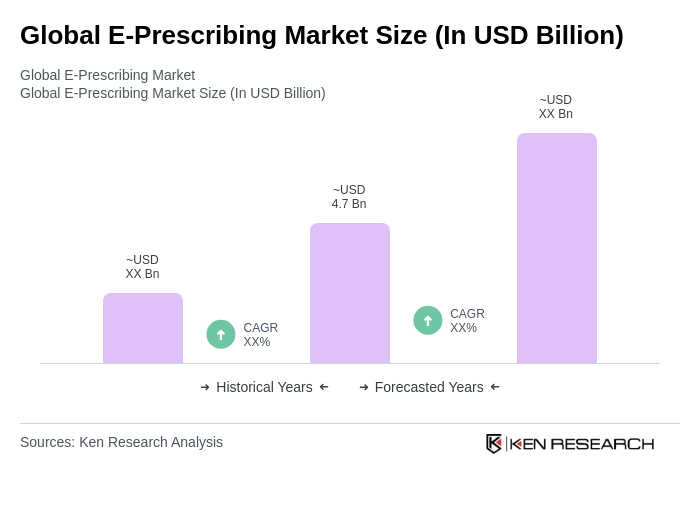

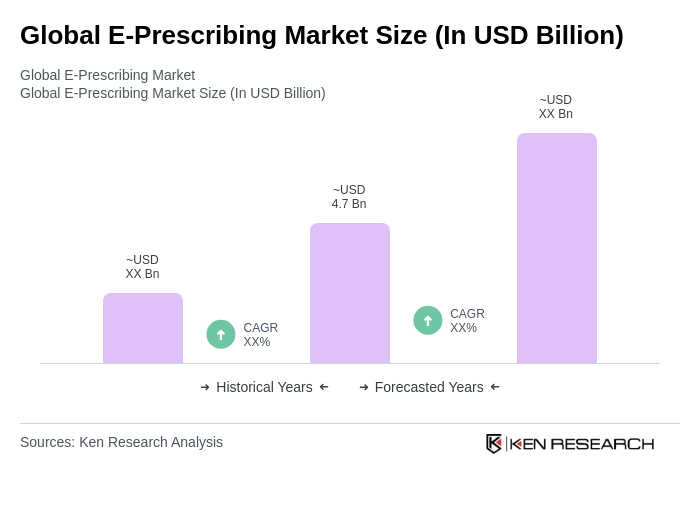

Global E-Prescribing Market Overview

- The Global E-Prescribing Market is valued at USD 4.7 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital health solutions, the need for improved patient safety, and the rising prevalence of chronic diseases that require ongoing medication management. The shift towards electronic health records (EHR) and the integration of e-prescribing systems into healthcare workflows have further accelerated market expansion. Enhanced regulatory mandates, the expansion of telemedicine, and the focus on reducing medication errors are also major contributors to market growth .

- The United States dominates the Global E-Prescribing Market due to its advanced healthcare infrastructure, high adoption rates of technology in healthcare, and supportive government initiatives. Other significant players include Germany and the United Kingdom, where robust healthcare systems and regulatory frameworks promote the use of e-prescribing solutions, enhancing efficiency and patient care .

- In 2023, the U.S. government implemented the 21st Century Cures Act, which mandates the use of interoperable electronic health records and e-prescribing systems. This regulation, issued by the U.S. Department of Health and Human Services, aims to improve patient access to their health information and streamline the prescribing process, thereby enhancing the overall efficiency of healthcare delivery. The Act requires healthcare providers to adopt certified health IT and ensure interoperability and secure electronic transmission of prescriptions .

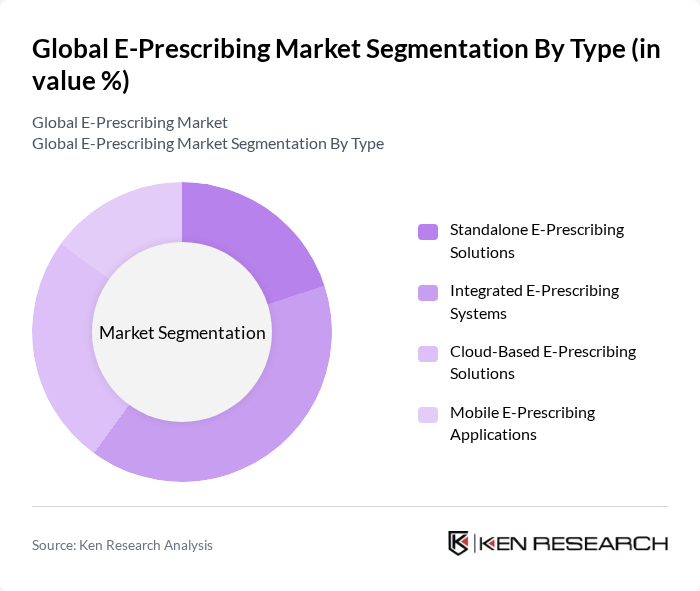

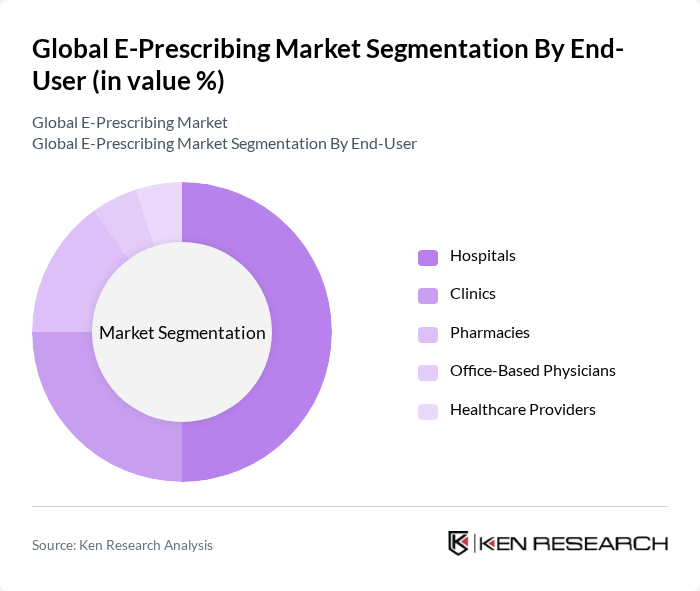

Global E-Prescribing Market Segmentation

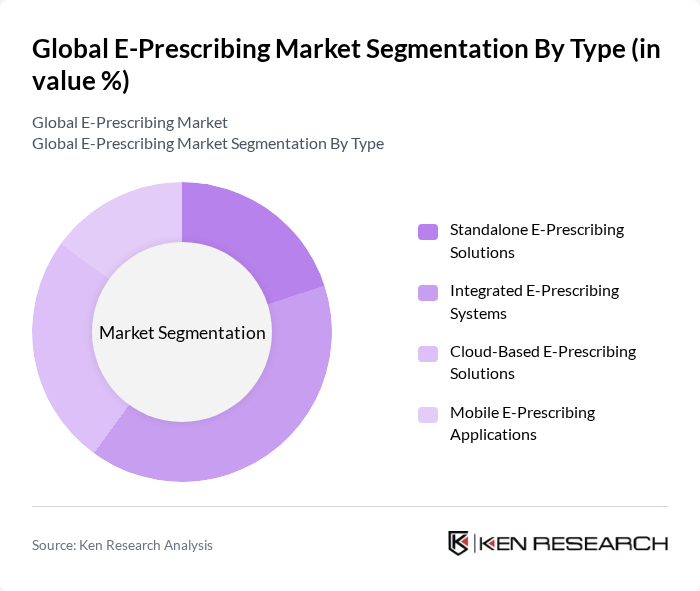

By Type:The e-prescribing market is segmented into four main types: Standalone E-Prescribing Solutions, Integrated E-Prescribing Systems, Cloud-Based E-Prescribing Solutions, and Mobile E-Prescribing Applications. Among these, Integrated E-Prescribing Systems are leading the market due to their seamless integration with existing healthcare IT systems, which enhances workflow efficiency and reduces errors. The demand for cloud-based solutions is also rising, driven by the need for flexibility, scalability, and remote access to patient data. Mobile e-prescribing applications are gaining traction as healthcare providers increasingly seek solutions that support point-of-care decision-making and telehealth services .

By End-User:The end-user segmentation includes Hospitals, Clinics, Pharmacies, Office-Based Physicians, and Healthcare Providers. Hospitals are the dominant end-user segment, primarily due to their large patient volumes and the need for efficient medication management systems. Clinics and pharmacies are also significant users, as they increasingly adopt e-prescribing to streamline operations and enhance patient safety. The adoption among office-based physicians and other healthcare providers is rising, driven by regulatory requirements and the need for interoperability with broader healthcare IT infrastructure .

Global E-Prescribing Market Competitive Landscape

The Global E-Prescribing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, Inc., eClinicalWorks, NextGen Healthcare, Inc., Practice Fusion, DrFirst, Inc., Meditech, McKesson Corporation, Siemens Healthineers, Athenahealth, Inc., Greenway Health, LLC, RXNT, Surescripts, Veradigm Inc., AdvancedMD, DoseSpot, FredIT Group, iCoreConnect, Inc., MDToolbox, PharmacyX, PracticeSuite contribute to innovation, geographic expansion, and service delivery in this space.

Global E-Prescribing Market Industry Analysis

Growth Drivers

- Increasing Adoption of Digital Health Solutions:The global digital health market is projected to reach $509.2 billion in future, driven by the increasing adoption of e-prescribing solutions. In future, approximately 70% of healthcare providers in the None region reported using some form of digital health technology, reflecting a significant shift towards electronic systems. This trend is supported by the growing demand for efficient healthcare delivery and improved patient outcomes, which e-prescribing directly facilitates.

- Government Initiatives for Healthcare Digitization:Governments worldwide are investing heavily in healthcare digitization, with the U.S. government allocating over $35 billion to promote electronic health records and e-prescribing systems. In future, initiatives such as the Digital Health Strategy aim to enhance healthcare access and efficiency. These investments are expected to increase the adoption of e-prescribing, as they provide the necessary infrastructure and regulatory support for healthcare providers.

- Rising Demand for Patient Safety and Medication Accuracy:The World Health Organization estimates that medication errors affect 1 in 10 patients globally, highlighting the urgent need for improved medication management. E-prescribing systems can reduce these errors by ensuring accurate prescriptions and enhancing patient safety. In future, hospitals implementing e-prescribing have reported a 30% decrease in medication errors, underscoring the growing demand for solutions that prioritize patient safety and medication accuracy.

Market Challenges

- Data Security and Privacy Concerns:With the rise of digital health solutions, data security remains a significant challenge. In future, healthcare data breaches affected over 45 million individuals in the None region alone. The increasing frequency of cyberattacks raises concerns about patient privacy and data integrity, leading to hesitance among healthcare providers to fully adopt e-prescribing systems. Ensuring robust cybersecurity measures is essential to mitigate these risks and foster trust in digital health solutions.

- High Implementation Costs:The initial costs associated with implementing e-prescribing systems can be prohibitive for many healthcare providers. In future, the average cost of implementing a comprehensive e-prescribing solution is estimated at $150,000 per practice. This financial burden can deter smaller practices from adopting these technologies, limiting the overall growth of the e-prescribing market. Financial incentives and support from government initiatives are crucial to overcoming this challenge.

Global E-Prescribing Market Future Outlook

The future of the e-prescribing market appears promising, driven by technological advancements and increasing healthcare digitization. As healthcare providers continue to embrace cloud-based solutions, the integration of artificial intelligence and machine learning will enhance the efficiency and accuracy of e-prescribing systems. Additionally, the growing emphasis on patient-centric care will further propel the adoption of e-prescribing, as it aligns with the broader trend of personalized healthcare solutions that prioritize patient engagement and safety.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present significant growth opportunities for e-prescribing solutions. With a projected healthcare expenditure increase of 10% annually in regions like Southeast Asia, there is a rising demand for efficient healthcare technologies. This trend offers e-prescribing vendors a chance to penetrate new markets and establish a foothold in regions with growing healthcare needs.

- Development of Mobile E-Prescribing Solutions:The increasing use of smartphones and mobile applications in healthcare creates opportunities for mobile e-prescribing solutions. In future, mobile health app downloads reached 3.5 billion globally, indicating a strong consumer interest. By developing user-friendly mobile e-prescribing applications, companies can cater to the growing demand for accessible healthcare solutions, enhancing patient engagement and adherence to medication regimens.