics landscape and creating new avenues for innovation and collaboration.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Order Management Software Inventory Management Software Freight Management Software Returns Management Software Cross-Border Logistics Software Supply Chain Visibility Software Others |

| By End-User | Retailers (Online & Omnichannel) Third-Party Logistics Providers (3PLs) E-Commerce Marketplaces Direct-to-Consumer Brands Wholesalers & Distributors Manufacturers Others |

| By Delivery Model | Same-Day Delivery Next-Day Delivery Standard Delivery Scheduled Delivery Cross-Border Delivery Others |

| By Deployment Type | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Integration Capability | API Integration EDI Integration Marketplace Integration Custom Integration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Software for Retail E-commerce | 100 | IT Managers, E-commerce Directors |

| Supply Chain Management Solutions | 90 | Supply Chain Analysts, Operations Managers |

| Last-Mile Delivery Software | 60 | Logistics Coordinators, Delivery Managers |

| Warehouse Management Systems | 50 | Warehouse Managers, Inventory Control Specialists |

| Returns Management Solutions | 40 | Customer Service Managers, Returns Analysts |

The Global E-Commerce Logistics Software Market is valued at approximately USD 17.5 billion, driven by the rapid growth of online retail and the increasing demand for efficient supply chain management solutions.