Region:Global

Author(s):Geetanshi

Product Code:KRAA1232

Pages:85

Published On:August 2025

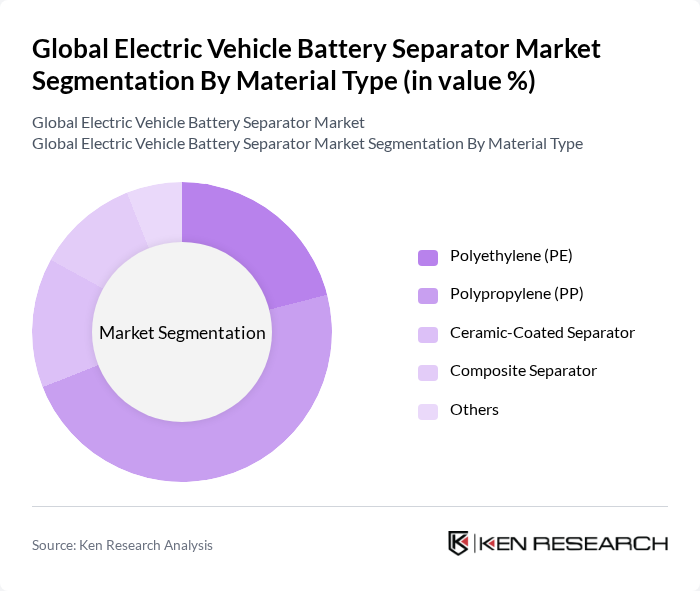

By Material Type:The material type segmentation includes Polyethylene (PE), Polypropylene (PP), Ceramic-Coated Separator, Composite Separator, and Others. Polypropylene (PP) is the leading subsegment, attributed to its superior thermal stability, mechanical strength, and chemical resistance, making it ideal for high-performance battery applications. The demand for lightweight, efficient, and durable separator materials in EV batteries has further accelerated the growth of this subsegment. Recent manufacturing advancements have also improved the quality and consistency of PP separators, reinforcing their leadership in the market .

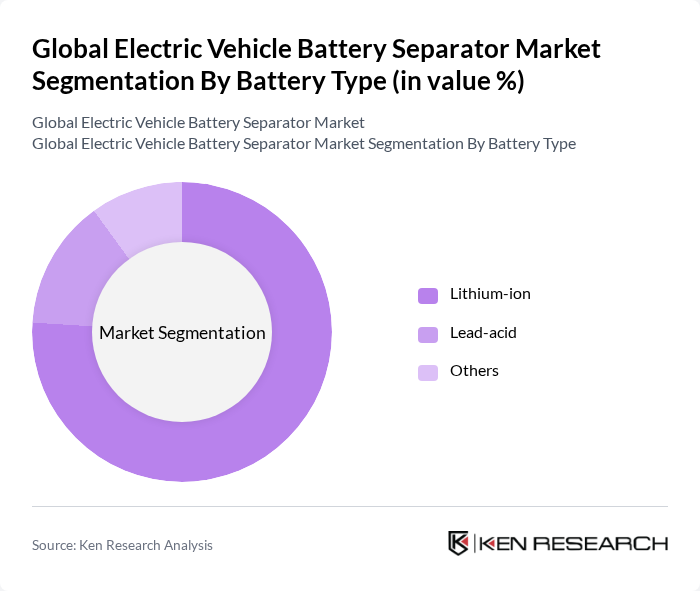

By Battery Type:The battery type segmentation covers Lithium-ion, Lead-acid, and Others. The Lithium-ion battery segment dominates due to its widespread use in electric vehicles, driven by high energy density, long cycle life, and ongoing cost reductions. The increasing shift toward electric mobility and renewable energy storage has significantly boosted demand for lithium-ion batteries, further strengthening the market position of this segment .

The Global Electric Vehicle Battery Separator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asahi Kasei Corporation, Celgard LLC (Polypore International, LP), Toray Industries, Inc., Mitsubishi Chemical Group Corporation, Sumitomo Chemical Co., Ltd., SK IE Technology Co., Ltd. (SKIET), W-Scope Corporation, Entek International LLC, Freudenberg Performance Materials SE & Co. KG, Ube Corporation, LG Chem Ltd., Samsung SDI Co., Ltd., Ahlstrom-Munksjö Oyj, Shenzhen Senior Technology Material Co., Ltd., Daramic, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle battery separator market appears promising, driven by technological advancements and increasing environmental regulations. As manufacturers focus on developing sustainable materials and enhancing separator performance, the market is likely to witness a shift towards innovative solutions. Additionally, the integration of smart technologies in battery systems will further enhance efficiency and safety, positioning the market for significant growth in the coming years, particularly in emerging economies.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Polyethylene (PE) Polypropylene (PP) Ceramic-Coated Separator Composite Separator Others |

| By Battery Type | Lithium-ion Lead-acid Others |

| By End-Use Application | Electric Vehicles (EVs) Hybrid Electric Vehicles (HEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Others |

| By Geography | North America South America Europe Middle East and Africa Asia-Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturers | 100 | Production Managers, R&D Directors |

| Automotive OEMs | 80 | Product Development Engineers, Procurement Managers |

| Material Suppliers | 60 | Sales Directors, Technical Support Engineers |

| Industry Analysts | 50 | Market Research Analysts, Industry Consultants |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

The Global Electric Vehicle Battery Separator Market is valued at approximately USD 2.9 billion, driven by the increasing adoption of electric vehicles, advancements in lithium-ion battery technologies, and the need for high-performance separators to enhance battery safety and efficiency.