Region:Global

Author(s):Geetanshi

Product Code:KRAB0022

Pages:90

Published On:August 2025

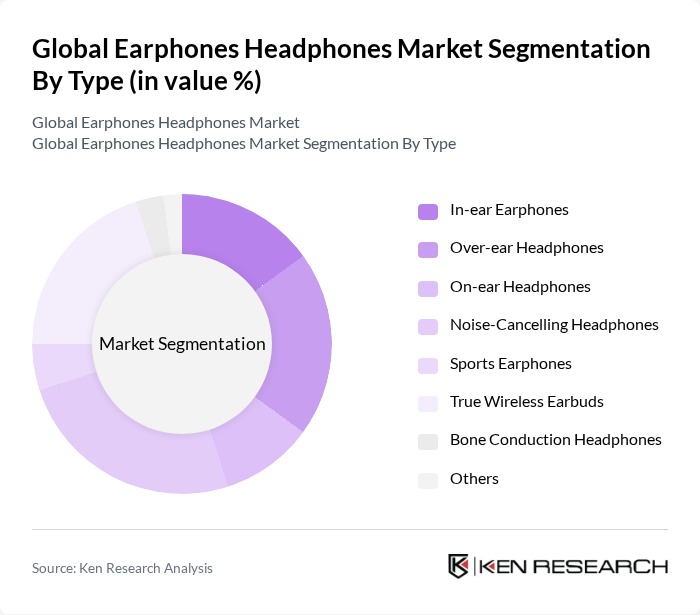

By Type:The earphones and headphones market is segmented into In-ear Earphones, Over-ear Headphones, On-ear Headphones, Noise-Cancelling Headphones, Sports Earphones, True Wireless Earbuds, Bone Conduction Headphones, and Others. True Wireless Earbuds have gained significant traction due to their portability, ease of use, and advancements in battery and connectivity technology. The increasing preference for wireless options is driving a notable shift in consumer purchasing behavior, with manufacturers focusing on features such as active noise cancellation, water resistance, and ergonomic design to meet evolving user needs .

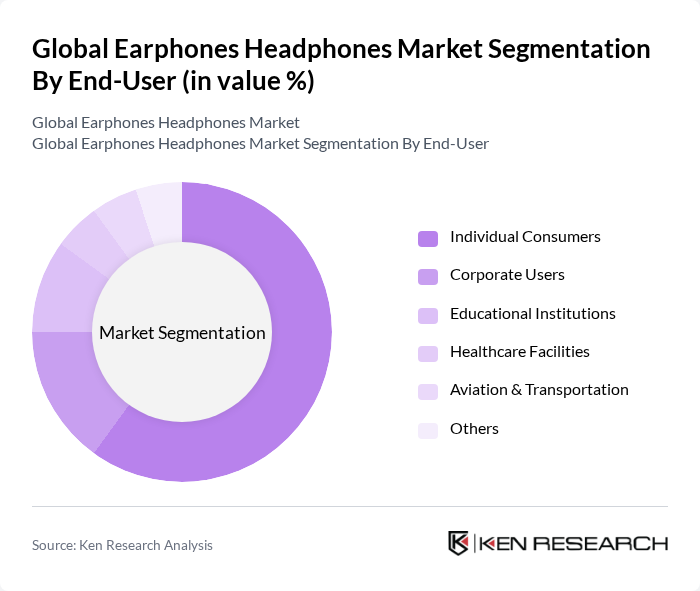

By End-User:The market is segmented by end-user into Individual Consumers, Corporate Users, Educational Institutions, Healthcare Facilities, Aviation & Transportation, and Others. Individual Consumers remain the dominant segment, driven by the widespread use of smartphones and portable devices for personal audio consumption. The increased adoption of remote work and online learning has further accelerated demand for high-quality audio solutions in home and professional environments, reinforcing the importance of this segment .

The Global Earphones Headphones Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Sony Corporation, Bose Corporation, Sennheiser Electronic GmbH & Co. KG, Samsung Electronics Co., Ltd., JBL (Harman International Industries, Incorporated), Beats Electronics LLC, Audio-Technica Corporation, Bang & Olufsen A/S, Skullcandy Inc., Anker Innovations Limited (Soundcore), Plantronics, Inc. (Poly), Razer Inc., Microsoft Corporation, Xiaomi Corporation, Shure Incorporated, Logitech International S.A. (Logitech, Ultimate Ears), Panasonic Corporation, Pioneer Corporation, Jabra (GN Audio A/S) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the earphones and headphones market appears promising, driven by technological advancements and evolving consumer preferences. As sustainability becomes a priority, manufacturers are likely to focus on eco-friendly materials and production processes. Additionally, the integration of smart technology, such as health monitoring features, is expected to gain traction, appealing to health-conscious consumers. The market is poised for growth as companies adapt to these trends and enhance their product offerings to meet changing demands.

| Segment | Sub-Segments |

|---|---|

| By Type | In-ear Earphones Over-ear Headphones On-ear Headphones Noise-Cancelling Headphones Sports Earphones True Wireless Earbuds Bone Conduction Headphones Others |

| By End-User | Individual Consumers Corporate Users Educational Institutions Healthcare Facilities Aviation & Transportation Others |

| By Distribution Channel | Online Retail (E-commerce Marketplaces, Brand Websites) Offline Retail (Consumer Electronics Stores, Supermarkets/Hypermarkets, Specialty Stores) Direct Sales Distributors Others |

| By Price Range | Budget (< USD 50) Mid-Range (USD 50–150) Premium (USD 150–300) Luxury (> USD 300) |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| By Features | Wireless Connectivity (Bluetooth, True Wireless) Active Noise Cancellation Water & Sweat Resistance Built-in Microphone Touch & Gesture Controls Voice Assistant Integration Long Battery Life Others |

| By Usage Scenario | Daily Commute Sports and Fitness Gaming & Esports Home Entertainment Professional/Studio Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 100 | Store Managers, Sales Associates |

| Audio Equipment Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Online Retail Platforms | 60 | eCommerce Managers, Category Buyers |

| Consumer Focus Groups | 40 | Audio Enthusiasts, Casual Users |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

The Global Earphones Headphones Market is valued at approximately USD 85 billion, driven by the increasing demand for portable audio devices and advancements in wireless technologies, including Bluetooth and AI integration.