Region:Global

Author(s):Rebecca

Product Code:KRAA2141

Pages:90

Published On:August 2025

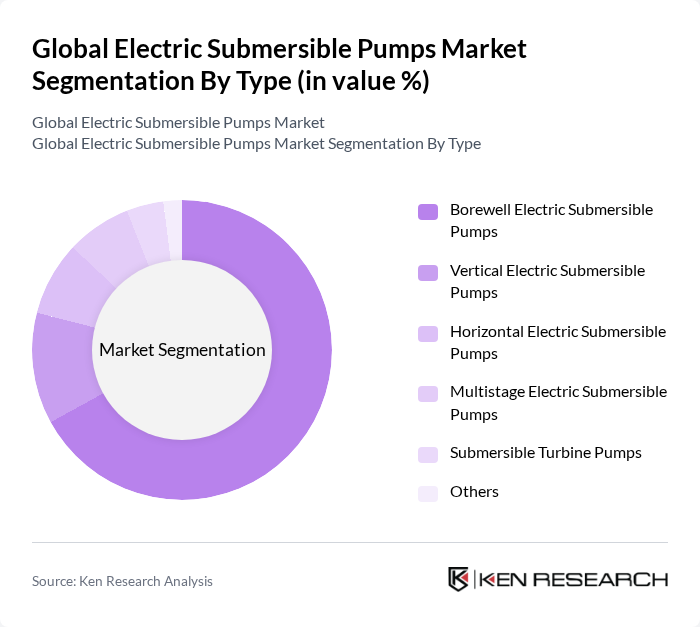

By Type:The electric submersible pumps market is segmented into Borewell Electric Submersible Pumps, Vertical Electric Submersible Pumps, Horizontal Electric Submersible Pumps, Multistage Electric Submersible Pumps, Submersible Turbine Pumps, and Others. Borewell Electric Submersible Pumps hold the largest share, driven by their widespread application in agricultural irrigation and groundwater extraction, especially in regions with limited surface water. The increasing focus on sustainable farming practices and efficient water management, particularly in Asia-Pacific and emerging economies, has driven demand for these pumps, making them a preferred choice for farmers and agricultural businesses .

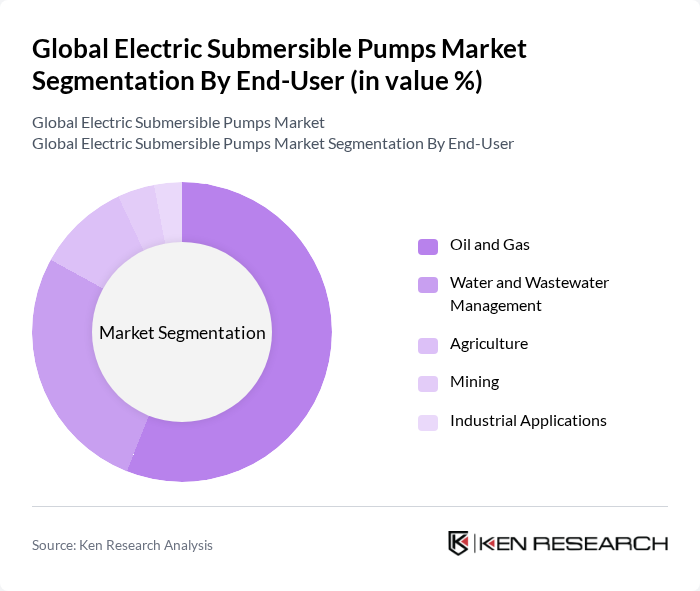

By End-User:The market is also segmented by end-user applications, including Oil and Gas, Water and Wastewater Management, Agriculture, Mining, and Industrial Applications. The Oil and Gas sector is the dominant end-user, driven by the need for efficient extraction and transportation of hydrocarbons. Increasing exploration and production activities in both offshore and onshore oil fields, along with the adoption of multistage pump designs for variable flow rates and pressure requirements, have significantly boosted demand for electric submersible pumps. The water and wastewater management sector is also expanding rapidly due to infrastructure investments and the need for improved treatment solutions in urbanizing regions .

The Global Electric Submersible Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, NOV Inc. (formerly National Oilwell Varco, Inc.), Grundfos Holding A/S, Xylem Inc., KSB SE & Co. KGaA, Pentair plc, Ebara Corporation, Franklin Electric Co., Inc., Sulzer Ltd., ITT Inc., Wilo SE, Tsurumi Manufacturing Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric submersible pumps market appears promising, driven by technological advancements and increasing demand for sustainable solutions. As industries prioritize energy efficiency and environmental compliance, the integration of smart technologies and IoT capabilities will likely enhance operational efficiency. Furthermore, the growing emphasis on renewable energy sources will create new avenues for electric submersible pumps, particularly in sectors like agriculture and water management, fostering innovation and market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Borewell Electric Submersible Pumps Vertical Electric Submersible Pumps Horizontal Electric Submersible Pumps Multistage Electric Submersible Pumps Submersible Turbine Pumps Others |

| By End-User | Oil and Gas Water and Wastewater Management Agriculture Mining Industrial Applications |

| By Application | Oil Extraction (Onshore & Offshore) Water Supply Irrigation Dewatering Mining |

| By Component | Motors Pumps Controllers Variable Speed Drives (VSD) Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Extraction Applications | 100 | Field Engineers, Operations Managers |

| Water Supply and Management | 80 | Water Resource Managers, Environmental Engineers |

| Agricultural Irrigation Systems | 60 | Agronomists, Farm Equipment Managers |

| Mining and Mineral Extraction | 50 | Mining Engineers, Project Managers |

| Industrial Applications | 70 | Plant Managers, Maintenance Supervisors |

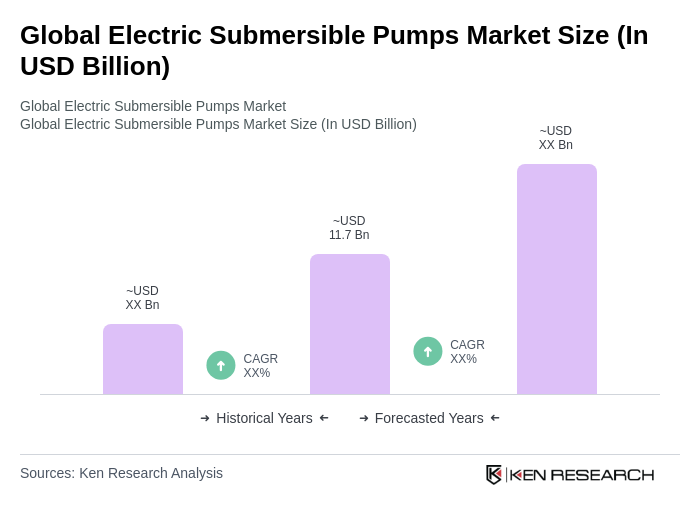

The Global Electric Submersible Pumps Market is valued at approximately USD 11.7 billion, driven by factors such as increased oil and gas production, demand for municipal water solutions, and advancements in technology like IoT and AI.