Region:Global

Author(s):Dev

Product Code:KRAC0567

Pages:92

Published On:August 2025

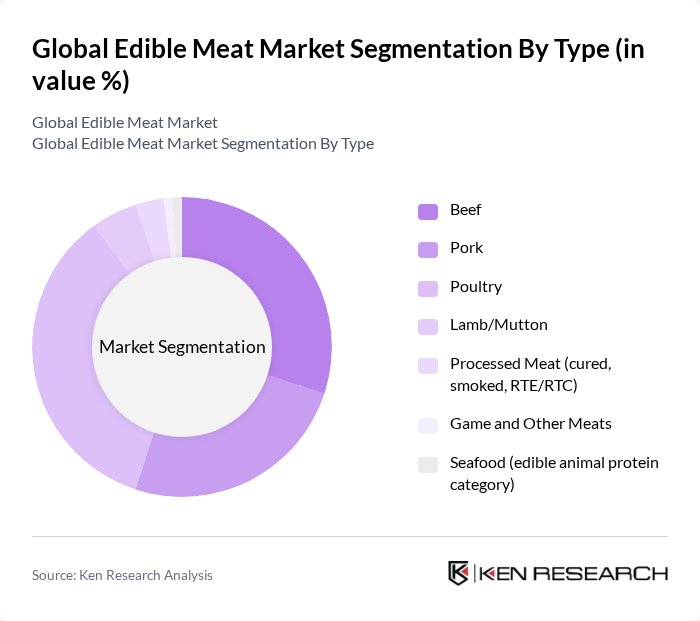

By Type:The Global Edible Meat Market can be segmented into various types, including beef, pork, poultry, lamb/mutton, processed meat, game and other meats, and seafood. Each of these subsegments caters to different consumer preferences and dietary needs, with varying levels of demand across regions. Poultry typically leads global consumption due to price competitiveness and versatility; pork demand is concentrated in East Asia; beef demand is strong in North and South America; processed meat aligns with convenience trends; lamb/mutton remains regionally concentrated in Middle East, North Africa, Central Asia, and Oceania; game/other meats are niche; seafood is often analyzed separately but is relevant in total animal-protein consideration .

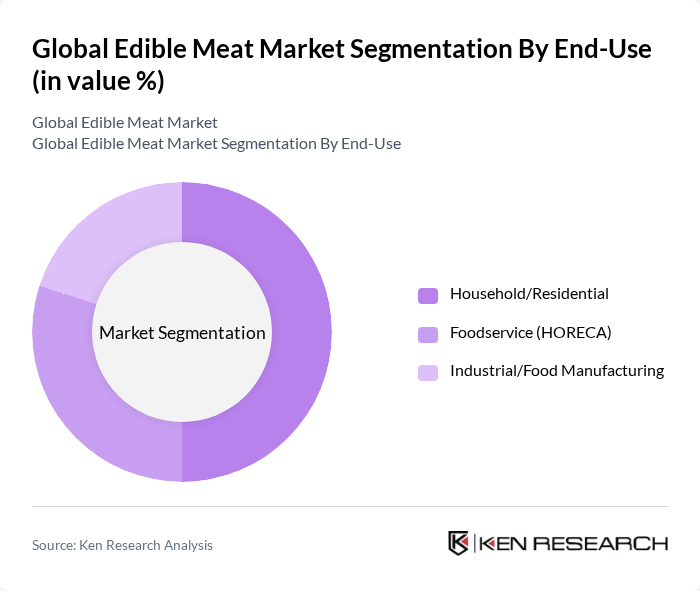

By End-Use:The market can also be segmented based on end-use, which includes household/residential, foodservice (HORECA), and industrial/food manufacturing. Each segment reflects different consumption patterns and purchasing behaviors, influencing the overall market dynamics. Retail/off-trade channels dominate volume in many markets due to supermarket penetration and at-home consumption, while foodservice/HORECA is significant in urban centers and tourism hubs; industrial demand is linked to further processing and packaged foods .

The Global Edible Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tyson Foods, Inc., JBS S.A., Cargill, Incorporated, BRF S.A., Hormel Foods Corporation, Pilgrim’s Pride Corporation, Smithfield Foods, Inc. (a WH Group company), Perdue Farms Inc., Marfrig Global Foods S.A., Sanderson Farms, LLC, Danish Crown A/S, WH Group Limited, Seaboard Foods LLC, Vion Food Group, NH Foods Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the edible meat market in None is poised for transformation, driven by evolving consumer preferences and technological advancements. The shift towards organic and sustainably sourced meat products is expected to gain momentum, with a projected increase in demand for ethically produced meats. Additionally, innovations in meat processing technologies will enhance product quality and safety, catering to health-conscious consumers. As online sales channels expand, the market will likely see a significant increase in direct-to-consumer sales, reshaping traditional distribution models.

| Segment | Sub-Segments |

|---|---|

| By Type | Beef Pork Poultry Lamb/Mutton Processed Meat (cured, smoked, RTE/RTC) Game and Other Meats Seafood (edible animal protein category) |

| By End-Use | Household/Residential Foodservice (HORECA) Industrial/Food Manufacturing |

| By Distribution Channel | Off-Trade (Supermarkets/Hypermarkets, Grocery) On-Trade (Restaurants, Hotels, Catering) Online/D2C Specialty Butcher Stores |

| By Product Form | Fresh/Chilled Frozen Canned/Shelf-Stable Ready-to-Eat/Ready-to-Cook |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging (MAP) Skin Packaging Sustainable/Recyclable Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Meat Processing Industry | 120 | Plant Managers, Quality Control Supervisors |

| Retail Meat Sales | 100 | Store Managers, Meat Department Heads |

| Consumer Preferences | 150 | Household Decision Makers, Health-Conscious Consumers |

| Export and Import Dynamics | 80 | Trade Analysts, Export Managers |

| Food Safety and Regulations | 70 | Regulatory Affairs Specialists, Compliance Officers |

The Global Edible Meat Market is valued at approximately USD 1.2 trillion, with recent assessments indicating figures ranging from USD 1.11 trillion to USD 1.23 trillion, reflecting variations in livestock and processed meat revenues.