Region:Global

Author(s):Dev

Product Code:KRAB0631

Pages:83

Published On:August 2025

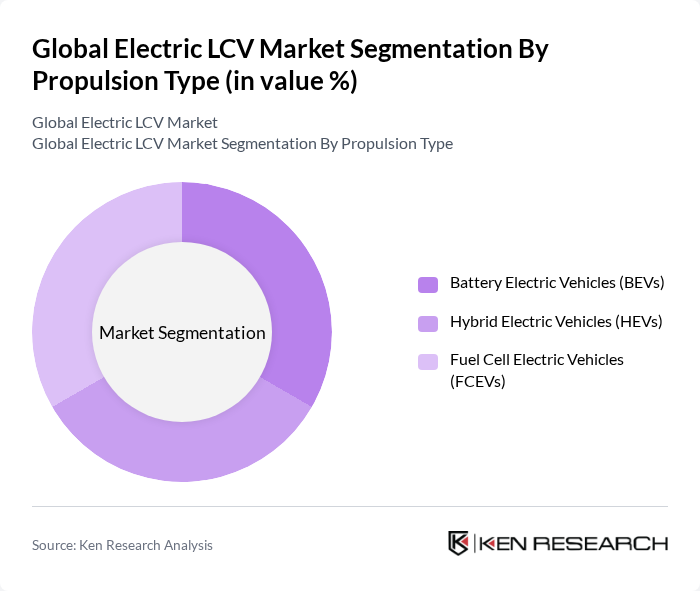

By Propulsion Type:

The propulsion type segment is dominated byBattery Electric Vehicles (BEVs), which are favored for their zero-emission capabilities and advancements in battery technology that enhance range and efficiency. The growing consumer preference for sustainable transport solutions, coupled with government incentives and the expansion of charging infrastructure, has significantly boosted BEV adoption.Hybrid Electric Vehicles (HEVs)also hold a substantial market share, appealing to consumers seeking a transitional solution, whileFuel Cell Electric Vehicles (FCEVs)are emerging but still face challenges in infrastructure and cost .

By Vehicle Type:

In the vehicle type segment,Pick-up Trucksmaintain a leading share due to their versatility and increasing demand in logistics, construction, and e-commerce sectors. Their ability to transport goods efficiently while maintaining lower operational costs makes them attractive to businesses.Vansalso play a crucial role, particularly in urban delivery applications, where their compact size and maneuverability are advantageous. The growing trend of last-mile delivery services further supports the demand for both vehicle types .

The Global Electric LCV Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., Rivian Automotive, Inc., Ford Motor Company, General Motors Company, Mercedes-Benz Group AG, BYD Company Limited, Nissan Motor Corporation, Volkswagen AG, Stellantis N.V., Tata Motors Limited, Workhorse Group, Inc., Arrival Ltd., Lightning eMotors, Inc., Canoo Inc., SWITCH Mobility Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric LCV market appears promising, driven by increasing environmental regulations and technological advancements. As battery costs continue to decline and charging infrastructure expands, adoption rates are expected to rise significantly. Additionally, the integration of smart technologies and fleet management solutions will enhance operational efficiency. Companies are likely to invest in electric LCVs to meet sustainability targets, positioning themselves competitively in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Propulsion Type | Battery Electric Vehicles (BEVs) Hybrid Electric Vehicles (HEVs) Fuel Cell Electric Vehicles (FCEVs) |

| By Vehicle Type | Pick-up Trucks Vans |

| By Power Output | Less Than 150 kW 250 kW More Than 250 kW |

| By End-User | E-commerce Retail Public Sector Logistics and Transportation |

| By Application | Urban Delivery Last-Mile Delivery Utility Services Others |

| By Battery Type | Lithium-Ion Batteries Solid-State Batteries Others |

| By Charging Type | Fast Charging Standard Charging Wireless Charging |

| By Distribution Channel | Direct Sales Online Sales Dealerships |

| By Price Range | Budget Segment Mid-Range Segment Premium Segment |

| By Region | North America Europe Asia Pacific Latin America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Delivery Services | 100 | Fleet Managers, Operations Directors |

| Construction and Utility Fleets | 60 | Procurement Managers, Fleet Supervisors |

| Last-Mile Logistics Providers | 80 | Logistics Coordinators, Supply Chain Analysts |

| Public Transportation Authorities | 40 | Transport Planners, Policy Makers |

| Retail Distribution Networks | 50 | Distribution Managers, Sustainability Officers |

The Global Electric Light Commercial Vehicle (LCV) Market is valued at approximately USD 22 billion, driven by factors such as environmental regulations, advancements in battery technology, and the growing demand for sustainable transportation solutions, particularly in the e-commerce sector.